- October 13, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

As of October 12th, Bitcoin’s price seems to be climbing to new highs despite a slight drop caused by El Salvador’s announcement to become the world’s first nation to accept the coin as legal tender earlier last month.

The optimism generated by El Salvador’s news was so high that a Reddit movement was started encouraging the platform’s 3.3 million users to ‘buy $30 of BTC’ – adding a further $99.5 million to the currency. Instead, Bitcoin and the wider cryptocurrency markets plummeted, with some altcoins shedding upwards of 25% from their value.

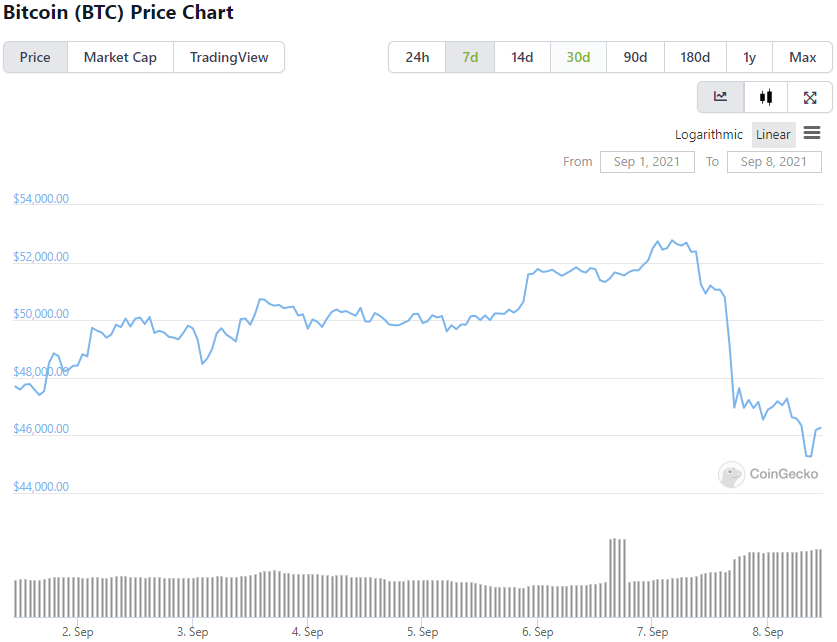

Bitcoin itself fell almost $4,000 to $45,300 in the space of 15 minutes at 4 pm on Tuesday (September 7th), dipping to $44,300 in the early hours of Wednesday.

The correction comes as a sharp decline in what’s been a week of cautious optimism across the cryptocurrency landscape. There was even an all-time high reached by Solana (SOL), thanks in no small part to the ongoing NFT boom across the cryptocurrency landscape.

In the chart above, we can see evidence of El Salvador’s BTC purchase as trading volume briefly doubled prior to the correction. In total, El Salvador bought 550 worth of Bitcoin as President Nayib Bukele claimed that he intended to spend more than $225 million on the adoption of the cryptocurrency.

The move meant that citizens could now receive their salaries in Bitcoin, buy groceries using BTC, and pay taxes in crypto, too.

Despite this optimism at such widespread adoption, the total cryptocurrency market capitalization fell by more than $300 billion in the wake of the pullback.

Why did the Crypto Markets Fall?

Unlike the market collapse of May 2021, which was brought on by severe regulatory clampdowns in China and fears over the carbon footprint of BTC publicized by the world’s richest man, Elon Musk, the recent dip was actually prompted by positive news surrounding El Salvador’s adoption. So, what went wrong?

Barron’s speculates that the fall may have been prompted by investors ‘selling the news’ of El Salvador becoming the first country to adopt BTC along with the prospect of Reddit users buying $30 worth of Bitcoin en masse. These sell-offs can lead to more widespread liquidations in cryptocurrencies that can carry a snowball effect across the market.

Elsewhere, Leah Wald, CEO of Valkyrie Investments, claimed that she was unsurprised by the sharp downturn. “When this move was first announced, it didn’t have nearly as big of an impact on price as some may have expected it might, possibly because El Salvador’s population is less than New York City’s, but also because the announcement was light on details and people were on the fence about how this was going to be implemented.”

