- January 21, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Cardano Price Prediction 2026, 2027 – 2030: Will ADA Price Hit $2? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the Cardano token is $ 0.36129023.

- Price prediction suggests potential to reach $2.75 to $3.25 by year-end 2026.

- Long-term forecasts indicate ADA could hit $10.25 by 2030.

The Cardano price prediction 2026 is generating significant buzz in the crypto market, as the last quarter is soon to close in few days, boosting interest for the next altcoin. The 2025 for ADA/USD began with numerous fundamental updates strengthening its future, including the transformative Plomin Hard Fork, but 2026 seems even more constructive.

Now, Questions abound: “Will Cardano spearhead the altcoin movement?” and “What heights can ADA reach by 2050?” Explore this Cardano price prediction 2026 and beyond, filled with expert insights and ambitious forecasts.

Coinpedia’s Cardano Price Prediction

The Cardano price outlook 2026 is shaped by its remarkable 4,000% surge in 2020, currently resting at a similar support level. If market sentiment improves, even a modest increase could trigger a potential 1,000% rise to around $4.50.

A more conservative target of $1.40 suggests a 300% gain based on current trends. Analysts are optimistic that ETF approvals could enhance institutional adoption and stability, with price projections ranging from $2.05 to $2.80.

Table of contents

- Coinpedia’s Cardano Price Prediction

- Coinpedia’s Cardano Price Prediction 2026

- Cardano Price Analysis 2025

- Cardano AI Price Prediction For January 2026

- ADA Price Prediction 2026

- Cardano On-chain Analysis

- Cardano (ADA) Price Prediction 2026 – 2030

- Cardano Price Prediction 2031, 2032, 2033, 2040, 2050

- Market Analysis

- FAQs

Cardano Price Today

| Cryptocurrency | Cardano |

| Token | ADA |

| Price | $0.3613 |

| Market Cap | $ 13,019,180,130.80 |

| 24h Volume | $ 737,434,189.2440 |

| Circulating Supply | 36,035,240,284.4779 |

| Total Supply | 44,994,357,503.7267 |

| All-Time High | $ 3.0992 on 02 September 2021 |

| All-Time Low | $ 0.0174 on 01 October 2017 |

Coinpedia’s Cardano Price Prediction 2026

The Cardano price prediction for 2026 is influenced by its remarkable rise in 2020, during which Cardano surged nearly 4,000%. Currently, it is at the same support level it experienced back then.

If market sentiment improves, even a modest increase could lead to a potential rise of 1,000%, bringing the price to around $4.50. A more conservative target of $1.40 indicates a potential gain of 300% based on current market trends. Analysts believe that the approval of ETFs could boost institutional investment and stability, with optimistic price predictions ranging from $2.05 to $2.80.

Cardano Price Analysis 2025

From January to December 2025, the price of Cardano (ADA) has undergone a significant decline, particularly notable after reaching an impressive peak of $1.32 in December 2024.

Upon examining the Cardano price chart, a falling wedge formation has emerged during this downward trend. This pattern often indicates a potential reversal, which could be the next possible move for ADA/USD price action.

However, the macro conditions and cautious interest are the major barriers that prevent ADA from meeting all necessary conditions to shift the trend with a strong catalyst involved. The pattern itself suggests that a bullish trend could follow the current bear market, but 2025 was not the chosen year for it.

The recent downturn came after a brief attempt to maintain a presence above the significant $1 mark in August 2025. This suggests that the current trend had very weak demand and was not strong enough to alter the existing pattern. As a result, December closed below $0.40.

But, On a positive note, the outlook for Q1 2026 appears more encouraging compared to Q4 2025’s pessimism. There is a potential for a shift towards the $1 mark and possibly beyond, depending on factors such as demand and liquidity.

Cardano AI Price Prediction For January 2026

| Source | Low Price | Average Price | High Price |

| Gemini | $0.85 – $0.95 | $1.00 – $1.20 | $1.30 – $1.50+ |

| BlackBox | $0.65 | $1.00 | $1.50 |

| ChatGPT | $0.75 | $0.95 | $1.25 |

ADA Price Prediction 2026

The Cardano price prediction 2026 highlights a crucial support level on its weekly chart, a zone that has historically functioned as a solid pivot point for price trends, and gives another rally vibes now.

This support level is known for displaying remarkable resilience over time, suggesting that if Cardano price USD can maintain its position above this threshold once again, it could pave the way for significant price movements in 2026.

Looking back at Cardano’s historical performance on the weekly chart, it reveals an extraordinary rally that occurred in 2020, when the asset experienced staggering gains of nearly 4000%.

During that bullish phase, the Cardano price USD spent an extended period consolidating around the dynamic support trendline, which appears to be a strategic accumulation at discounts from smart money, contributing significantly to its eventual surge.

If the current market sentiment shifts positively, a resurgence in investor confidence could lead to a recovery. Not ambitiously, even modestly, past performance could give a tremendous surge. Last year’s performance was 4000%. If we assume 1/4 of that momentum, it will result in an increase of approximately 1000%, which could potentially elevate Cardano’s price to an estimated $4.50 by 2026.

