- March 27, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Definition

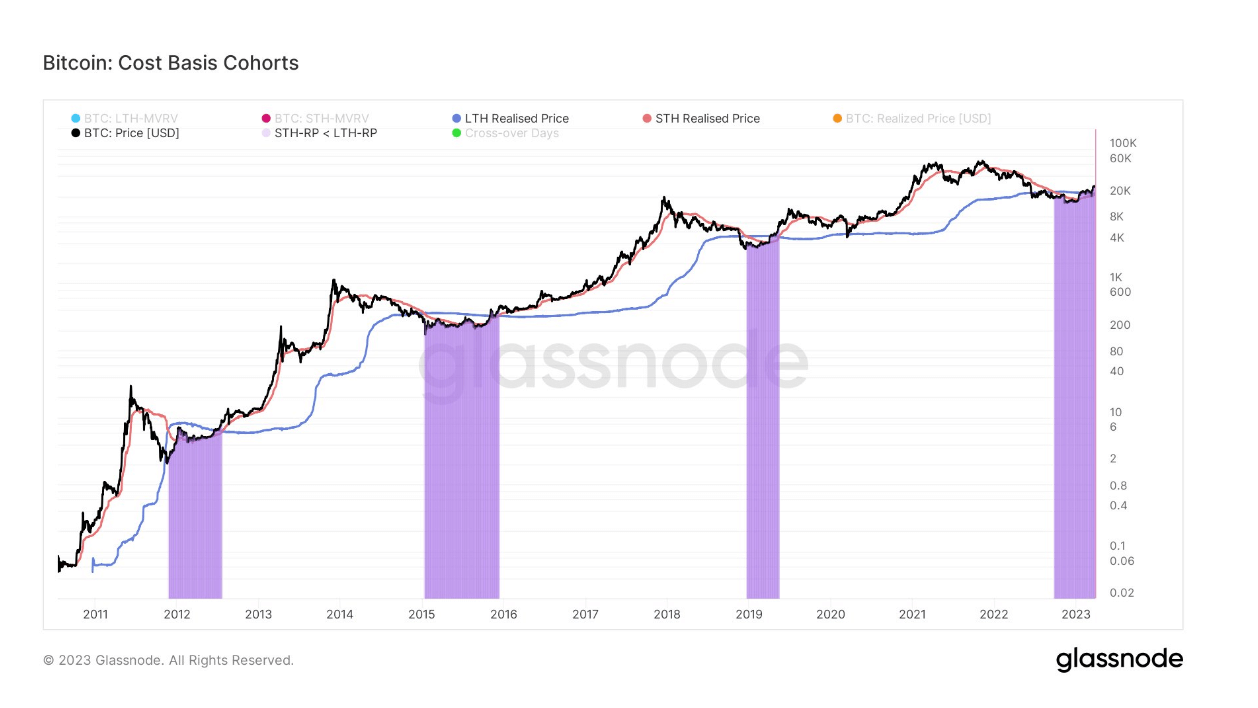

Realized Price reflects the aggregate price when each coin was last spent on-chain.

The Realized Price reflects the average on-chain acquisition price for the entire coin supply.

The Realized Price reflects the average on-chain acquisition price for the entire coin supply. Short-Term Holder Realized Price (STH RP) reflects the average on-chain acquisition price for coins held outside exchange reserves, which were moved within the last 155-days. These reflect the most probable coins to be spent on any given day.

Short-Term Holder Realized Price (STH RP) reflects the average on-chain acquisition price for coins held outside exchange reserves, which were moved within the last 155-days. These reflect the most probable coins to be spent on any given day. Long-Term Holder Realized Price (LTH RP) reflects the average on-chain acquisition price for coins held outside exchange reserves, which have not moved within the last 155-days. These reflect the least probable coins to be spent on any given day.

