- April 6, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Definition

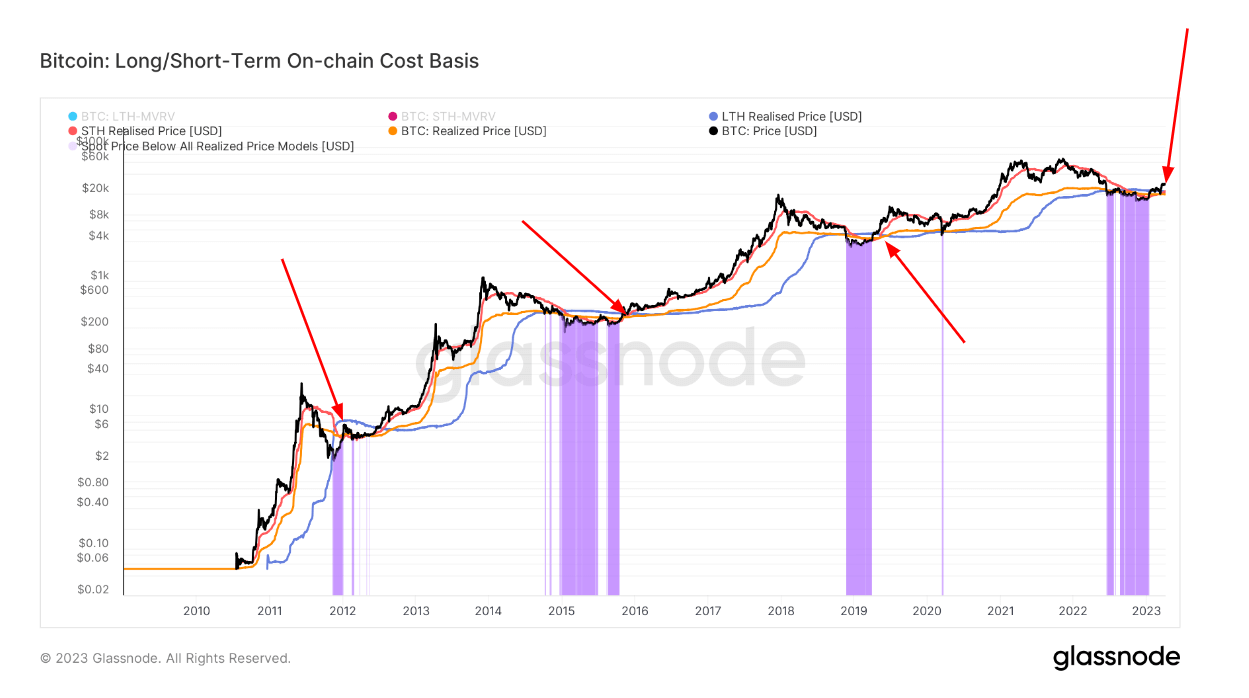

STH Realized Price is the average price of the Short-Term Holder BTC supply, valued at the day each coin last transacted on-chain. This is often considered the ‘on-chain cost basis’ of this cohort.

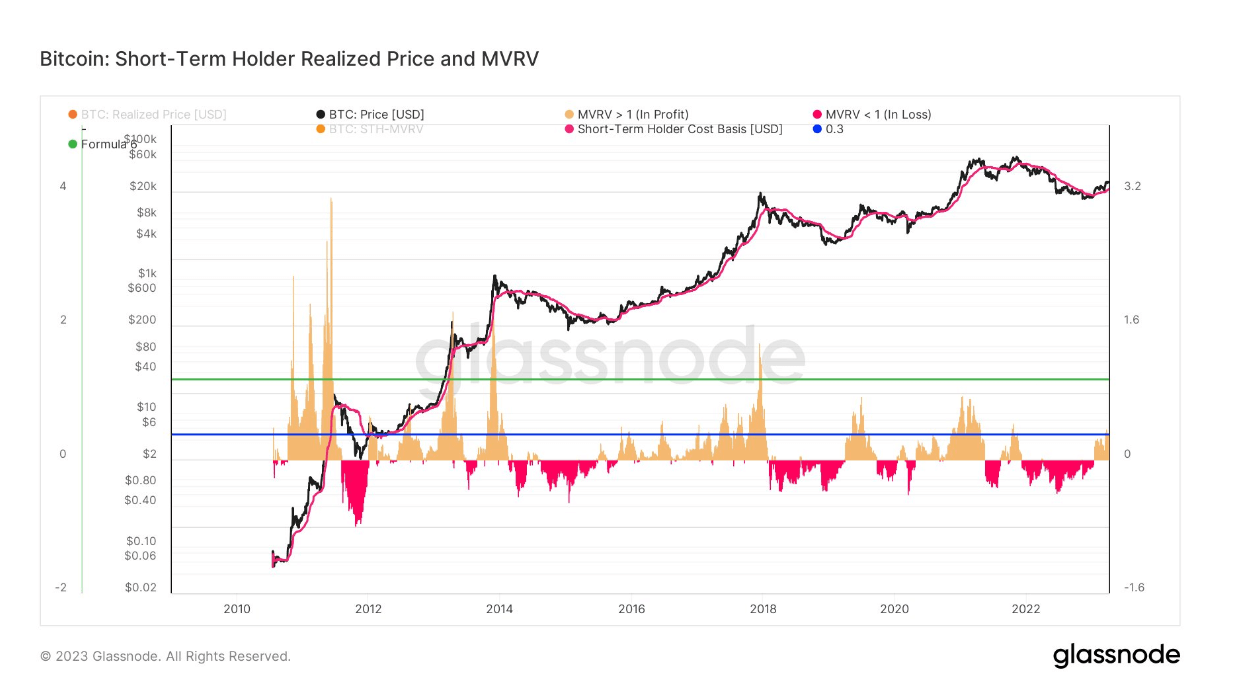

STH MVRV Ratio is the ratio between the market value (MV, spot price) and the Realized value (RV, realized price) for the Short-Term Holder Cohort. This allows for a visualization of Bitcoin market cycles and the unrealized profitability of this cohort.

Quick Take

- For months, CryptoSlate has analyzed the transition from bear to bull market, and last week the metric we have been tracking flashed on our screen.

- After each bullish crossover of the STH cost basis above the LTH cost basis tends to be the end of the Bitcoin bear market.

- Now more than ever, it is time to be analyzing the behavior of the short-term holder cohort.

- As the STH supply continues to grow, this will have a knock-on effect on RP and MVRV ratio to continue to grow.

- The MVRV ratio is currently at 0.3, which means the current price is -70% below the market avg cost basis (STH BTC holder is underwater by -70%).

- As Bitcoin continues to consolidate, this will improve the cost basis for both STHs and LTHs.

The post Bitcoin Deja Vu: History repeating itself with a familiar market pattern appeared first on CryptoSlate.