- November 3, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin’s unique energy use incentives, ability to store stranded energy and more make it the future of our energy consumption as a planet.

Here goes a full-length, easy-to-read article based on my recent Twitter thread, part one on Bitcoin and the nuclear future of our energy grid. In part one, I breakdown the narratives around energy markets in general and Bitcoin’s energy usage, cover some industry facts and insights and offer some of my personal opinions along the way for a hopefully enjoyable read.

But before I begin, I want to provide my own little background since it’s relevant to the topic today. I’m a chemical engineer by degree (BS and MS) and have been working as a lead engineer in the advanced nuclear technology space for the last few years, so this topic feels like home.

I want to give a shoutout upfront to some of the references I use and cite from below. None are bigger or better than Lyn Alden — I take charts and information from her recent newsletter to cover a part of this thread, everyone should go read it here.

The other resources I’ll cite from are the following (in no particular order):

- “Bitcoin Mining Council Q2 2021 Report

- Square’s paper on Bitcoin’s energy usage

- “Only The Strong Survive” by Allen Farrington

Having got this out of the way, let’s get into it by starting from the basics. What’s the innovation in Bitcoin? Here’s a list I like, taken from Farrington’s recent article:=

- The proof-of-work algorithm

- The difficulty adjustment

- The native monetary unit that is able to endogenously emerge

- Socially, the innovation is an immutable and uncheatable distributed ledger

To achieve this, Bitcoin needs to have a tie in to the physical world: energy. Energy expenditure is the tie in between the real world and the digital world. Henry Ford proposed this in 1921, to have a currency backed by energy for the world.

Ford proposed the following design criterion for a universal money which would free the world back in 1921:

- Backed by energy

- Unconfiscatable

- Fixed supply

- Outside government control

There was nothing that satisfied these design criteria before, until bitcoin came along. Bitcoin is an engineering breakthrough. It’ll turn out to be the greatest invention/discovery of human history once we humans catch up to its brilliance. I treat it as akin to the discovery of fire by the early humans which pushed civilization along.

Michael Saylor covered this with Robert Breedlove on the latter’s show. He went through human discoveries which were crucial to the advancement of civilization as a whole and put Bitcoin in that bracket.

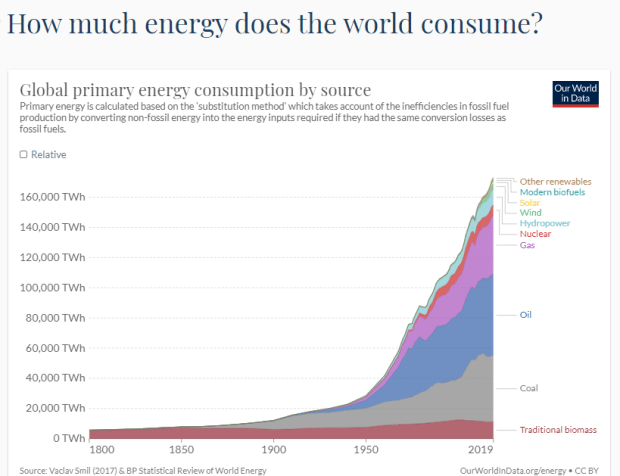

Now that we’ve got that out of our way, let’s go through energy first and put Bitcoin’s energy usage in relative terms to the world’s total energy consumption. The world uses slightly north of 173,000 terawatt hours (TWh) of energy per year. Is that all the accessible energy for us humans?

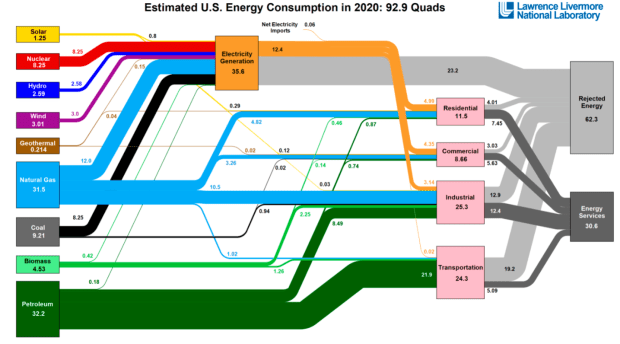

No. Take a look below as U.S. energy consumption in 2020, for example. Out of 92.9 quads of energy available, only 30.6 quads get put to use for energy services. So almost two-thirds is rejected energy for multiple reasons. If we become more efficient, we can extract a lot more.

