- February 21, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

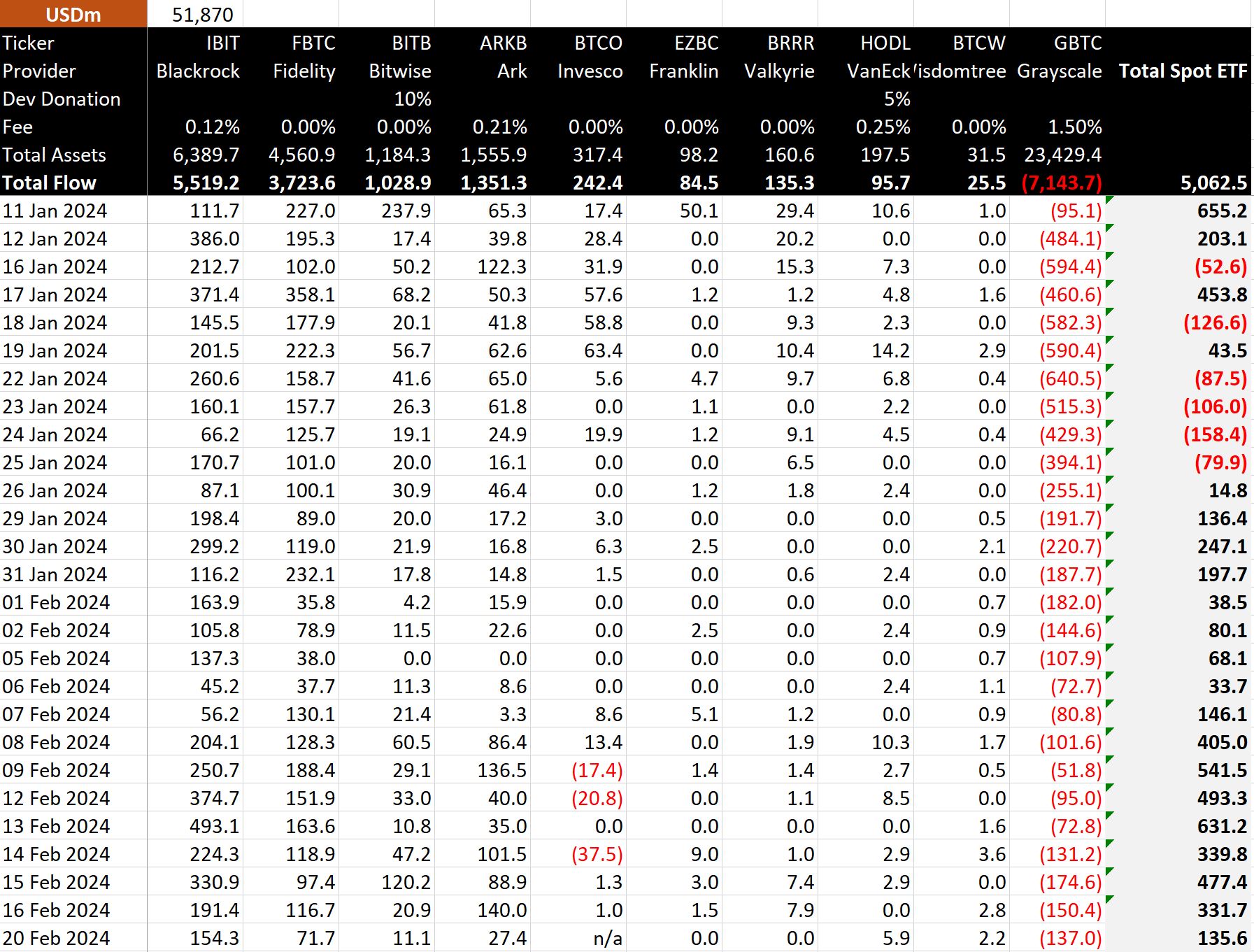

The financial landscape of Bitcoin ETFs saw considerable inflows on Feb. 20, as reflected in recent data from BitMEX, with an influx of $136 million, the equivalent of 2,606 BTC. BlackRock IBIT is at the helm, with an additional inflow of $154 million, raising BlackRock IBIT’s total net inflows to an impressive $5.5 billion.

BitMEX data shows that GBTC experienced a significant outflow of $137 million, pushing their total net outflows to a staggering $7.1 billion. Since the Bitcoin ETFs started trading on Jan. 11, they have now seen overall net inflows surpass the $5 billion mark.

