- January 5, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

OpenSea, the biggest NFT marketplace, announced on Tuesday that it has successfully raised $300 million in a Series C funding round.

The total amount of capital raised made OpenSea reach its valuation milestone of $13.3 billion. This round of funding started in November and was backed by major names like Paradigm and Coatue.

The round also saw the participation of KRH, Andreessen Horowitz general partner Katie Haun’s new fund, according to Decrypt. Haun is also a member of OpenSea’s board of directors.

OpenSea Has it Nailed!

Business expansion, which focuses on human resources, NFT’s growth as well as Web3 construction are the key motives behind this fund. The fund will support the long-term vision and mission that OpenSea is leading.

Devin Finzer, OpenSea co-founder shared further thoughts in his emailed statement,

“Our vision is to be the destination for these new open digital economies to thrive. We’ll start this year by lowering the barriers to entry to the NFT space on OpenSea and investing in the ecosystem and the community that powers it.”

In July 2021, OpenSea became the latest crypto unicorn after completing a $100 million Series B funding round led by Andreessen Horowitz’s a16z venture capital firm.

The company’s valuation after the Series B was at $1.50 billion. As expected, the Series C funding completed with an exceeding number of $10 billion – $13.3 billion valuation.

Another Crypto Unicorn

The term “unicorn” refers to the companies that are valued over $1 billion. With the successful funding in July, OpenSea has signed its name to the list of crypto unicorns, alongside major names such as Chainalysis, Blockfi, Kraken, Gemini.

In the meantime, there is no Hectocorn company in the crypto industry with a valuation of more than $100 billion. Coinbase is the most valuable Decacorn in the mass market, with a market capitalization of $46 billion. But it took a backward step as the company’s valuation was over $70 billion in April 2021.

OpenSea went public in January 2018, by Alex At allah and Devin Finzer, with the ambition of building an NFT ecosystem. The success of CryptoKitties was the inspiring factor to launch the marketplace.

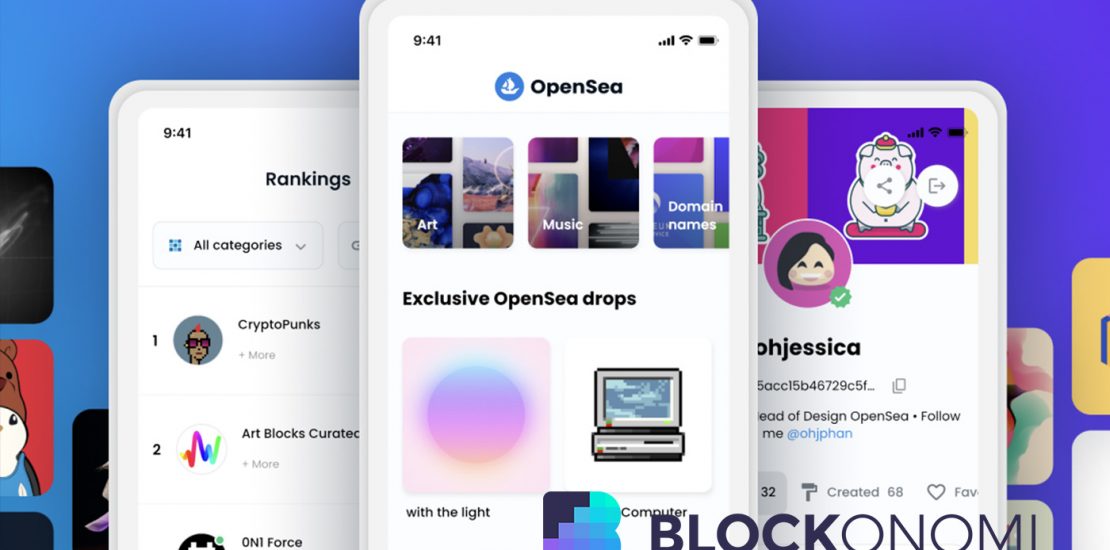

The marketplace attracts more interest from the community due to its ease of use. It takes simple steps for sellers to list their works on the blockchain.

The member identification on OpenSea is also very simple. Since its launch, the marketplace quickly became popular. Currently, there are over 10 million visits on the platform per month.

OpenSea also creates a fair and solid launch pad for some of the most popular NFT projects like Cryptopunks, Axie Infinity, Gods Unchained, CryptoKitties, SuperRare, and many more.

It came with no surprise that it also attracts attention of famous figures or influencers like Mark Cuban, Gary Vaynerchuk and Chamath Palihapitiya.

The NFT fever is growing…

As Decrypt previously highlighted, OpenSea’s monthly volume has maintained its impressive performance months after many non-fungible tokens were claimed to have become a fad back in June, when the initial craze subsided.

In August, the NFT market experienced a resurgence, and in December, OpenSea experienced its second-largest month ever, with $3 billion worth of Ethereum NFTs transacting hands on the exchange.

There’s no sign of slowing down. Ethereum NFT volume reached $243 million on January 2, making it the third biggest trading day in the company’s history. The company’s Polygon NFT trading volume is also increasing, having increased for three straight months to reach $76.1 million in December last year.

OpenSea has hired Shiva Rajaraman, a former Facebook executive, as its new Vice President of Product, according to Finzer, who made the revelation as part of the financing announcement.

Nate Chastain, the company’s previous head of product, resigned after it was discovered that he had exploited inside information to purchase NFTs before they were available on the market and then sold them at a profit.

Rajamaran’s responsibilities will include assisting the company with the support of NFTs from other blockchains and linking users with tools to find digital art and maintain their collections.

NFT use cases are constantly evolving and appear to be limited only by one’s imagination.

By far the most attention has been paid to in-game items, artwork, collectibles, virtual worlds, and encrypted real-world assets, especially as the field grows in greater integration with decentralized finance (DeFi), implying more NFT asset classes are underway.

And leading NFT marketplaces such as OpenSea are expected to explode in the future.

The post OpenSea Now Valued at $13.3 Billion After Red-Hot Series C appeared first on Blockonomi.