Also, there are plenty more sources of energy coming online and being worked upon, which increases the total available energy supply sources even more. So, in a nutshell, there’s a decent amount of energy being used, plenty being wasted and more to come online.

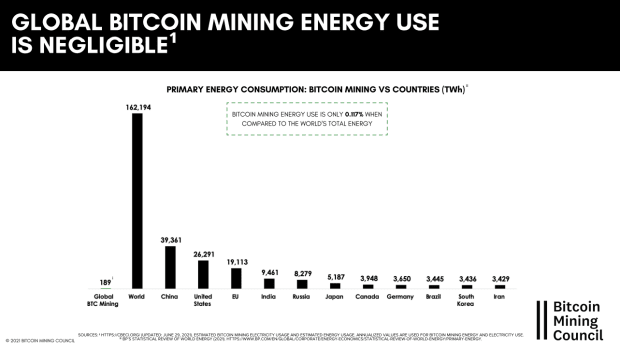

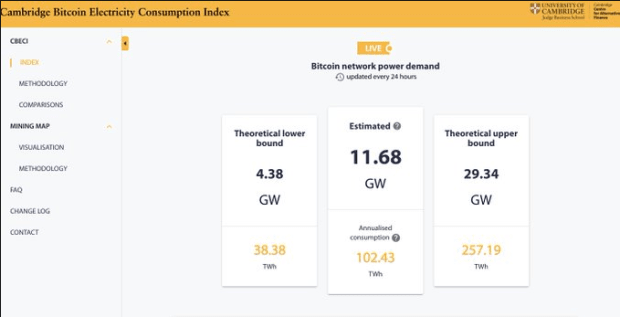

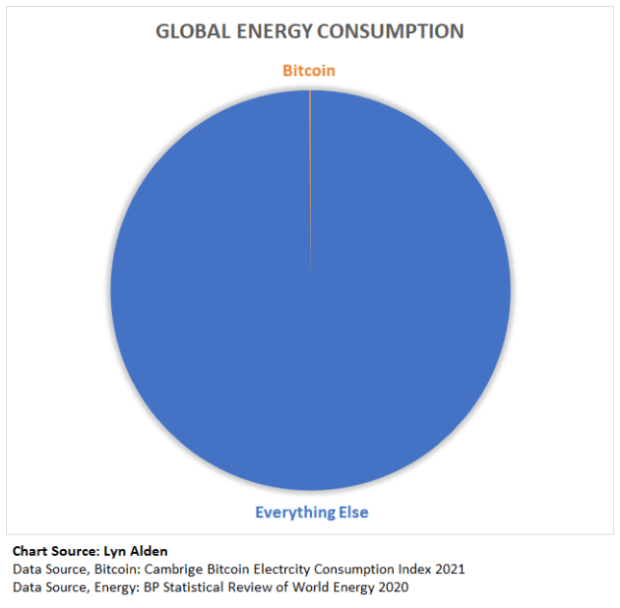

Now, how much is Bitcoin’s energy expenditure used to maintain proof-of-work consensus? Per the University of Cambridge, Bitcoin’s (peak) annualized energy consumption rate is around 103 TWh currently, and was as high as 190 TWh earlier in the year, due to the exodus of bitcoin mining from China this year.

How much is 103 TWh compared to 173,000 TWh? That’s 0.06%. That’s it. Even if you take the 190 TWh from earlier in the year, it’s still only about 0.1%. So, Bitcoin uses only one-tenth of 1% of the world’s total energy. That’s it. Let’s get this one fact right.

Bitcoin’s energy use is simply a rounding error relative to global energy usage. Scientists who generally come up with energy usage numbers for the world can easily be off by 1% to 2% in either direction, and we’re talking one-tenth of that here. Simply very little.

Would Bitcoin’s energy usage go up over time? Yes. If bitcoin becomes successful in becoming the “energy currency” of the world, it’s energy expenditure has to rise to defend the proof-of-work consensus and the network. If its value to humans increases, so would its energy use.

