- October 1, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

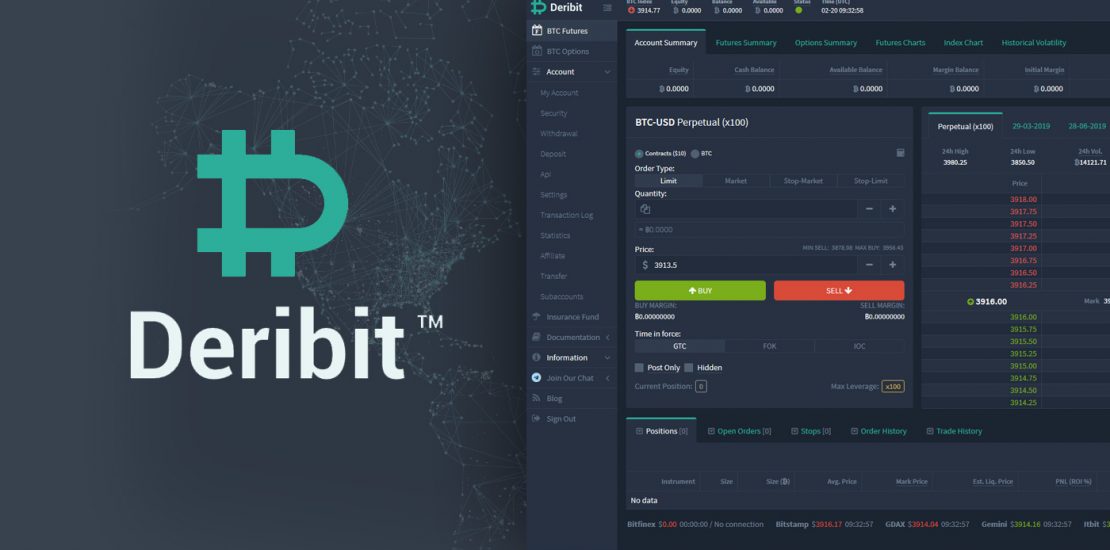

Deribit is a Bitcoin trading platform that enables individuals around the world to engage in futures and options trading.

The team behind the project combined the first letters from the words Derivates and Bitcoin in order to create the name of their website, and members can use Bitcoin in order to make deposits, withdrawals, and to collateralize trades.

The platform also allows traders to take advantage of up to 100x leverage when trading Bitcoin futures. While not as well known as other cryptocurrency futures exchanges, Deribit is growing in popularity and proving to be an attractive alternative for crypto enthusiasts actively involved in futures trading.

Deribit Overview

Deribit is a derivatives exchange based in the Netherlands with the team conducting their day to day operations from an office in Amsterdam. The project launched in 2016, and is registered as Deribit B.V., and retains an address at Stationsstraat 2 B, 3851 NH, Ermelo, The Netherlands.

The company was founded by current CEO John Jansen, and CTO Sebastian Smyczýnski and the Bitcoin and trading enthusiasts have set about creating a platform that caters to their passions. The Deribit team is one of the more transparent in the space and includes CMO Marius Jansen and Lead developer Andrew Yanovsky.

Despite this transparency, all transactions on the platform are processed solely in BTC, and Deribit is currently acting as an unregulated broker as European regulators haven’t classified cryptocurrencies as financial instruments and are still in the process of drawing up a unified framework.

However, the platform is also open to the residents of over 100 countries, and allows traders to take advantage of fee free deposits and withdrawals, up to 100x leverage, and competitive trading fees.

Deribit Features

- Functionality – Deribit utilizes a web-based trading platform, and incorporates an intuitive and relatively easy to use interface that also includes a wide range of functions. Common features such as the order book, trading history, and recent trades are well laid out. The platform also includes futures, index, and volatility charts and a range of statistics, technical analysis indicators, and key data related to futures and options trading.

- Technology – The exchange strives to be technologically advanced and allows users to trade via their trade matching engine with less than 1MS latency. Users can also trade via web interface, mobile (iOS/android), or API and Deribit also integrates with trading bot software such as HaasOnline, BotVS, and Actant. In addition, the platform makes use of cold storage in order to secure approximately 95% of user funds.

