- February 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

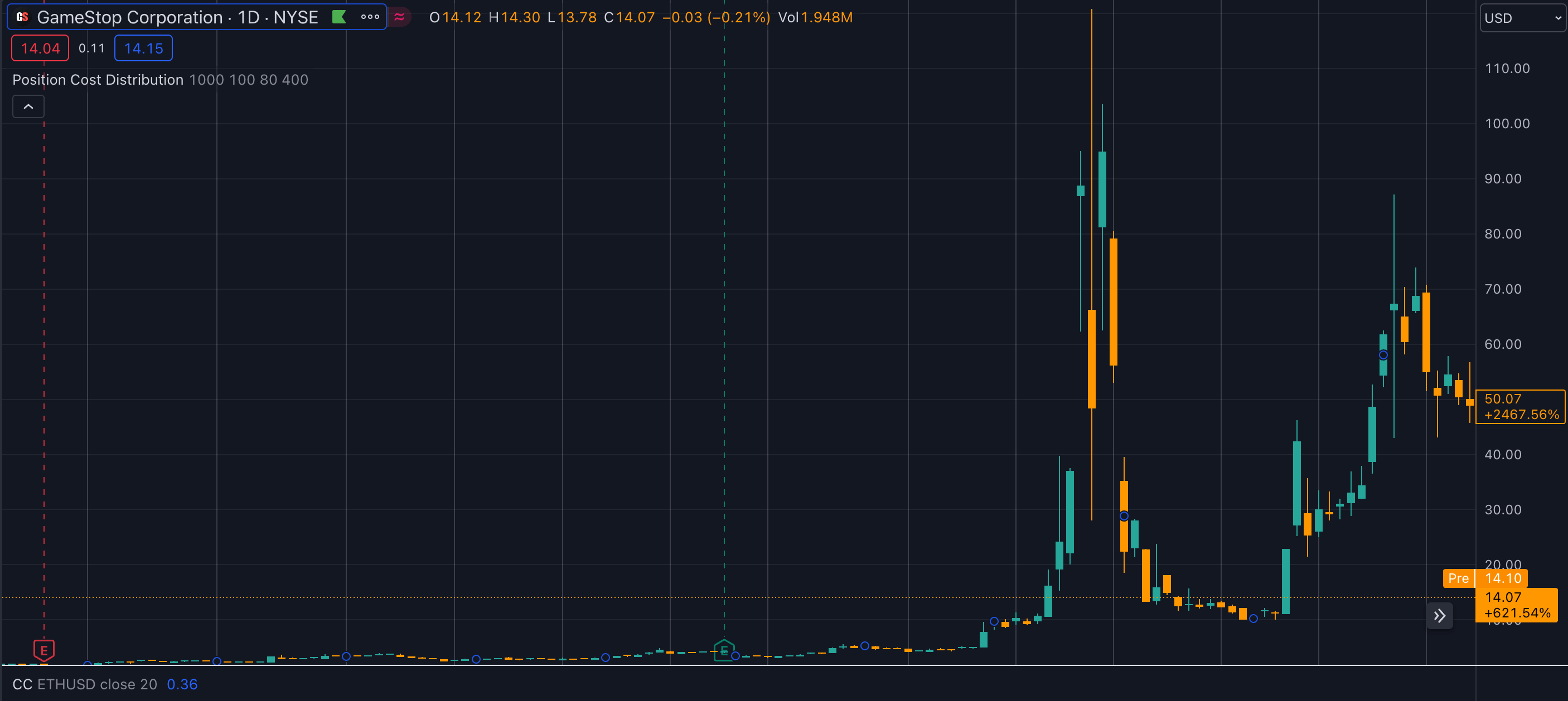

The 2021 GameStop saga, recently featured in a Netflix movie, may have unexpected parallels with Bitcoin, particularly in the context of a potential supply crunch.

Echoes of the Reddit-fueled’ mother of all short squeezes’ (MOASS) for GameStop, in Bitcoin’s context, could manifest as a significant supply squeeze, or ‘Bitcoin Mother Of All Supply Squeezes’ (Bitcoin MOASS.) I’ve referenced this in several articles this year, but I wanted to break down exactly why I think this could happen.

