- August 13, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

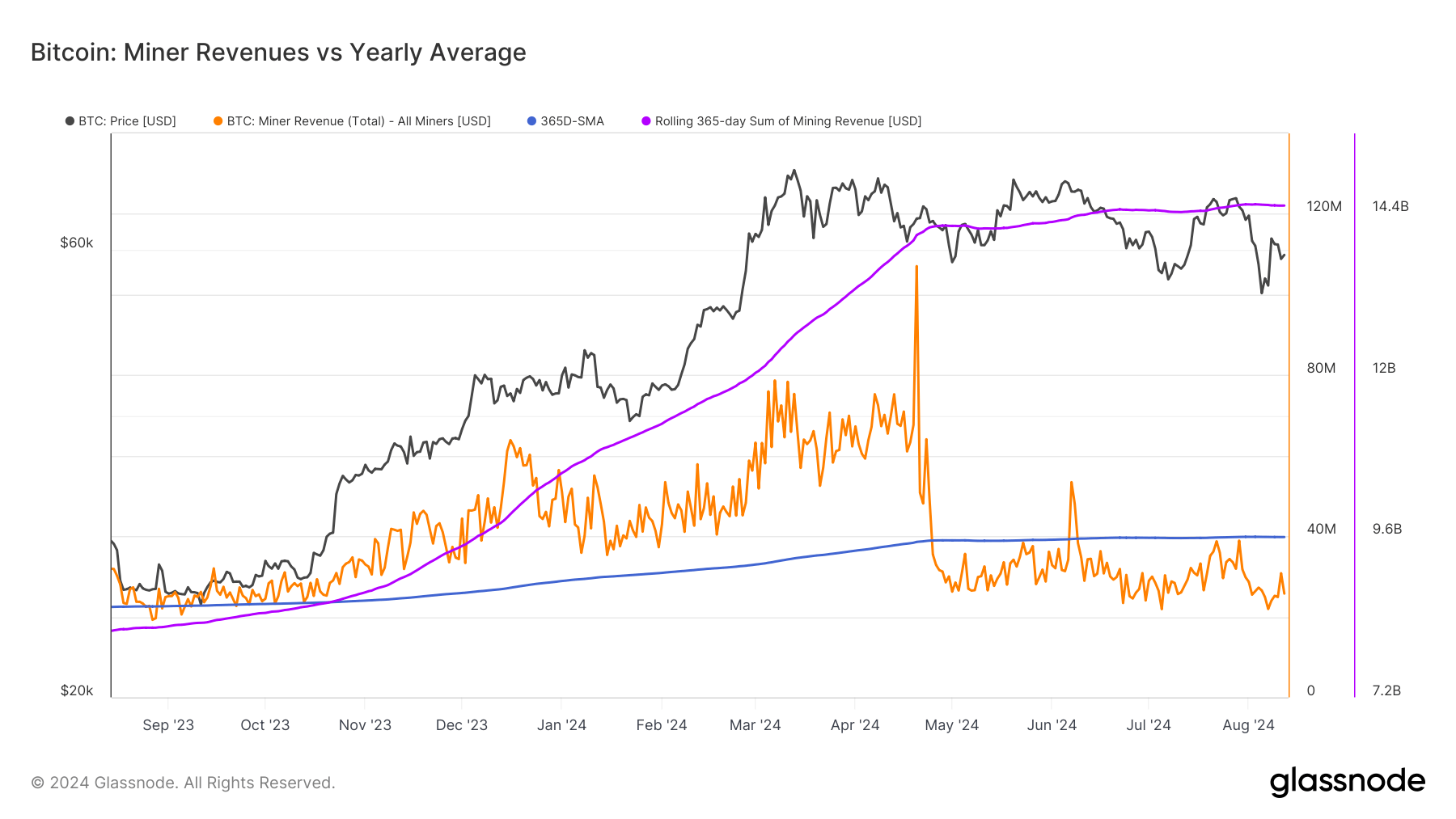

Miner revenues serve as a barometer for the overall state of the Bitcoin ecosystem, reflecting the delicate balance between mining costs, Bitcoin price, and network difficulty. Since Apr. 24, miner revenue has consistently been below its 365-day simple moving average (SMA), with only two brief exceptions in early June.

This prolonged period of below-average revenue culminated on Aug. 7, when miner revenue plummeted to its lowest level since September 2023. While this sustained downturn can be attributed to several factors, last week’s drop resulted from a significant drop in Bitcoin’s price.

Bitcoin saw significant volatility in August, dropping from $65,360 at the beginning of the month to below $50,000 on Aug. 5 before partially recovering to $54,000 within 24 hours. Significant price fluctuations like this directly impact miner revenue, as the USD value of each mined Bitcoin decreases with the price.

