- May 1, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

- According to the Kobessi letter, JP Morgan said its acquisition of First Republic would generate a one-time gain of $2.6 billion.

- Not only that, JP Morgan also expects over $500 million in profit per year from the acquisition.

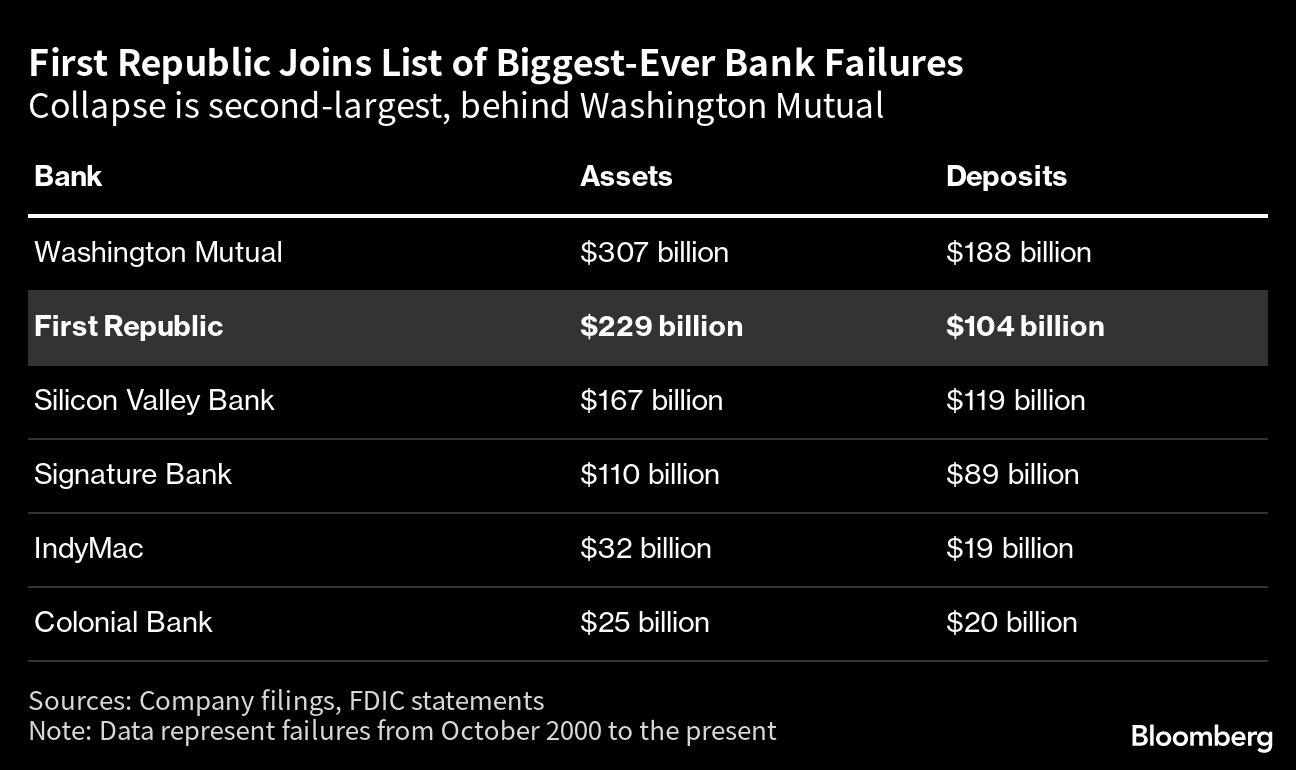

- First Republic Bank is the second largest bank to have failed in the U.S. It is now behind Washington Mutual.

- The FDIC estimated that the cost to the deposit insurance fund would be about $13 billion.

- However, JP Morgan should be ineligible to acquire FRB under U.S. regulation as they have already amassed more than 10% of its nationwide deposits. Authorities have made an exemption.

The post JP Morgan and First Republic Bank deal: a step towards financial monopoly? appeared first on CryptoSlate.