- Trading Options – Deribit provides an extensive range of trading options and users have access to both an Options and a Futures exchange. The platform specializes in offering leveraged trading at up to 10x leverage, while BTC futures are available at up to 100x leverage. Users can also take part in margin trading and practise their trading strategies on the Deribit testnet after receiving 10 BTC worth of demo funds.

- Customer Support – The site is available in English, Spanish, Chinese, Russian, Korean, Japanese, and Turkish. In addition, a support team is available to deal with any issues, and the team provide a list of email addresses in the members section. The Deribit team can also be contacted via their Twitter account or Telegram group, and provide a Blog, a Docs page, and an FAQ page in the members section that explain a number of key issues They also run a YouTube channel which contains a number of explanatory videos.

How to Get Started on Deribit

The Deribit website displays login and register panel in the center of the page and you can begin by clicking “Create Account”.

1) Create an Account

You can sign up by entering your email address, username, password and county of residence.

After confirming your email address by clicking the link in the confirmation email, you will gain access to your account.

2) Make a Deposit

You can fund your account by clicking the “Deposit” button at the top right of the page. You can then generate a deposit address that will allow you to transfer Bitcoin onto your Deribit account. When you have processed the transfer, Deribit will only require one confirmation before allowing you to begin trading.

The withdrawal process is very much the same, and you can access the “Withdrawal” tab via “My Account”. Once on the withdrawal page, you’ll need to enter your BTC wallet address, and the desired withdrawal amount. There are a number of priority level options and the choices are linked to the fee you are willing to pay, and the higher the priority, the higher the withdrawal fee.

3) Select BTC Futures or Options Trading

You can navigate your account in order to select your preferred type of trade. The main options are laid out on the left side of the dashboard, while other key features are located centrally.

The futures contracts are quite standard and have monthly expirations; Deribit’s price index is derived from a number of leading exchanges including Bitfinex, Bitstamp, GDAX, Gemini, and Kraken.

Deribit sells future contracts for $10 each, and by using the order panel on the left-hand side, it is possible to choose the order type from Limit, Market, Stop Market, and Stop Limit.

The Stop Limit option allows the user to limit risk by changing the Trigger and Stop price depending on the desired Buy and Sell option. After reviewing the prospective order, it can be confirmed by clicking on BUY or SELL, and a confirmed order will appear at the bottom of the page among all open orders and positions.

Options on the platform are European style and can’t be executed before expiration as opposed to US style options. The Options section can be accessed by clicking on BTC Options on the upper left-hand side of the screen.

From here, order forms can be accessed by clicking on any order that has been posted on the back of the order panel.

The platform also provides a live testnet for its users, and it’s necessary to create another account on test.deribit.com. After signing up, users receive 10 BTC in demo funds, and these funds can be used in order to practice various strategies and get to know the platform and the world of derivatives trading in general.

The testnet can also be used to fine-tune bots that may later be used on live accounts via the Deribit API.

Supported Currencies & Fees

Deribit specializes in BTC futures and options trading and users of the platform are required to deposit BTC into their accounts. There is currently no support for fiat deposits and more experienced users often make fiat purchases of BTC on exchanges such as Coinbase, Gemini, and Kraken before transferring them over to Deribit.

The team do not charge fees for deposits; however, withdrawals incur a fee dependent on the Bitcoin network’s mining fees.

The exchange also operates a maker-taker fee model, and futures orders which improve liquidity receive a rebate of 0.02%, and orders that take liquidity are charged a fee of 0.05%. Perpetual contracts orders that provide liquidity receive a rebate of 0.025%, while orders that take liquidity incur a fee of 0.075%. Selected fees are as follows:

Perpetual Contracts

- Maker Rebate: 0.025%

- Taker Fee: 0.075%

Futures

- Maker Rebate: 0.02%

- Taker Fee: 0.05%

Options

- 0.04% of underlying or 0.0004 BTC/option contract

- Fees can also never rise higher than 12.5% of the price of the option.

Futures liquidations fees

- 0.35%

Perpetual contracts liquidations fees

- 0.375%

Options liquidations trades

- 0.19% of underlying or 0.0019BTC/options contract,

With both futures and perpetual contract liquidations, 0.30% of the fee goes to the insurance fund, while 0.15% of underlying or 0.0015BTC per contract goes to the insurance fund for options liquidations.