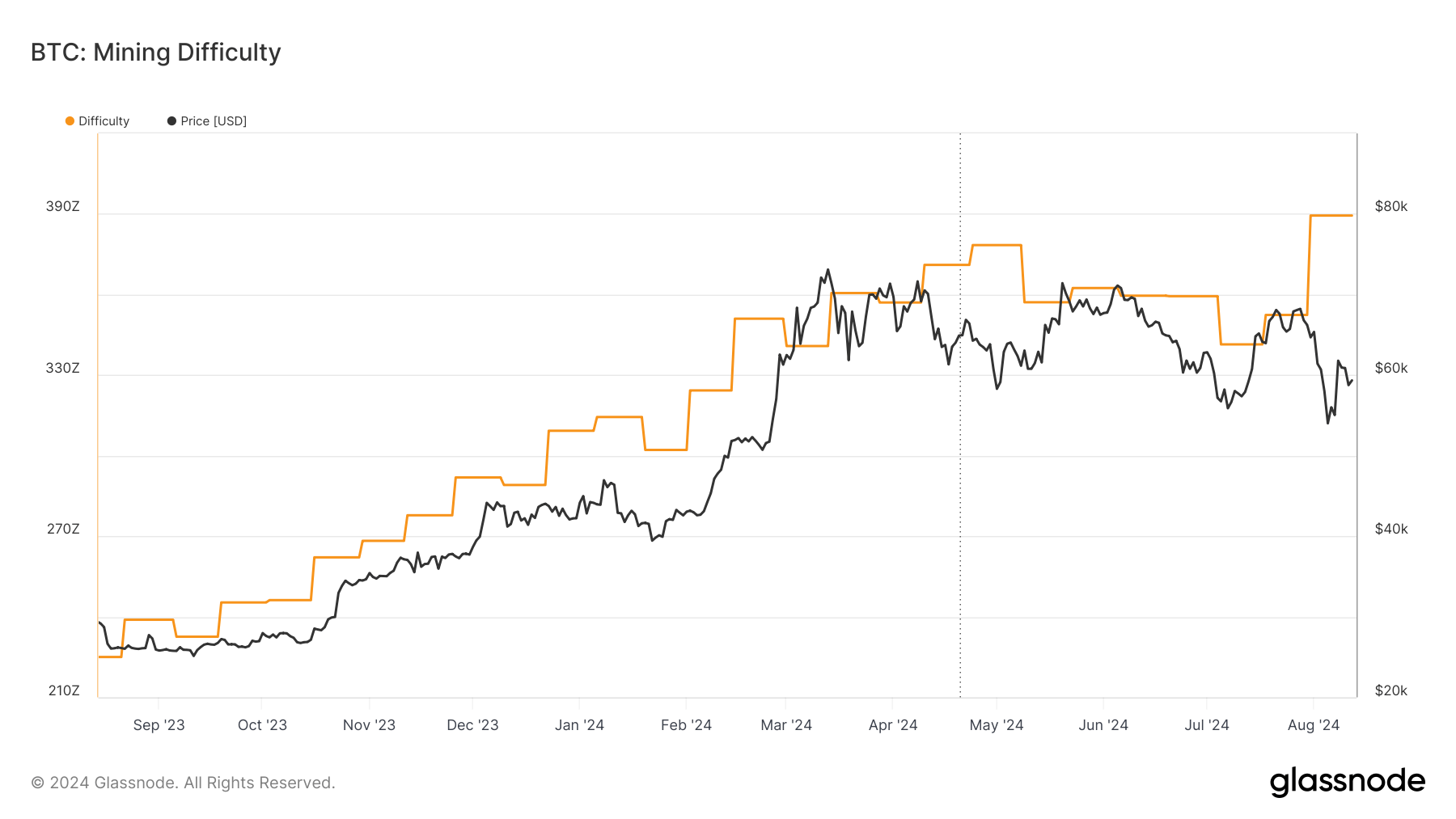

Bitcoin mining difficulty has also been increasing this month, requiring more computational power to mine each Bitcoin and further squeezing profit margins.

This short-term volatility is part of a long-term trend that began with Bitcoin’s halving in April. The halving reduced the block reward from 6.25 BTC to 3.125 BTC, halving the number of new Bitcoins entering circulation. This structural change has impacted miner revenues and profitability, forcing the industry to adapt to a new economic reality while juggling short-term volatility.