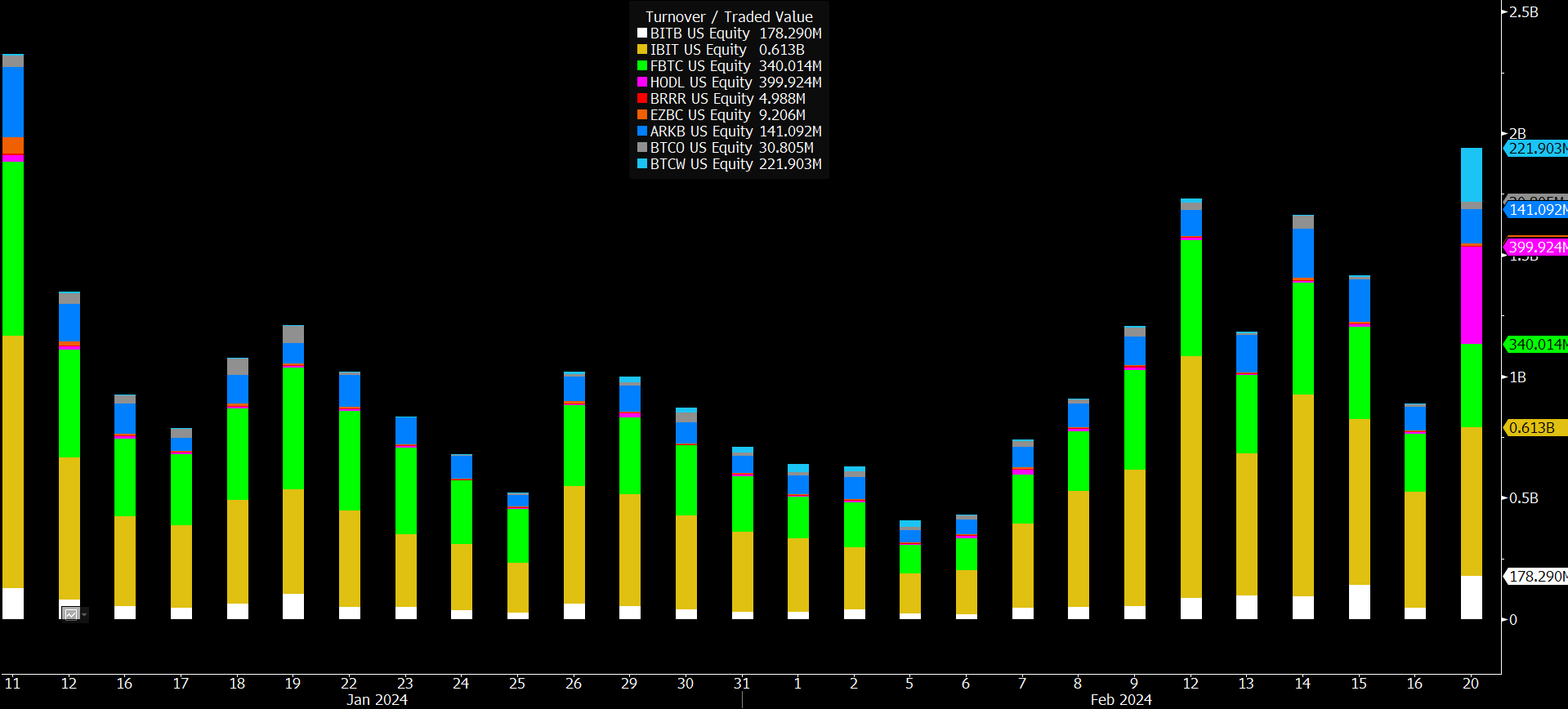

Adding to this robust financial scenery, Senior Bloomberg ETF Analyst Eric Balchunas highlighted a record-breaking day for ‘The New Born Nine‘. He noted that these funds had their largest volume day since day one, with a combined trading contribution of about $2 billion, significant contributions from Vaneck Bitcoin Trust ETF (HODL), Wisdomtree Bitcoin ETF (BTCW), and Bitwise Bitcoin ETF (BITB), according to Balchunas.

The post Bitcoin ETFs attract more than $5 billion in net inflows since market debut appeared first on CryptoSlate.