- April 15, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The Acala Build initiative is underway and has seen large amounts of support from the crypto community. The foundation is taking a new approach to how funds are raised, and what the proceeds are used for.

Unlike an ICO, the Acala Build initiative is a way to support Acala’s development, and further create liquidity in the Acala treasury, so that the platform can grow.

Many platforms use the proceeds of fundraising to support the people who work on the platform, but Acala has opted for a system that supports the goals on the foundation instead.

Acala is working to be an all-in-one totally decentralized financial hub for the Polkadot ecosystem, so having a strong financial position is a very good idea.

According to the foundation,

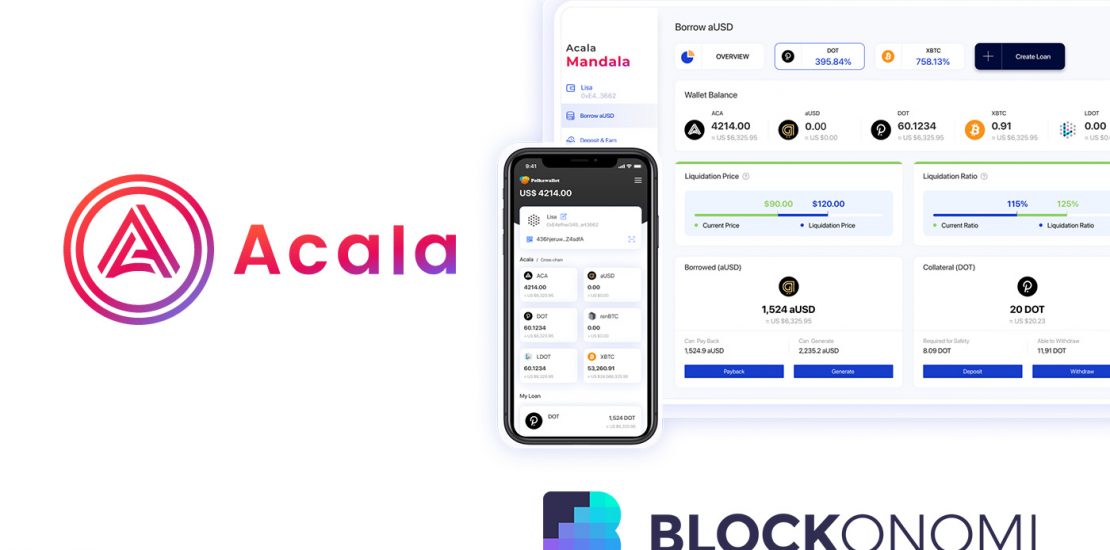

“Acala is an Ethereum-compatible platform for financial applications to use smart contracts or built-in protocols with out-of-the-box cross-chain capabilities and robust security. The platform also offers a suite of financial applications including: a trustless liquid DOT staking derivative (LDOT), a multi-collateralized Acala Dollar stablecoin backed by cross-chain assets (aUSD), and an AMM DEX – all with micro gas fees that can be paid in any token.”

The Acala Build initiative is similar to an ICO, in that it will seek funding from the wider crypto community, and offer ACA tokens for anyone who participates – but unlike an ICO, the funds that are raised won’t go to executives’ salaries, or to run the foundation.

The Acala Build Initiative Found Strong Support

Pre-registration for the Acala Build initiative had to be closed at 7 a.m. UTC on 9th April 2021 due to the demand to participate in the event. DeFi has become a very popular market segment, and Acala is a well-known foundation in the space.

The event will accomplish the following goals (according to the foundation),

- In the Build Acala event, ACA tokens are denominated in DOT, though participation in the event requires BTC as the settlement token.

- All proceeds of the event will be converted to DOT and contributed to the Acala Treasury.

- Deployment of the Acala Treasury will be determined by the network governance following Acala’s launch. These contributions will not go to the Acala team or foundation.

- The Acala Treasury can then be allocated to the decentralized Sovereign Wealth Fund (dSWF) for use cases like providing liquidity to DeFi protocols, ensuring stability for the Acala Dollar, and sustaining the network through development and operational initiatives like obtaining future parachain slots, and supporting grants.

- For every 10 ACA distributed, 1 KAR will also be distributed to the same account used to participate in the event upon Karura’s launch.

- ACA will be distributed upon the mainnet launch of Acala.

- KAR will be distributed upon the launch of Karura.

A Good Way to Grow

As a decentralized financial hub – having the ability to offer liquidity to the market is vital for Acala’s successful launch. That is one of the big reasons why the architecture that the foundation is using for the Acala Build initiative makes so much sense.

The foundation explains,

“Effectively upon network launch, all proceeds from this Build Acala Event will be contributed to the Acala Treasury, which can then be allocated to the decentralized Sovereign Wealth Fund (dSWF) to inject liquidity, generate yield, and gain access to network security. Acala may also reserve up to 10% of all proceeds to bootstrap Karura’s Treasury, which upon the network launch will effectively be managed by holders of KAR tokens.”

For more information about the Acala Build initiative, or the foundation in general, just click here for all the details.

Acala is clearly well supported by its community and is making solid decisions on how to grow into a successful financial platform in the Polkadot ecosystem.

The post The Build Acala (ACA) Initiative: Bootstrapping the Acala Treasury appeared first on Blockonomi.