- February 27, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

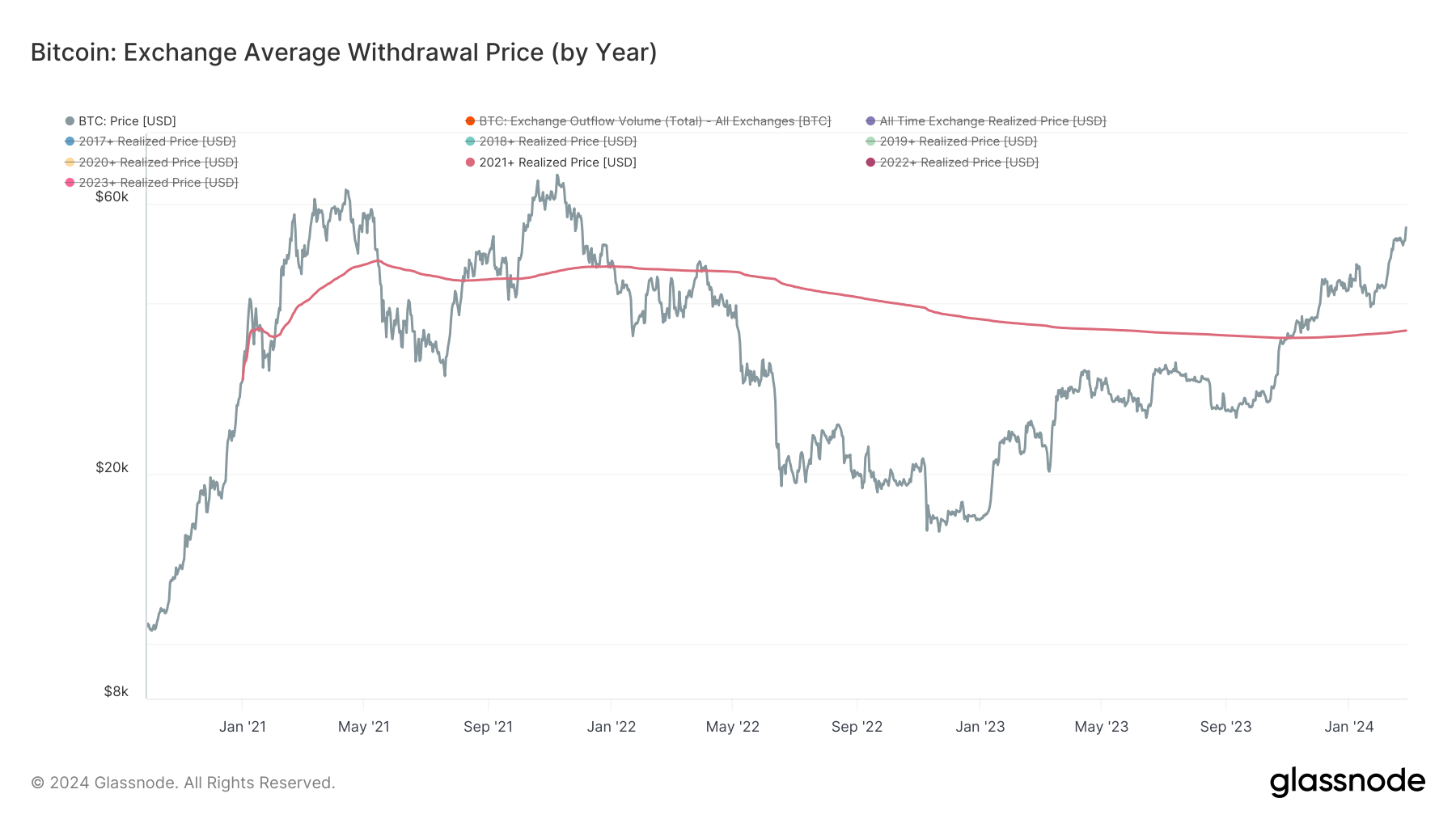

Data shows that the 2021 cohort of Bitcoin investors, those who purchased Bitcoin during the fervor of 2021 when it hit highs of over $60,000 in Q1, possess an impressive holding record.