But Bitcoin’s energy will forever be a rounding error relative to global energy consumption numbers. We’ll go through the math later, but it’s energy usage won’t exceed its long-run utility (however large or small it becomes over time). Alden covered this in her article cited above amazingly.

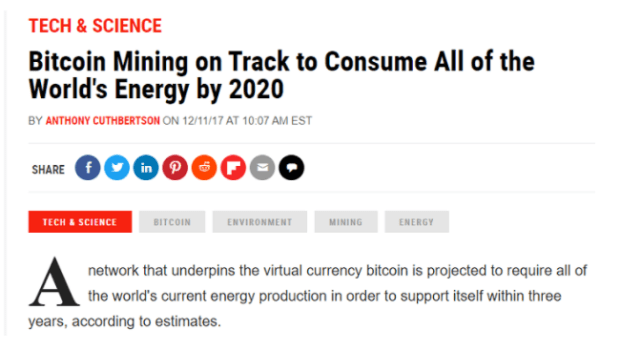

Now, what’s the mainstream media telling you? See below a telling excerpt. You see these types of messages all the time. We just established above that they are not true at all. If anything, Bitcoin uses too little energy for its relative utility for the world today as we’ll establish next. The mainstream media is gaslighting you.

Before we dive into some of the energy math, let’s point some of bitcoin’s utility to the world today. Bitcoin offers:

- A fixed supply hard asset that provides a store of value/wealth

- Unconfiscatable private property rights

- A censorship-resistant, permissionless, peer-to-peer medium of exchange

- The most decentralized monetary network outside of the control of any central authority or nation state (resilient to attacks)

- The best form of bearer asset (pristine collateral)

- A frictionless, borderless, instant, low cost, global payments network ( via the Lightning Network, a Layer 2 solution built on top of Bitcoin)

Do you think something with those properties, the hardest form of money backed by energy, can have any form of utility for humans going forward in the world we live in today? If the answer is yes (which I hope it is), than 0.1% of the world’s energy usage is nothing and is easily justifiable.

Let’s move on then to some of Bitcoin’s energy math. First, let’s establish how bitcoin even consumes energy. Like, how does this proof-of-work consensus model work? What does it even mean to mine bitcoin? Like, WTF is all this?

Simply speaking, bitcoin’s proof of work is designed to produce one “block” every 10 minutes. A new block is produced by solving a math puzzle, by brute forcing it using computational work and therefore, you guessed it, electricity or energy.

Energy expenditure is key to producing blocks and proof of work. In a way, Bitcoin is backed by energy, expended to secure the network by the miners who go about producing these blocks. Although they don’t control the network, as was demonstrated in the blocksize wars.

The puzzle is designed as such that one block is produced roughly every 10 minutes. If it takes less time to produce a block, the puzzle gets harder to solve, while if it takes more time to produce a block, the puzzle gets easier. This is the “difficulty adjustment” innovation which is key to Bitcoin. Never in history have we had an asset whose supply is absolutely independent of demand, pre-programmed, engineered to precision and set in code, immutable by any central authority.

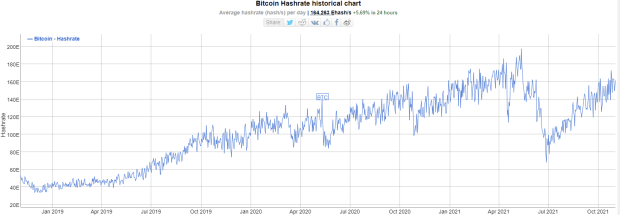

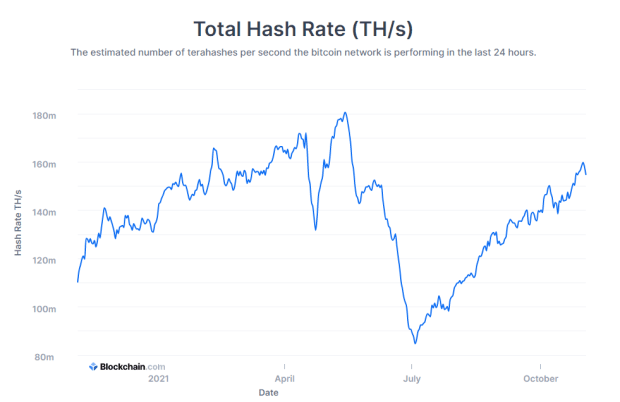

Now, due to the incentive model built into the network, millions of machines are deployed to “mine” Bitcoin blocks by offering computational power to the network, or “energy.” This is measured in something called the “hash rate” which is currently at 166 exahashes per second (EH/s).

