- March 26, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Crypto fund DragonFly Capital announced the launch of a new $225 million fund to invest in projects across the crypto space.

Following the success of the original $100 million fund kickstarted in late 2018, the Dragonfly Fund II will target four potential areas: decentralized finance (DeFi) protocols, non-fungible token projects, Ethereum Layer 2-based businesses, and centralized finance (CeFi) platforms.

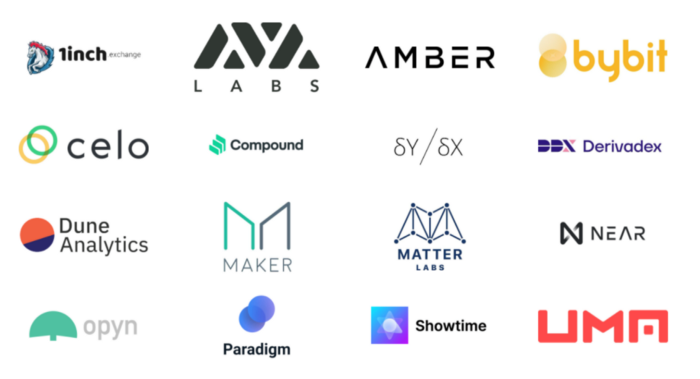

The San Francisco-based venture capital fund have been early backers of notable projects such as ByBit, Compound, Celo, and Maker, among others. Much of DragonFly Capital’s past investments have been focused on the DeFi space, but as the crypto space continues to rapidly evolve, it’s clear that the fund is exploring new opportunities.

Notable projects DragonFly Fund I has backed to date.

In a blog post, they acknowledged the risk of betting on volatile, “frothy” spaces like NFTs. Non-fungible tokens have been all the rage this year, with the industry gaining mass-popularity as cryptos rallied to record highs. Riding on the fresh NFT wave, digital marketplace OpenSea raised $23 million in Series C funding earlier this month.

Once the novelty wears out, however, it’s uncertain whether the industry can continue its parabolic growth. Despite such concerns, DragonFly Capital reiterated that these emerging spaces have the potential to become an “important component of the digital future.”

Venture capital giant Sequoia will back the fund as a strategic limited partner, alongside OKEx, Huobi, Bitmain and Bybit. “Together with many of the technology and cultural leaders from US technology firms and VCs, we’re in an incredible position to help unite and push the crypto movement forward,” said Hasseb Qureshi, managing partner at DragonFly Capital.