- August 30, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

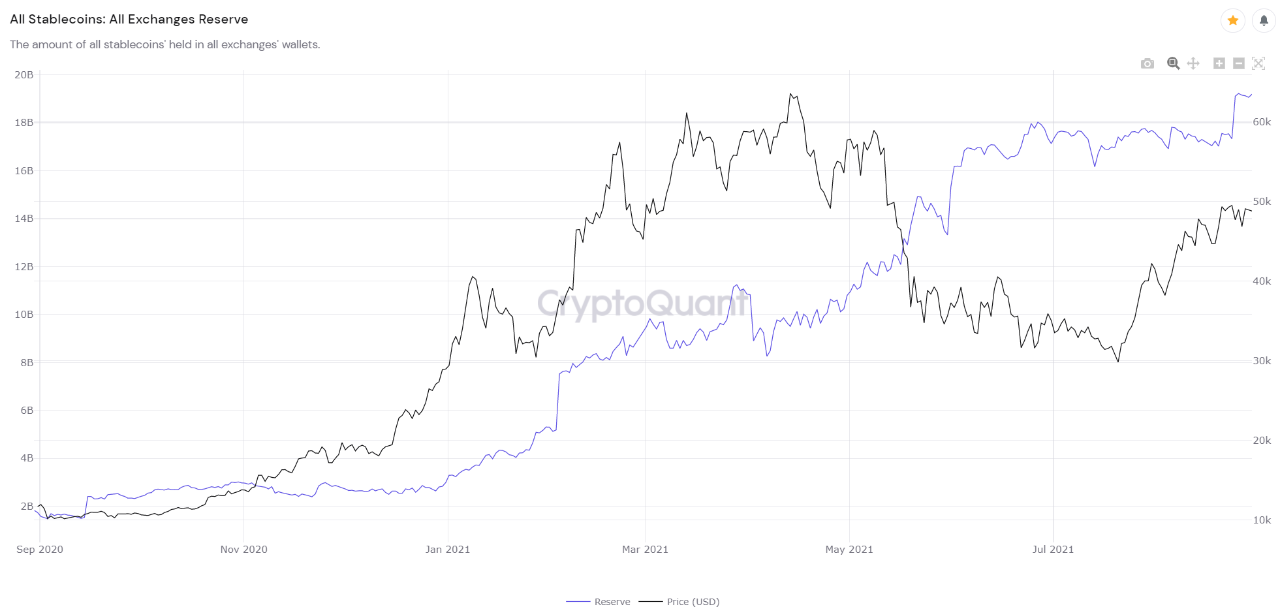

On-chain data shows Bitcoin dry powder has been accumulating on exchanges as stablecoins reserve exceeds $19 billion.

Stablecoins Reserve Crosses $19 Billion

As pointed out by a CryptoQuant post, exchanges now hold stablecoins worth more than $19 billion. Such a large reserve might mean enough dry powder for Bitcoin to make a big move soon.

The all exchanges stablecoins reserve is an indicator that shows the amount of fiat-tied coins being held in exchange wallets.

An increase in the value of this metric implies investors have pulled out of their positions in volatile markets like BItcoin, waiting for the right opportunity to jump back in.

A decrease could mean the opposite; investors are using their stablecoins supply to grab some BTC or other cryptocurrencies. They can also just be sending their coins to personal wallets for storage purposes.

Here is the chart for the stablecoins reserve vs Bitcoin Price over the past year:

The stablecoins reserve shoots up | Source: CryptoQuant

As the above graph shows, the value of the indicator has sharply risen recently, and now is over $19 billion. This is a new all-time-high (ATH) value for the metric.

Related Reading | Comparing Bitcoin And Crypto To The Internet In 1997

The trend with the stablecoins reserve has lately been that the indicator quickly goes up as BTC’s price shows a dip, and then gradually decreases while Bitcoin’s price moves upwards.

This makes sense as a decrease in the value of the metric means investors are using these assets to buy BTC, thus driving the price up.

Related Reading | This Metric Suggests Bitcoin Miners Rarely Catch The Cycle Top

Based on this pattern, the current high value of the stablecoins reserve could mean there is a lot of dry powder waiting to be poured into the Bitcoin market, helping the cryptocurrency make a big move.

Though, one thing to note is that while the indicator seems to be reacting to BTC’s movements, investors could always use these fiat coins to buy some other cryptocurrencies instead. Thus, in such a case, BTC’s price wouldn’t be affected much.

Bitcoin Price

At the time of writing, BTC’s price seems to be around $47.8k, down 3% in the last 7 days. Over the past 30 days, the crypto has gained 16% in value.

The below chart shows the trends in the value of Bitcoin over the past three months:

BTC catches a downward trend | Source: BTCUSD on TradingView

Bitcoin reached above $49k again yesterday, but has since fallen back off. It looks like the crypto is in consolidation as its price keeps bouncing back and forth between the $45k-$50k range.

It’s hard to say where the coin might head next. It could continue the current downtrend and dip further below, or if the stablecoins reserve is anything to go by, investors might jump in during a dip, and help BTC make a large move up.