What do the miners get in return for providing this energy? They get block rewards, which consists of two things: the block subsidy and transaction (tx) fees. Bitcoin block subsidy follows a four-year halving cycle (something you might have heard of from the chart analysts).

The block subsidy was 50 bitcoin per block when it started back in 2009, and dropped to 25 bitcoin four yrs later, then 12.5 bitcoin four more years later, and recently dropped to 6.25 bitcoin last year, in May 2020. This is the only way new bitcoin can come into existence, so think about the supply shock.

The network suddenly tells the miners looking to mine bitcoin, “Hey, from today you’ll only get one-half of what you used to get, and in four years it’ll be one half of that and so on.” That’s a tremendous amount of supply shock to the market itself.

We’ve seen in the past that bitcoin’s price rise has been linked to these “halving cycles” because of the inherent supply shock that comes along with it. As some say, “number go up” is built into the consensus model itself.

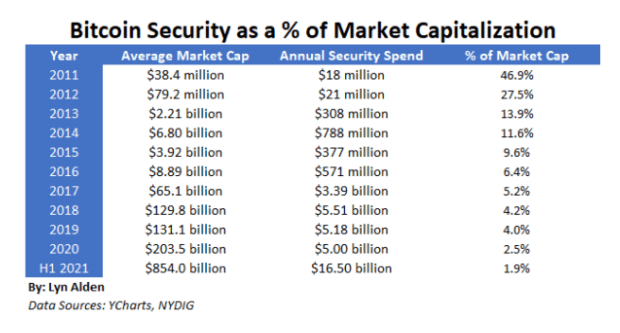

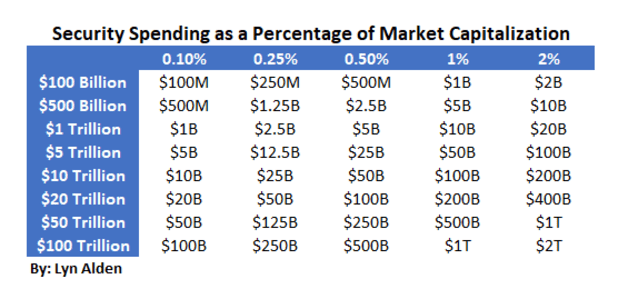

Now, enough of the mining rewards. We were talking energy usage, weren’t we? If we assume the market cap of bitcoin in the open market is how much value is locked onto the network, meaning that’s how valuable bitcoin is to us humans, then we can table the energy expenditure, or in other words “security spending” (energy) as a percentage of bitcoin’s market cap to see if the network is getting energy efficient over time or not. The less the percentage, the more efficient the network is becoming, simply speaking.

Let’s take the total block reward, i.e., block subsidy and tx fees, as a proxy for security spend on the network. This is not exactly true, since the security spend is only the electricity cost or energy expenditure, which is a percentage of this reward. So, this is in fact an upper bound measure.

As we see, the annual security spend has gone up over time in USD terms, but as a percentage of bitcoin’s market cap, it’s been falling ever since 2011. In the first half of 2021, it sat at less than 2% of the market cap, as Alden pointed out in her article. This is exactly what the analysts do not get.

Bitcoin is becoming incredibly energy efficient over time. It’s using literally fractions of the value of the network to secure it (currently at 2%). There’s another halving coming in 2024 which brings the block subsidy down to 3.25 bitcoin, and the one in 2028 will bring it to 1.625 bitcoin.

As you see, the security spend over the coming decade will keep getting cut short by this halving of the block subsidy. For sure, more of the spend will be covered by the tx fees going forward. Alden’s expectation is to see the spend at 0.25% to 1%, depending on tx fee levels.