To understand this better, let’s revisit the GameStop phenomenon.

I wasn’t early enough to follow Roaring Kitty through his initial thesis on GME at around $3 per share. However, I was active within the WallStreetBets subreddit, and by the time the stock hit $13, it was hard to ignore his daily updates. Around the $50 (pre-stock split) price, I cracked and ‘YOLOed’ in and took the ride up to $500, determined to hold for the moon or bust. Ultimately, I bust, but I enjoyed being a part of something.

GameStop short squeeze thesis basics.

For those unfamiliar, GameStop shares were heavily shorted by several hedge funds who saw easy prey in a retail store headed for bankruptcy with the added pain of the pandemic. Seemingly, the goal was to short the stock to zero. This strategy, often employed against faltering companies (like Blockbuster before its demise), is essentially betting on the company’s failure.

However, hedge funds underestimated the attachment many gamers had to the GameStop brand and the power of retail investors uniting behind a cause. There was also a more philosophical aspect to why many investors, myself included, purchased shares related to the broken traditional finance system. As a Bitcoiner, this message resonated with me, and I bought shares intending to HODL ‘to the moon.’

Long story short, retail investors, mainly through Robinhood (but also all around the world,) actively piled in, buying GME shares aggressively in the hope that it would force the hedge funds to close their shorts at higher prices and trigger a short squeeze. This tactic did inflict significant losses on some hedge funds, although many had the financial buffer to absorb these losses.

The lack of real-time short-interest reporting further complicated matters. Hedge funds were able to close their short positions without the knowledge of retail investors, perpetuating the short squeeze narrative and leaving it unclear whether all short positions have truly been covered.

Further, as many investors entered the fray above $100, they were not as impressed with the 2x or 3x increase in value. Ultimately, from the $3 original price point to where it peaked before Robinhood turned off buy orders, GME rallied around 11,000% in a few months.

For all intents and purposes, GME had a monumental short squeeze, followed by a further 700% secondary squeeze a few months later.

Yet, to this day, there are investors on Reddit who are adamant that the shorts have still not been covered, and a MOASS that will take GME prices over $1 million is on the horizon.

Now, how does this relate to Bitcoin?

Bitcoin’s mother of all supply squeezes.

Bitcoin and GameStop differ in many ways. Ultimately, GameStop is a traditional equity that was being bullied out of existence by TradFi, while Bitcoin is a solution to the inherent problems of TradFi as a whole.

However, GameStop, specifically GME, represented a similar ethos at one point in its history. Before it became the poster child for ‘meme’ stocks, to many, GME was about unifying retail investors against ‘the man.’ It was a way to fight back against corporate greed, devouring everything in its path.

This ideal still drives those of r/superstonk or whatever the current subreddit is for the die-hard GME diamon hands. However, in my view, while that is now but a mere misguided dream, there is a genuine opportunity with Bitcoin for a real MOASS.

The chart below highlights some key aspects of the GameStop and Bitcoin comparison. The key drivers are the halving, Bitcoin ETF inflows, and scarce supply.

| GameStop | Bitcoin |

|---|---|

| High short interest | Majority of BTC in personal cold storage |

| Retail purchases reduce supply | ETFs launch and buy Bitcoin |

| Price increase to cover shorts | ETF demand outpaces supply |

| 5 million new shares issued worth $1.2 billion | Fixed issuance per block |

| Unlimited supply of shares | Fixed supply of Bitcoin |

| Price falls as shorts cover | Price increases after halving |

| Price falls as shares diluted | Price increases as supply dries up |

Bitcoin’s fixed supply contrasts starkly with GameStop’s ability to issue more shares, which happened six months after the short squeeze. Bitcoin’s limited supply and increasing inflows into Bitcoin ETFs suggest a looming supply squeeze. This could mirror the GameStop scenario but in a unique, Bitcoin-specific context.

In contrast, the Bitcoin market operates with greater transparency, thanks to blockchain technology. This brings us to the relevance of this comparison to Bitcoin. Unlike GameStop, which can issue more shares, Bitcoin has a strictly limited supply. With the current rate of inflows into Bitcoin ETFs, a supply squeeze is becoming increasingly likely. This situation could parallel the GameStop short squeeze but in a different context.