“Transaction fees, processing times, and other hurdles also make this feel more like a beta test rather than a solution to many of the problems plaguing the country’s poor,” Wald explained.

Spilling onto Wall Street

The crypto market pullback was so severe that some cryptocurrency-based stocks experienced similar downturns on Wall Street as a result.

Frustratingly for crypto exchange, Coinbase, the market uncertainty in the wake of El Salvador’s adoption of BTC caused the company’s stock to lose out on much of its recovery following a challenging start to August.

The wider market pullback will undoubtedly be a setback for the company, which Freedom Finance Europe recently anticipated could be subject to some 35% growth towards highs of $300 USD per share with clearer forecasts.

Robinhood, an investment platform that also offers cryptocurrency options, has also experienced a weak start to September in the wake of Bitcoin’s latest price fall – however, this appears to be part of a more long-term downward trend.

Optimism for Recovery

Skipping to early October, we can now see that Bitcoin is heading towards a new high.

While investor panic is liable to set in during such significant dips, multi-thousand-dollar drops in the space of minutes aren’t uncommon in the cryptocurrency landscape, and one of the most calming influences during the downturn was President Bukele himself, who tweeted: “Buying the dip. 150 new coins added.”

It appears that Bukele isn’t the only buyer to remain optimistic in the face of harsh pullbacks. Trading volume in the 24 hours following the dip accelerated by 43.4% as investors interpreted the falling price of BTC as a discounted rate for more purchases.

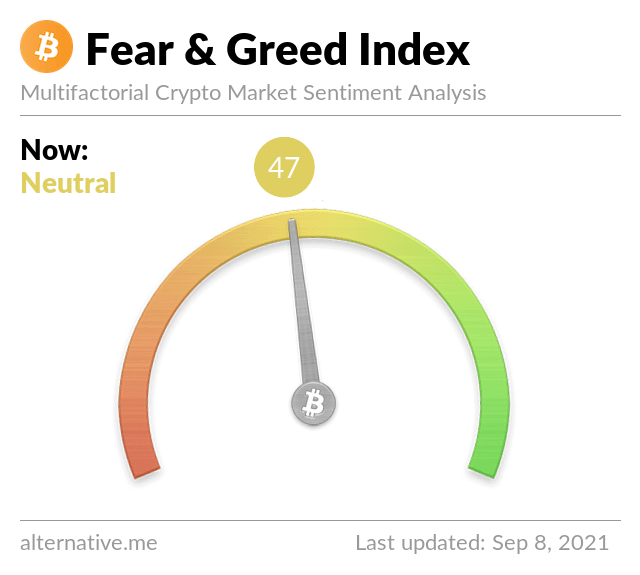

In the wake of Bitcoin’s pullback, the cryptocurrency’s Fear and Greed Index, which charts social media sentiment surrounding BTC fell to a neutral level at 47 from a score of 79 (extreme greed) prior to the crash.

Although this is a significant drop in sentiment, opinions towards the currency remaining neutral following a steep decline show that investors are largely remaining unperturbed by the events.

Maxim Manturov, head of investment research at Freedom Finance Europe notes that “the crypto market lacks stability and can start being regulated any time, which actually already happened in China. In June, the Chinese government banned banks and payment systems from using Bitcoin, which led to a temporary collapse of the flagship crypto’s price.”

Bitcoin’s decline from its peak of $52,774 at 4 am on Tuesday 7th September to $45,264 just over 24 hours later has served as a fitting welcome for El Salvador to the wildly volatile world of cryptocurrencies.

However, unlike earlier in the summer when the value of the coin plummeted below $30 briefly, there’s more optimism that this is a blip on the road to greater price accumulation. If this remains the case, El Salvador may be the first of many more adoptee nations.

The post Op-Ed: Here’s why Bitcoin is primed to be heading to its $64,000 high appeared first on CryptoSlate.