Here are some projections for security spend as a percentage of bitcoin’s market cap in the years to come. Let’s say bitcoin reaches $1 million (or about a $20 trillion market cap) by 2025, and after 2024, halving security spend now goes down to say 0.5%, so that’s a spend of $100 billion. The current spend is $16.5 billion.

That would mean that Bitcoin’s total energy usage in 2025 would be about 0.6%, or six times today’s usage only. And keep in mind, security spend is not exactly the same as energy expenditure, which is a percentage of it and, secondly, the total energy usage of the world is going to go up as well.

For an easy math equation, we’re still below about 1% of total world energy usage to secure the network, even at a point where $20 trillion of world’s monetary energy will be secured in the network itself. That’s super low energy usage for something of such grand utility, wouldn’t you say?

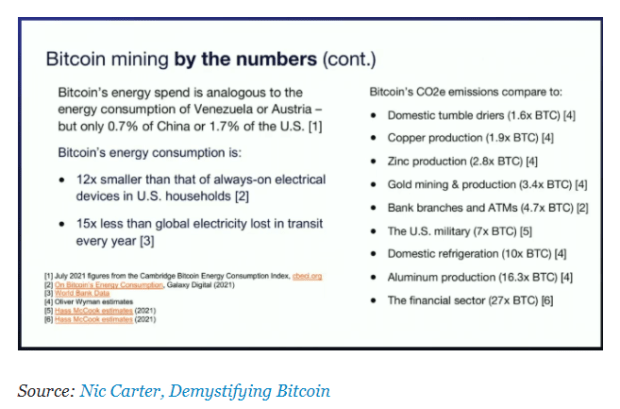

Here is a comparison of Bitcoin’s current energy use to other industries and its CO2e emissions as well. As we’ve gone through the numbers before, bitcoin’s energy use is a rounding error as of now. Nothing to add here.

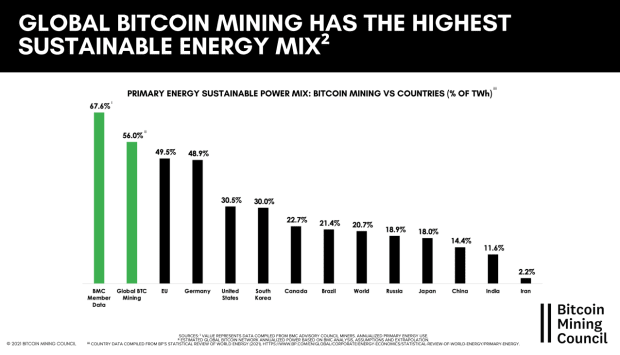

Now, having established Bitcoin’s energy use numbers, let’s look at the energy mix of current usage. As reported by the Bitcoin Mining Council’s quarter two report, Bitcoin’s energy mix is the most sustainable out there and is significantly more so than most countries.

Mainstream media paints a picture that bitcoin miners are competing with other industries for electricity, as if it would push someone else out of their energy usage. This is not true. Bitcoin miners go looking for the cheapest source of electricity out there. Why? Because that’s the majority of their daily operation costs of running the miners. They simply cannot compete with the other miners on a global scale with moderate- to high-cost electricity prices charged for normal users. So, they are not your competitors.

Bitcoin miners seek to find supply versus demand inefficiencies in the power markets and look for underutilized or wasted sources of energy to gain a competitive advantage over other miners by securing a low cost of energy. This is a global hunt everywhere.

Humans have never organized themselves around an energy source, at least that’s not been the major driver of human settlements. You generally see energy being transported and brought to them, instead of them settling around energy.

Bitcoin miners are unusual in this way. They will go anywhere where the energy is cheapest to mine. Here are some unusual snippets about them:

- They can collocate at the source of electricity generation

- They can consume intermittently without harming their core business

- Energy cost is like 80% to 90% of their operations cost

- All they need is available land and an internet connection (cellular or satellite)

- They are buyers of any stranded sources of energy, anything below 6 cents per kilowatt hour (kWh)

- They can make new energy projects economically viable

That sounds like an incredibly interesting bunch of people to study a little bit more. Like, who are these freaks? Any anecdotes? Okay let’s dig in a bit more and get some evidence of these unusual set of individuals and why I call them “stranded energy hunters.”

