- March 27, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The competition breaks the first rule that makes Bitcoin so powerful in the first place.

This article is the written version of a video presentation which can be viewed here:

Bitcoin is outdated. Bitcoin is too slow. Bitcoin is too simple.

Chances are you’ve heard one of these arguments, or maybe even made some of these claims yourself.

With bitcoin sitting around $40,000 at the time of this video, many people feel as though they have missed the boat. “If I just could have gotten in at $10, $100, or even $1,000,” they think, “then I’d be set for life.”

The truth, of course, is not so simple. In reality, if you would have bought bitcoin at $10, you likely would have sold right around $20 and then bragged to your friends about your 100% gains. Or maybe you would have ended up like this guy:

It takes a special — maybe even a bit crazy — type of person to sit on 300,000% unrealized gains. Chances are you’re not that guy. This then brings us to a very important point. It is not about when you buy; it’s about why you buy. Many people who first got into bitcoin over a decade ago remain broke, while many others who just a few years ago began religiously stacking sats are sitting comfortably. The difference lies entirely in philosophy.

And chances are, if you’re searching for “the next bitcoin” you have a flawed philosophy. You likely suffer from one of the following conditions:

You don’t fully understand Bitcoin’s purpose.

You don’t fully understand bitcoin’s upside.

Or you don’t fully understand what makes Bitcoin special.

The focus of this article will be on the third condition.

What makes Bitcoin special is not simply the fact that it was the first cryptocurrency. When it comes to Bitcoin’s first-mover advantage many people like to bring up the fates of MySpace and Yahoo. However, this comparison is a common fallacy and demonstrates a fundamental misunderstanding of what Bitcoin really is.

Instead of thinking of Bitcoin like an internet company, it is more accurate to think of Bitcoin as akin to the internet itself.

The Internet Of Money

Just as the internet revolutionized the world of information, Bitcoin revolutionizes the world of value. At its foundation, the internet of today is the same as the internet of the early 90s. However, when it comes to the number of applications, user interface and overall societal significance, the internet of today is nearly unrecognizable from the internet of the 90s. It was not necessary to create an entirely new internet: rather these new features and applications were eventually built on top of the existing infrastructure. Many people struggle to extend their gaze beyond the present, and thus had absolutely no ability to foresee the slow, bulky, confusing internet of the early days evolving into the high-speed, compact, intuitive version we now carry around in our pockets.

TCP, transmission control protocol, and IP, internet protocol are two of the base layers underpinning the internet. TCP/IP was invented in the 1970s and still serves as the foundation of internet data transfer.

Has technology not improved since then? Have the brightest computer scientists throughout the world not been able to come up with anything more efficient than TCP/IP?

The answer, of course, is that technology has improved since the 70’s and many proposals to replace TCP/IP have been made. So then why are we still using an outdated protocol despite the existence of “improved” versions?

The answer to this question gives us a hint as to why bitcoin is likely not to be replaced by any of the 16,000+ cryptocurrencies circulating today.

Keep this question in mind as you continue reading and we’ll come back to it later.

It’s important to remember what the purpose of Bitcoin is. Bitcoin’s purpose is to serve as an alternative to our corrupt fiat financial system which is dominated by governments and central banks. Bitcoin was created to bring financial sovereignty to the individual by removing power from central banks, commercial banks and governments, and giving this power directly to the people.

Bitcoin’s job is simple. Follow the rules agreed upon by the network and keep going.

That’s it.

It does this job extremely well. Not even the most powerful government in the world has the power to change Bitcoin’s rules.

This, then, is Bitcoin’s key feature. The one thing that sets it apart from every single altcoin: Immutability.

Bitcoin Versus Ethereum

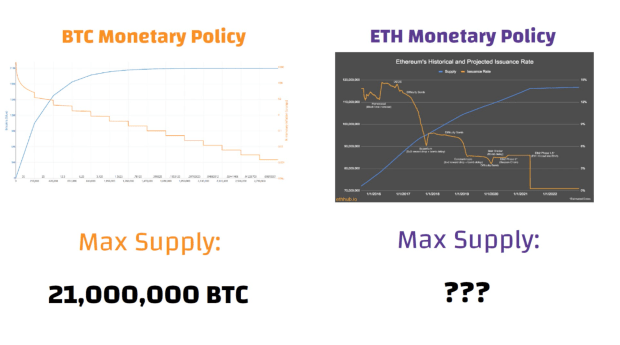

Bitcoin’s monetary policy has not wavered from its course originally set by Satoshi over a decade ago.

This can be compared to the monetary policy of the second-largest cryptocurrency: Ethereum. As you can see, it changes drastically, and changes often. What is the maximum supply of ETH? There is no answer to this question.

In fairness, Ethereum was not created to be a Bitcoin alternative. It was created as an attempt to fulfill another niche: namely that of smart contracts. However today, many of the most vocal Ethereum advocates posit that the transition to ETH 2.0 will position ETH as a monetary alternative to bitcoin. They have even gone so far as to unironically call ETH “Ultra Sound Money” in response to the sound-money properties of Bitcoin.

What these people fail to understand is that the ability of Ethereum to alter its monetary policy in order to be “ultra sound” is itself the reason why it cannot be.

Bitcoin is sound money, not because of the maximum supply of 21 million coins, or its inflation rate halving every 210,000 blocks — both of these figures are arbitrary and could have easily been different. We are confident calling bitcoin sound money because of the fact that these numbers are set in stone.

Bitcoin and Ethereum have almost nothing to do with one another. They are both doing separate things, and neither one should be trying to compete with the other. Ethereum is no more a threat to Bitcoin than aluminum foil is to gold.

Bitcoin Versus “Faster Coins”

Ever since Bitcoin was launched there have been countless “faster and cheaper” coins that have been created to solve Bitcoin’s supposed problems.

