- January 27, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

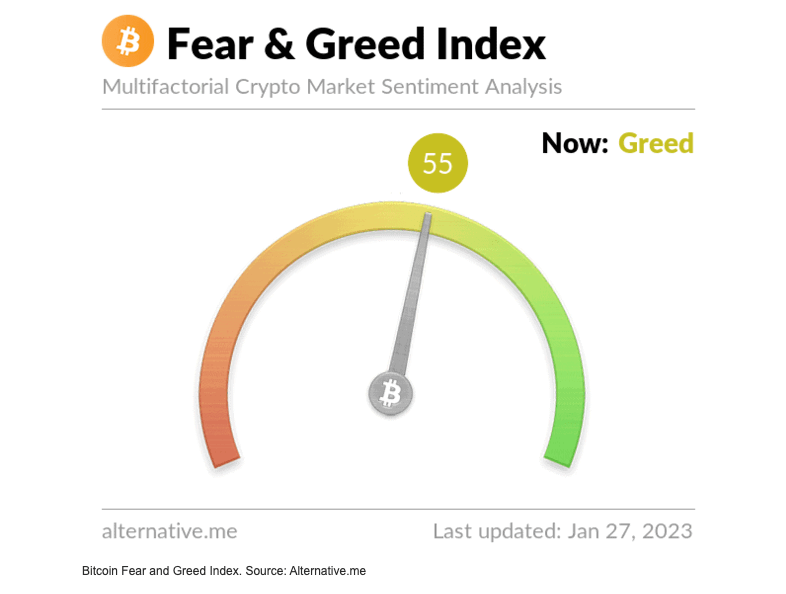

For the first time since March 30, 2022, the Bitcoin Fear and Greed index is firmly in the “greed” zone.

With BTC up nearly 40% year-to-date, the index signals a bullish sentiment as the original cryptocurrency makes significant strides after plummeting to below $16,000 and a two-year low in 2022.

What metrics make up the BTC/FGI?

The Bitcoin Fear and Greed Index (FGI)uses a combination of technical and fundamental analysis to measure the sentiment of the market. The index uses a variety of data points, including:

- Volatility: Measures the volatility of the price of BTC, based on the daily standard deviation of returns.

- Market Momentum/Trend: looks at the direction of the moving averages and the gap between them

- Trading Volume: Analyzes the trading volume of BTC, looking for changes in the buying and selling pressure.

- Social Media Sentiment: Analyzes the sentiment of the online community by looking at the number of positive and negative mentions of BTC in social media.

- Surveys: Surveys of investors and traders, to gauge their sentiment towards BTC and the cryptocurrency market as a whole.

- The index ranges from 0 to 100, with a higher score indicating a higher level of fear and a lower score indicating a higher level of greed. It is published by alternative.me, a website that tracks alternative investments, including BTC.

The post Bitcoin fear and greed index enters ‘greed’ zone after 10 months appeared first on CryptoSlate.