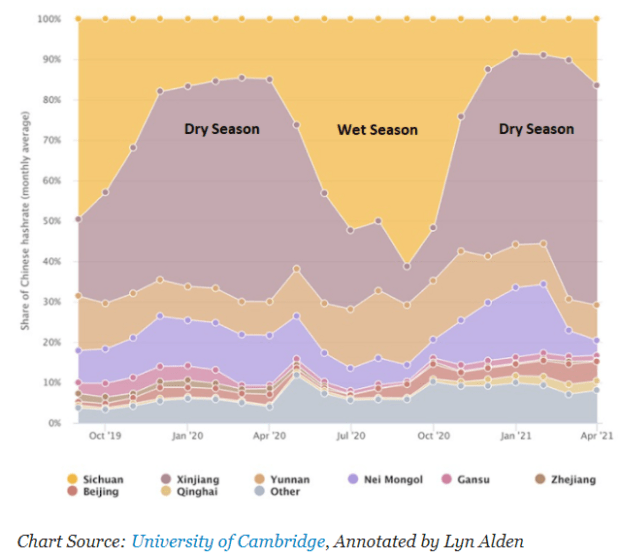

China had been the biggest mining country for a long time until 2021 after the China mining ban and mass exodus of miners from their provinces over the last few months. The province of Sichuan is unique. It has a ton of over-built hydroelectric capacity which goes wasted.

During the wet season, it produces more energy than it can use. So, these Chinese bitcoin miners flocked to Sichuan to capture that stranded or wasted energy to mine bitcoin instead. Simply because, yes, there are incentives to find the cheapest energy possible to mine.

What would happen to this energy if they had not used it to mine bitcoin? It would have just gone to waste. Bitcoin miners turned that stranded energy into a source of revenue. Most of these miners are now flocking to the West in light of the mining ban in China.

Look at Bitcoin’s hash rate again. See that massive drop of more than 50% in hash rate after the China mining ban? Well, guess what: It’s almost back up to where it was before. Talk about how resilient this network is. No single point of failure, no single country controls or governs it.

Here’s another example: “flared gas mining.” Many oil fields have trapped natural gas associated with them. Typically, these drilling sites are far out and have no connected pipelines through which you can transport and sell this gas, if it is even in reasonable quantities to sell.

With natural gas prices so low, it doesn’t make sense to invest in pipelines or related infrastructure to transport them. So, what are the options? Vent it in the open atmosphere or flare it. The first option vents methane, the latter, CO2. In what quantities? 1.48 billion cubic feet, or 150 TWh per the U.S. EIA. And that’s only in the U.S. in 2019, not even worldwide.

Remember how much energy the Bitcoin network uses today? 100 TWh. So, you can power the entire network and more by simply capturing this stranded gas which is flared instead. Would this also be helpful to the environment? Absolutely.

Now, here’s a great one, which is my favorite: The concept of “Bitcoin as an energy battery.” The first time I heard of this was from this article. Nick Grossman wrote about how Iceland transports its vast amounts of geothermal energy to the world by aluminum. Iceland uses its renewable geothermal energy, which is otherwise stranded since it’s difficult to build pipelines to it under the Atlantic, to smelt aluminum, and then they transport aluminum to the world. So, in a way, they are transporting energy. Aluminum serves as the battery.

Like, what is even an energy battery? Something that can transport energy across both space and time. Well, guess what? That’s exactly what Bitcoin is. And it’s much better at it than literally anything else in the world. It’s the most liquid form of energy battery, something that can run 24/7 in a permissionless, frictionless, borderless, unconfiscatable, resilient, energy conserving, power-dense form of battery. Wouldn’t it be wise for Iceland to mine bitcoin instead of using its geothermal for aluminum? Yes.

Electric grids balance two things: supply and demand. Very few sources of energy can run 24/7 uninterrupted. Nuclear power is the best one. Solar, wind and hydro power are all variable depending on weather conditions. Due to this variability, grids are over built on the supply side.