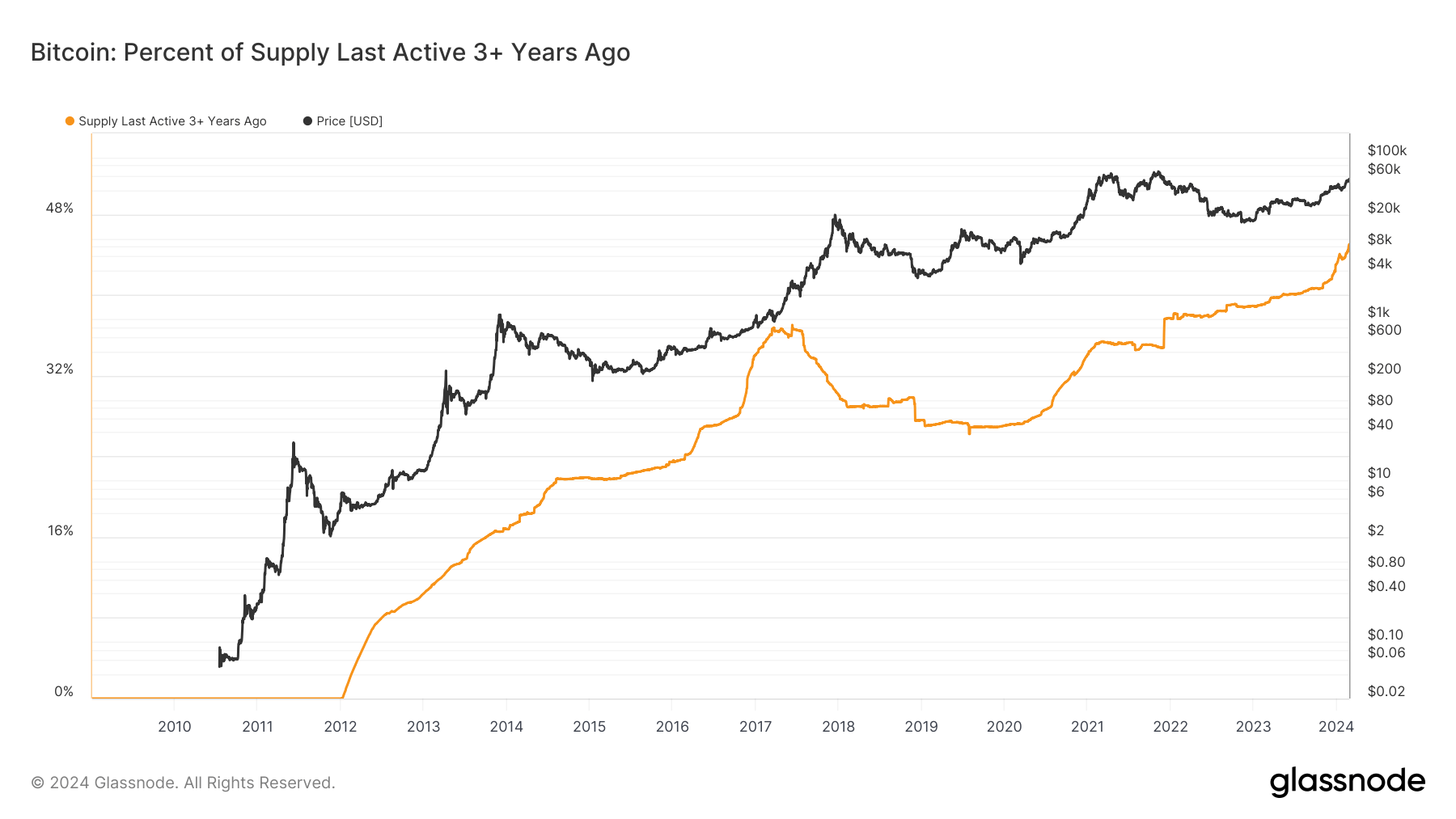

Three years later, they epitomize long-term holding in an often volatile market. The proportion of circulating supply that has remained static for a minimum of three years is noteworthy. Approximately 45% of the total circulating supply has not seen any movement for at least three years.

As we progress and conclude this quarter, it is projected that this percentage will further increase, demonstrating the remarkable resilience of this cohort.

Interestingly, their realized price, the cost basis of the cohort, dramatically reduced during the bear market. Initially, their realized purchase cost peaked at a substantial $47,000 during Q1 2021, but consistent buying through the market downturn resulted in a reduced cost basis to $35,000. In November 2023, this cohort experienced their first profits since the fourth quarter of 2021.

The post 2021 Bitcoin investors showcase long-term holding resilience appeared first on CryptoSlate.