From Dogecoin to Litecoin, to Digibyte and Bitcoin Cash there is no shortage of competitors promising to dethrone Bitcoin.

The reason this is unlikely to happen is the same reason that TCP/IP remains the internet standard 50 years after its creation.

Upending and rebuilding the entire internet every time a slightly better data-transfer protocol was invented would be sort of like an artist scrapping and repainting their most famous paintings every time a slightly better canvas was invented. The point is, the best paintings are not those with the highest-quality canvases, but rather those with simply a good enough canvas to allow the artist to create his masterpiece. All the canvas must do is get the job done.

TCP/IP gets the job done. It allows for the internet to function and for applications to be built on top of it.

In the same way, Bitcoin gets the extremely difficult job of separating money from state done. The fact that the Bitcoin blockchain is seemingly slower and more expensive than many other blockchains is irrelevant.

Altcoin marketers have been working hard boasting of greater scalability and faster transaction speeds than bitcoin.

The only problem is that no one seems to care. Countries are not adopting Digibyte as legal tender. Corporations are not holding Dogecoin on their balance sheets. World- class wealth managers are not allocating to Litecoin or Bitcoin Cash.

Why not? Let’s answer this question with an analogy.

Imagine two travelers both leaving from Cleveland, Ohio looking to fly into Cairo to visit the pyramids of Egypt. Traveler A’s flight costs $500, and takes 10 hours. Traveler B gets his ticket for only $100 and it takes only 2 hours.

Traveler B boasts and brags to Traveler A about how much more cost- and time-effective his trip is.

Both travelers board their flights and arrive in Cairo. The only difference is, while Traveler A ends up in Cairo, Egypt, Traveler B arrives in Cairo, Illinois!

All of that time and money saved by Traveler B ended up actually being a waste of time and money because the prerequisite — the correct destination — was not accounted for.

When it comes to the soundness of a money, immutability is a prerequisite. Nothing else matters if this property is not fulfilled. If the monetary policy of a cryptocurrency can be changed after a few phone calls from the U.S. government, or because powerful insiders say so, then every other feature it offers is completely irrelevant.

Can Bitcoin Be Copied?

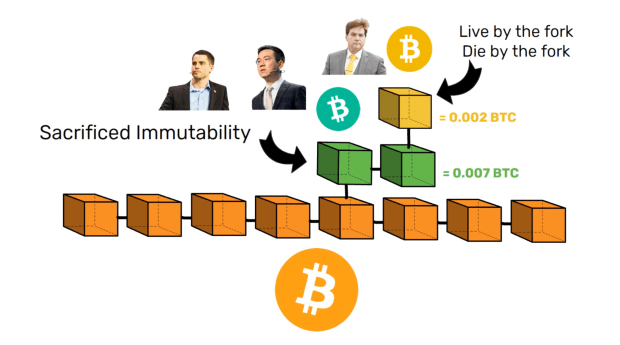

Bitcoin did not achieve immutability by virtue of its code, but rather through the unique circumstances by which it was created. Bitcoin’s code is completely open source. It can and has been copied and forked several times.

Yet by definition, none of these copies can be considered immutable because of the simple fact that immutability had to be broken in order for the fork to exist in the first place. Empirically, we can see this playing out in real time with Bitcoin Cash.

In 2017, a group headed by Roger Ver and Jihan Wu decided that it was worth it to sacrifice immutability in order to increase the blocksize. With this precedent set, it came to nobody’s surprise when a year later a faction within the Bitcoin Cash community headed by Craig Wright decided to fork off from Bitcoin Cash, creating BSV. As these forks continue to be forked and fade into irrelevance, Bitcoin continues to chug along unscathed; immutability intact.

Layered Scaling: The Internet And Bitcoin

In 1995 a writer for Newsweek by the name of Clifford Stoll made these sarcastic remarks about the internet:

“We’re promised instant catalog shopping — just point and click for great deals. We’ll order airline tickets over the network, make restaurant reservations and negotiate sales contracts. Stores will become obsolete. So how come my local mall does more business in an afternoon than the entire internet handles in a month? Even if there were a trustworthy way to send money over the internet — which there isn’t — the network is missing a most essential ingredient of capitalism: salespeople.”

Stoll was describing the internet as he saw it in 1995. He failed to take into account the numerous applications that that same 1995 internet would eventually enable as time went on.

In the same way, many people see Bitcoin today as slow and costly. After all, it takes around 10 minutes for a transaction to confirm on the blockchain and fees can run up to a few dollars or more depending on the congestion of the network. Just as it took foresight to be able to recognize the ability of the internet to scale in the 90s, it takes looking deeper than the surface to understand how Bitcoin can scale to millions of transactions per second.

For those who do not mind giving up some privacy in exchange for ease of transaction, many companies such as Square and PayPal are integrating bitcoin into their services.

For people who want to maintain privacy and send bitcoin at the speed of light with negligible fees, the Lightning Network is quickly becoming the payment option of choice. Already adopted in El Salvador and currently being integrated into Cash App, the Lightning Network is turning bitcoin into a transactional currency, rendering thousands of altcoins useless in the process.

Two Parallel Systems

Right now the Federal Reserve is debating whether to keep interest rates low and let the economy be destroyed by inflation or raise interest rates and destroy the economy by popping the debt bubble.

Meanwhile, there exists a parallel system where no such decisions need to be made. This system has an algorithmic monetary policy that is known to everyone before they choose to opt in. Over time, beginning with small allocations, rational actors will move away from the current system characterized by bureaucracy, corruption and inflation, and move into this other system run on the principles of mathematics, immutability and scarcity.

This system is called Bitcoin. And it has no competition.

This is a guest post by Bob Simon. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.