Deliveries

Deliveries incur half the fees of taker orders, therefore:

- Futures: 0.025%

- Perpetual Futures: 0.025%

- Options: 0.02%

Is Deribit Safe?

The team makes use of cold storage in order to secure their users’ funds with approximately 95% of all BTC being held in this way. This helps the platform to remain resilient to hacking attempts but can also lead to slower customer withdrawals.

In addition, in order to further secure user accounts, Deribit incorporates two factor authentications (2FA), although this function is not enabled by default and must be set up after you login.

Furthermore, IP pinning provides additional security by identifying a change of IP address during a session, and terminating it as a result. The platform also allows users to adjust their session timeouts, and the default timeout period for inactivity on an account of one week can be shifted to just one hour.

Despite this, it’s always best practice to only keep funds on an exchange when they are being used for trading. Lastly, Deribit has an insurance fund that is set up to cover the losses of bankrupt traders.

The majority of trader positions should be reduced or closed by the platform’s real time incremental liquidation system, however bankruptcies still occur.

The insurance fund allows the withdrawals of profits from unexpired futures to be available immediately after settlement. The fund is maintained by liquidation order fees and if it gets depleted, bankruptcies become socialized among the winning traders. A list of bankruptcies is maintained on the “Insurance” page.

Is Deribit Suitable for Beginners?

Newer entrants to the world of cryptocurrency trading may be used to logging into an exchange, and trading cryptos for either digital or fiat currencies. However, Deribit deals in the more complicated world of derivatives and as a result, may not be suitable for newcomers.

In addition, the ability to margin trade and enter into leveraged trades adds a further level of risk and this makes the world of futures and options trading best suited to more experienced traders.

Having said that, the team have developed their live testnet which allows users to practice trading 10 BTC in demo funds, and learn various strategies as well as get to know the slightly complicated interface and different analytical tools.

The team have also made a number of resources available aimed at helping traders to improve their skill sets and these include a Blog, a Docs page, an FAQ page in the members section, and a YouTube channel which contains a number of explanatory videos.

Therefore, while it may not be the best place to start live trading, it may still be a good place to learn how to engage in derivatives trading.

Deribit Pros & Cons

Pros

- Transparent team

- Futures and options trading available

- Competitive trading fees

- No deposit or withdrawal fees

- High leverage offered

Cons

- Not regulated

- All account activity in BTC

- No fiat support

- Not beginner friendly

Conclusion

Deribit specializes in the trading of Bitcoin derivatives and provides access to the world of futures and options trading. The platform incorporates a number of features that may help it to gain a competitive advantage over exchanges such as BitMEX and Digitex and these include low fees, up to 100x leverage, test trading, and an insurance fund. Despite this, Bitcoin derivative trading is still relatively new and only accounts for small volumes being traded.

In addition, a lack of clarity regarding EU regulations means that Deribit isn’t regulated even though it offers derivatives and the complicated nature of the service may be difficult to overcome for newer traders.

The platform doesn’t support fiat payments and accounts are held in Bitcoin, which leaves users exposed to the volatility of BTC at all times. The exchange also chooses to block the inhabitants of certain jurisdictions, and is currently unavailable to residents of the United States, Canada, or the Netherlands.

Despite this, Deribit provides a viable alternative to other Bitcoin futures trading exchanges and incorporates a comprehensive range of features that appeal to more experienced traders.

The platform gives experienced futures and options traders exactly what they want and the wide range of analytics, high leverage, and insurance fund should prove enticing.

Less experienced traders may be better off with a platform such as IQ Option which allows its customers to trade Contracts for Difference (CFDs) on cryptocurrencies and is a much more straightforward platform to use.

Anyone who lacks experience but is determined to get into Bitcoin futures trading would be best served by going through the written resources and videos before spending time using a test account.

Due to its range of features, Deribit is a solid option for Bitcoin derivative traders but not recommended for beginners.

The post Deribit Review: Cryptocurrency Futures & Options Trading appeared first on Blockonomi.