Conditions required for a supply squeeze.

Certain conditions must be met for such a Bitcoin supply squeeze.

First, the continuous inflow into Bitcoin ETFs is crucial. The recent addition of Bitcoin ETFs into other funds is a great sign of this enduring.

Secondly, Bitcoin holders need to transfer their holdings into cold storage, making it inaccessible to over-the-counter (OTC) desks.

Unlike traditional brokerages, platforms like Coinbase can’t simply lend out Bitcoin as it’s not commingled, offering a layer of protection against such practices. However, the recent outflows from Grayscale indicate that there is still ample liquidity in the market for major players like BlackRock, Bitwise, Fidelity, and ARK to purchase Bitcoin.

The situation could shift dramatically if the Newborn Nine ETFs amass holdings in the range of $30-40 billion each. Considering that approximately 2.3 million Bitcoins are on exchanges and about 4.2 million are liquid and regularly traded, a significant portion of Bitcoin could be absorbed or become illiquid. If the trend towards storing Bitcoin in cold storage continues and trading diminishes, the available Bitcoin for OTC desks could decrease markedly.

Should ETFs persist in acquiring Bitcoin, and individual users continue to buy and store it in cold storage, we could see a notable rise in Bitcoin prices within 18 months due to diminishing market availability. This situation could prompt ETFs to purchase at higher prices, raising questions about the sustainability of demand for these ETFs at elevated Bitcoin valuations.

Bitcoin in cold storage vs GameStop ComputerShare.

The true GameStop HODLers transferred their GME shares to Computershare to prevent shares from being lent out for shorting, akin to putting Bitcoin in cold storage. They did this to attempt to limit supply. However, this didn’t stop the GameStop board from issuing more shares, which will never happen with Bitcoin.

Thus, the market could witness a significant shift if the trend of transferring Bitcoin to cold storage accelerates, coupled with persistent ETF purchases. About 4.2 million Bitcoins are now considered liquid and available for regular trading. However, if this liquidity decreases through reduced trading activity or increased storage in cold wallets, the supply accessible to over-the-counter (OTC) desks could diminish rapidly.

This potential scarcity raises intriguing scenarios. Should ETFs continue their buying spree, and retail users also keep purchasing Bitcoin, directing it into cold storage, we could be on the cusp of a significant supply squeeze. Based on current data, if inflow rates remain constant, this convergence might occur as soon as next year, primarily influenced by major players like BlackRock buying from the available liquid supply. If retail users remove all Bitcoin from exchanges, there’s scope for it to happen sooner.

Pyschology of investors and momentum trading.

The total supply of Bitcoin that can be considered potentially liquid is still substantial, around 15 million. This means that the potential supply at any price needs to be considered, as even long-term HODLers could be convinced to sell at prices above the last all-time high. While it’s not a guaranteed outcome, the possibility is intriguing.

The psychology of retail investors, already proven significant in cases like GameStop, could also play a crucial role in Bitcoin’s scenario. The advice to ‘HODL,’ buy Bitcoin, and invest in ETFs could resonate strongly with investors who share this mindset.

Notably, the appeal of Bitcoin ETFs lies partly in their affordability and accessibility; they are priced much lower than an actual Bitcoin, making them attractive to a broader audience. This psychological aspect, similar to the perceived affordability of tokens like Shiba Inu or Dogecoin, could drive investor behavior toward Bitcoin ETFs.

Ultimately, the parallels between the GameStop saga and the potential supply dynamics in the Bitcoin market are striking. The combined effect of continued purchases by ETFs and the trend of Bitcoin holders moving their assets to cold storage could lead to a ‘mother of all supply squeezes’ in the Bitcoin market. While various factors are at play, and the outcome is not inevitable, the potential for a significant shift in the Bitcoin market is an exciting prospect. As the situation unfolds, it will be interesting to observe how the interplay of retail investor psychology, ETF inflows, and Bitcoin’s unique supply characteristics shapes the market.

The post Could Bitcoin echo GameStop with a Mother Of All Supply Squeezes? Maybe appeared first on CryptoSlate.