- October 28, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

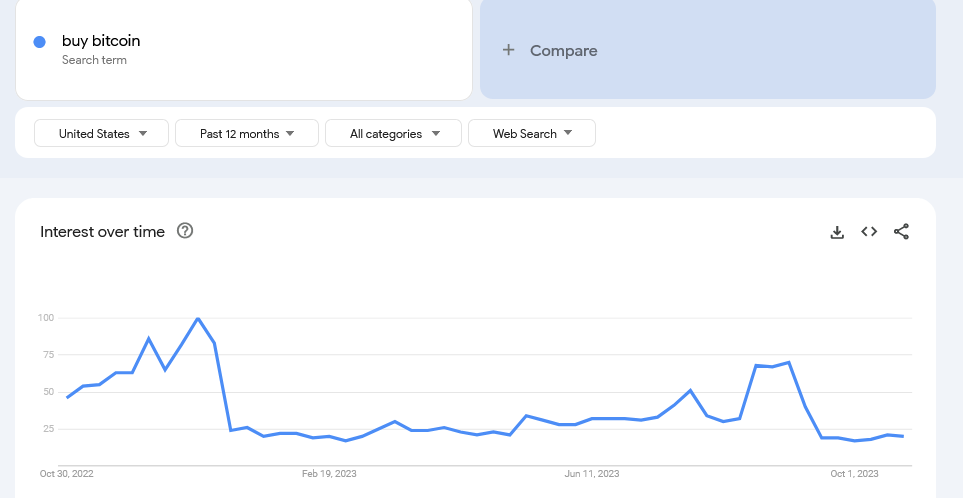

If Google Trends data is anything to go by, it could mean that Americans don’t care about Bitcoin (BTC) or the interest is ultra-low and falling despite the series of bullish events in the last few days.

Americans Are Not Interested In Bitcoin?

A spot check of Google Trends over the past years shows that not only are searches related to “buy Bitcoin” discouragingly falling but are at 2023 lows, with related average daily searches scoring less than 20. The only time “buy Bitcoin” searches spiked was in early September when it rose to a score of 70, an indicator that more people were curious, willing to explore, and even buy the world’s most valuable coin.

Sentiment is a crucial factor in crypto because it can influence prices. To illustrate, when sentiment improves, crypto investors are more likely to buy and hold on to their treasured coins in hopes of riding the emerging trend and raking in profits.

Related Reading: The Plot Thickens: Sam Bankman-Fried Incriminates Lawyers In FTX Fraud

Conversely, when crypto assets begin falling, as in 2022 and the second half of 2023, holders will often flee to safety, selling their coins for stablecoins like USDT or cash. In some instances, however, without an option, investors will look to exit for an established coin like Bitcoin or Ethereum (ETH), pumping those respective assets.

As the market evolves, sentiment can be influenced by news events, regulatory developments, or influencer comments. Elon Musk, the owner of X, the social media platform, has been sued on allegations that the billionaire deliberately conducted a pump-and-dump scheme, manipulating Dogecoin (DOGE) prices and profiting at the expense of others.

SEC Likely To Approve The First Spot Bitcoin ETF In The US

Google Trends is one of the tools users can use to gauge crypto sentiment. However, looking at events in the United States, interest in BTC is yearly low. This is despite the community expecting the Securities and Exchange Commission (SEC) to approve the first spot Bitcoin Exchange-Traded Fund (ETF).

After several attempts in the past, analysts have been gradually increasing the odds of the strict regulator green-lighting the first Bitcoin ETF in Q4 2023 or early 2023. Still, it needs to be clarified whether the agency will authorize one or multiple products simultaneously. If the SEC disapproves a Bitcoin ETF, JPMorgan analysts led by Nikolaos Panigirtzoglou said the agency could face “legal troubles.”

In anticipation of the product and ahead of Bitcoin halving in 2024, the coin recently broke above July 2023 highs, registering a new 2023 high above $35,000. Though prices have been steadying, the uptrend remains, and traders expect more gains.