Conversely, a more conservative approach suggests a realistic price target of around $1.40, indicating a potential increase of about 300%. This estimate remains feasible, especially since it is based on fundamental analyses and market trends that are not reliant on speculative triggers, such as the possible approval of exchange-traded funds (ETFs).

Additionally, many experts propose that these ETFs could significantly impact the market by boosting institutional investment and improving market stability. In a situation where ETF approvals occur and retail investor excitement rises, Cardano’s price could realistically range from $2.05 to $2.80.

| Scenario | Potential Low | Average Price | Potential High |

| Without ETF Approval | $0.85 | $1.10 | $1.25 |

| With ETF Approval + Retail Surge | $1.20 | $1.65 | $2.05 |

| Bullish Breakout (with ETF & macro support) | $1.50 | $2.05 | $2.80 |

Cardano On-chain Analysis

As per Cardano’s on-chain metrics, “Smart Money” accumulation phase is the best observation right now, because the divergence between retail and institutional holders is more vivid than ever.

As the number of addresses holding between 10 and 1 million ADA is declining, and the consistent surge in the 10 million to 100 million coin bracket confirms this, this represents a major supply consolidation. The observation shows that these mega-whales are strategically absorbing the “weak hands” during price dips, effectively building a rock-solid fundamental floor for the asset. Also, the fact that the 1M to 10M coin bracket is also growing confirms that professional high-net-worth investors seem to be positioning for a recovery, too.

Similarly, the surge to 4.57 million total holders despite a grueling 2025 proves that Cardano’s ecosystem is expanding its reach even in a “stress test” environment. This growth in the holder base suggests that the asset is not being abandoned; rather, it is being redistributed into a more stable, long-term foundation. When a holder count rises as prices fall, it signals that the market views current levels as a deep-value opportunity rather than a reason to exit.

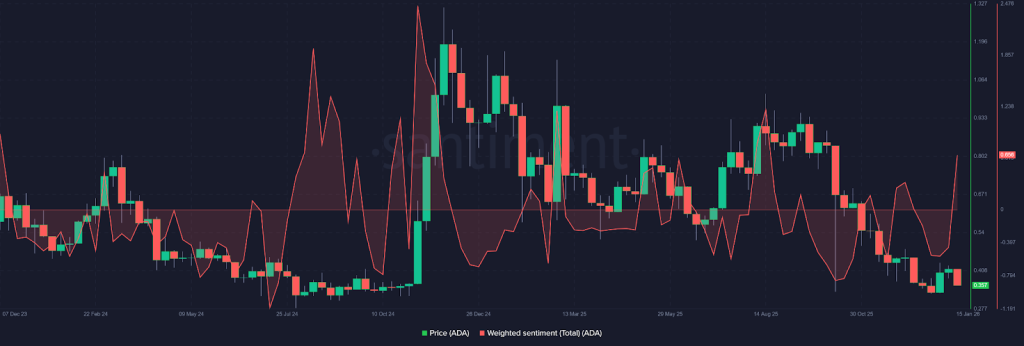

Additionally, the Weighted Sentiment flipping the 0 line to 0.656 is a crucial momentum trigger. Professionally, this “0-line flip” indicates that the aggregate social and market bias has shifted from fear to optimism.

Combined with the strategic whale accumulation, this sentiment pivot suggests that the “disbelief” phase is ending and that a bullish rally is likely once the remaining retail sell pressure is fully absorbed by the growing whale cohorts.

Cardano (ADA) Price Prediction 2026 – 2030

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2026 | 2.75 | 3.00 | 3.25 |

| 2027 | 4.50 | 4.75 | 5.00 |

| 2028 | 5.25 | 5.50 | 5.75 |

| 2029 | 6.75 | 7.25 | 7.75 |

| 2030 | 9.00 | 9.75 | 10.25 |

This table, based on historical movements, shows ADA prices to reach $10.25 by 2030 based on compounding market cap each year. This table provides a framework for understanding the potential Cardano price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Cardano Price Prediction 2031, 2032, 2033, 2040, 2050

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 10.50 | 11.00 | 11.25 |

| 2032 | 13.75 | 14.25 | 14.75 |

| 2033 | 17.50 | 18.50 | 19.75 |

| 2040 | 34.25 | 51.75 | 69.25 |

| 2050 | 128.25 | 228.75 | 329.50 |

Based on the historic market sentiments and trend analysis of the altcoin, here are the possible Cardano price targets for the longer time frames.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $0.752 | $1.18 | $6.05 |

| Coincodex | $0.79 | $0.53 | $0.89 |

| Binance | $0.79 | $0.83 | $1.01 |

*The aforementioned targets are the average targets set by the respective firms.

Coinpedia’s Price Analysis provides you with the latest content on the recent market trend that enables you to get closer to the price movements & actions of the various cryptocurrencies.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Cardano could trade between $2.75 and $3.25 in 2026 if market sentiment improves, adoption grows, and key support levels hold.

Cardano is considered a long-term project due to its research-driven development, scalability upgrades, and focus on decentralization.

ETF approval, institutional adoption, network upgrades, and improved macro conditions could all positively impact ADA’s price.

In five years, ADA could trade between $7 and $10 if Cardano adoption grows, scalability improves, and the crypto market enters a strong cycle.

By 2030, Cardano could be valued around $9 to $10 based on long-term growth, network usage, and sustained investor confidence.