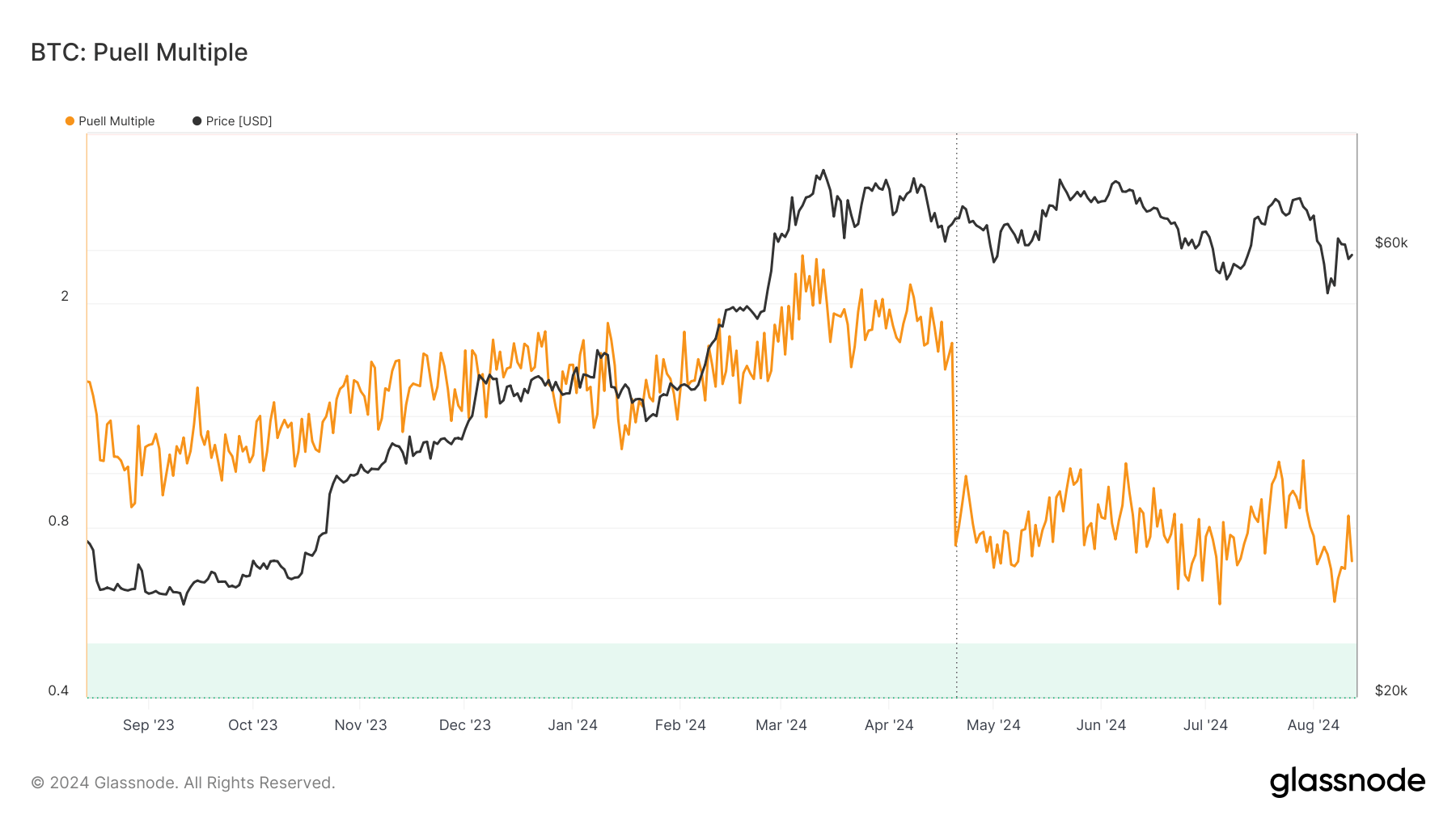

To better understand the implications of these changes, we can turn to the Puell Multiple, a valuable metric for assessing miner profitability and market conditions. The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value. This metric helps identify periods of miner stress and potential market turning points.

On Aug. 5, the Puell Multiple dropped to 0.5910, its lowest level since Jan. 3, 2023. This sharp decline from 1.0525 on Jul. 29 indicates that the daily issuance value fell significantly below the yearly average. An even more dramatic drop occurred immediately after the halving, with the multiple plummeting from 1.6999 on Apr. 19 to 0.7441 on Apr. 20.

Historically, a Puell Multiple below 0.5 has signaled market bottoms and presented attractive buying opportunities for investors. The current value of 0.7, while not yet below this threshold, suggests that miners are under considerable pressure and that the market might have approached a bottom. However, it’s crucial to note that the recent halving event has fundamentally altered the issuance, potentially affecting how we interpret the Puell Multiple in the near term.

The combination of below-average revenue and a low Puell Multiple shows significant stress in the Bitcoin mining industry. Miners are currently earning less USD per Bitcoin mined, pushing less efficient operations towards the brink of unprofitability. The reduced rewards post-halving have intensified competition among miners for the available Bitcoin, leading to increased hash rates and mining difficulty.

If these conditions persist, the market may see another capitulation event, where miners are forced to sell a large part of their reserves or shut down operations altogether. This scenario could increase market volatility as miners liquidate holdings to cover operational costs. However, it may also drive efficiency improvements across the industry as miners seek cheaper energy sources and upgrade to more efficient hardware.

From a market perspective, the current state of miner revenues and the Puell Multiple carries several implications. as noted, periods of miner stress and low Puell Multiples have often signaled a good buying opportunity for long-term investors. Additionally, miners operating at or near breakeven levels may be less inclined to sell their Bitcoin holdings, potentially reducing overall market supply and supporting prices.

The stress on the mining ecosystem could lead to a more efficient and resilient industry in the long term, a trend we’ve already begun seeing among large, public miners. As less efficient operations are forced out of the market, those that remain will likely be better equipped to weather future market fluctuations.

The post Puell Multiple drops as miner revenues hit 10-month low appeared first on CryptoSlate.