Demand from the consumers varies as well, especially season to season and between day and night. You get periods of peak demands in between. So, you’ve got to cater to this variable demand. Hence, it’s always a balance that the grids need to maintain.

One big problem with intermittent sources of energy like solar and wind is storage. They are simply not reliable as base load without energy storage. And energy storage is not an easy problem to solve. Guess what: We may just have an engineering option on our hand in Bitcoin.

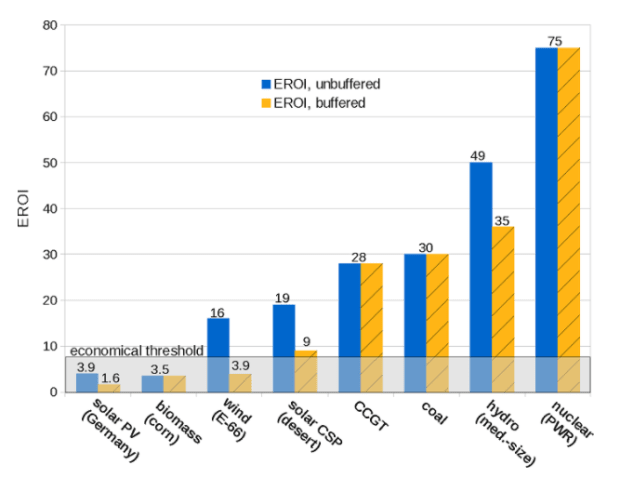

The chart below shows the energy return on investment (EROI) for energy sources. If you can see how it is currently, solar/wind do not even meet the energy threshold with storage costs included.

Nuclear power has a 75-times EROI with no energy storage cost. It is simply the best energy source we have available on the planet, and yet we keep shutting down our nuclear power plants. Why? Again, mainstream media narratives and certain accidents in the past have changed public opinion. But the facts are there.

Other renewable forms of energy could do with Bitcoin as their energy storage option to lower their cost of storage and become economically more viable as projects for investments. Bitcoin miners can help make advanced energy technology projects economically-viable options.

Bitcoin miners can serve as first customers and buyers of last resort for these advanced energy technology solutions and help get them with long-term investment capital to make them succeed. As we’ve seen all along, Bitcoin and energy are intricately intertwined.

In my opinion, Bitcoin will lead us into a Type I Kardashev civilization, one that can use and store all of the energy available on its planet. Today, we’re a Type 0 Kardashev civilization, and this process can take years to play out. I may not be here to see it in person.

Let’s do some quick takeaways then from this article before we wrap up:

- Bitcoin has great utility and is important for humans. Not everyone may use or appreciate its utility today, which is fine, but that doesn’t mean it doesn’t hold utility to others. Currently, close to $1 trillion of the world’s wealth is stored in it, that’s a lot of monetary energy to disregard.

- Bitcoin uses only about 0.1% of global energy. Current energy usage is between 100 TWh per year to 200 TWh per year and, per our projection’s math, Bitcoin’s energy usage will always be a rounding error with regards to global energy consumption. It would most likely be sub-1% for a long time to come.

- Bitcoin, in fact, may use too little energy for the value it may store in the future. Considering bitcoin grows over this coming decade and stores $20 trillion of the world’s wealth, maybe even $50 trillion, or, dare I say, $100 trillion, that’s a lot of monetary energy to be secured safely and protected. We should invest and use more energy to protect the network than what we do currently.

- Bitcoin miners are highly mobile and look for the cheapest and lowest-cost energy to mine.

- Bitcoin miners do not compete with other industries or your personal use for energy.

- Energy usage is a good thing. You probably want to live in a place where there is a good amount of energy available to use and enjoy, rather than too little. We need to use and harness more energy to become a Type-I civilization, which will take decades.

There are a lot of items that I did not cover in this article, which I’m planning to write on as a more detailed follow up to this. I wanted this to be an introductory article.

My focus of the next one would be a deep dive on energy markets, energy grid structure, the synergy between next-generation molten salt nuclear reactors and bitcoin mining, and a whole lot more of Bitcoin energy math and future projections. If you liked reading this, do let me know on Twitter, I appreciate any feedback. Thanks for spending time going through this.

This is a guest post by Puru Goyal. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.