Long-Term Holder Realized Price (LTH RP) reflects the average on-chain acquisition price for coins held outside exchange reserves, which have not moved within the last 155-days. These reflect the least probable coins to be spent on any given day. Periods where spot price falls below all cost basis models typically occur in deep bear markets where the average investor, irrespective of hold time, is holding an unrealized loss.

Periods where spot price falls below all cost basis models typically occur in deep bear markets where the average investor, irrespective of hold time, is holding an unrealized loss.

Quick Take

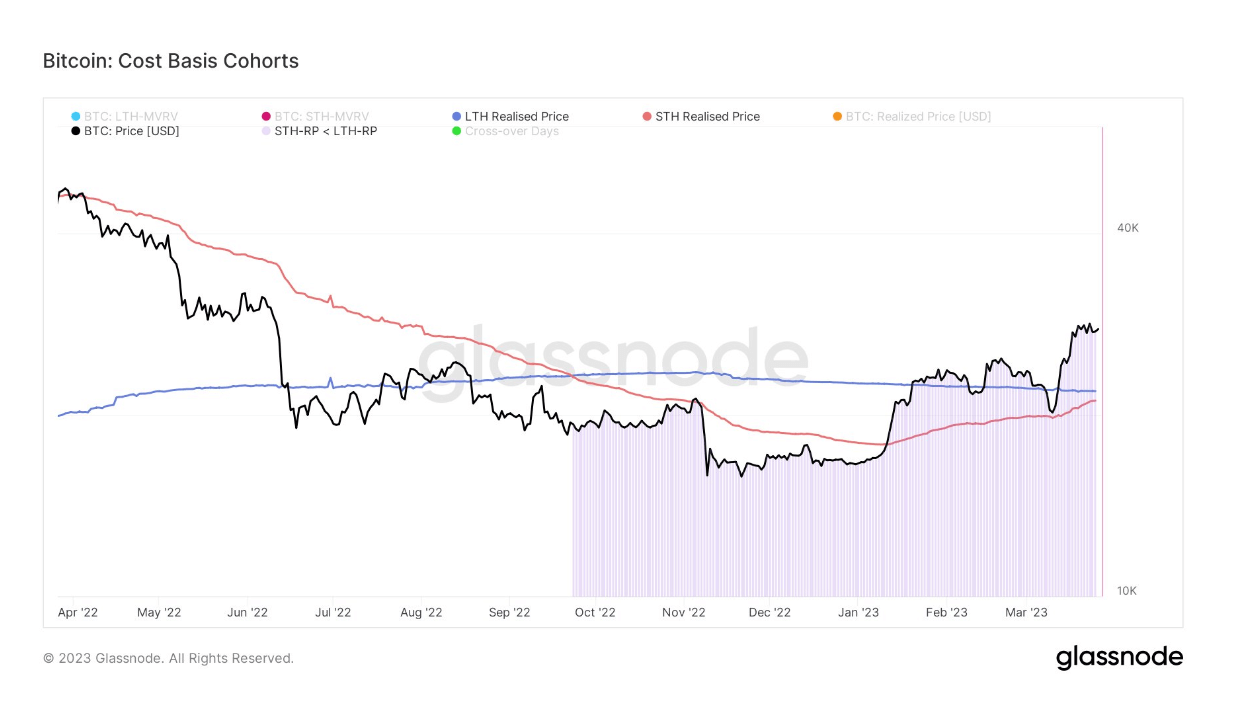

Bitcoin short-term holder realized price is now less than $1,000, away from the Long-term holder’s realized price.

Each time STH RP has gone above, LTH RP has signaled the end of a bear market.

- STH RP = $21,095

- LTH RP = $21,900

- RP = $19,960

We are currently in the 903 cross-over days, split below by each bear market.

- 2012: 239 days

- 2015: 334 days

- 2019: 145 days

- 2023: 184 days

The post Bitcoin breaks 900-day milestone stuck in bear market – according to realized price metrics appeared first on CryptoSlate.