- October 30, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

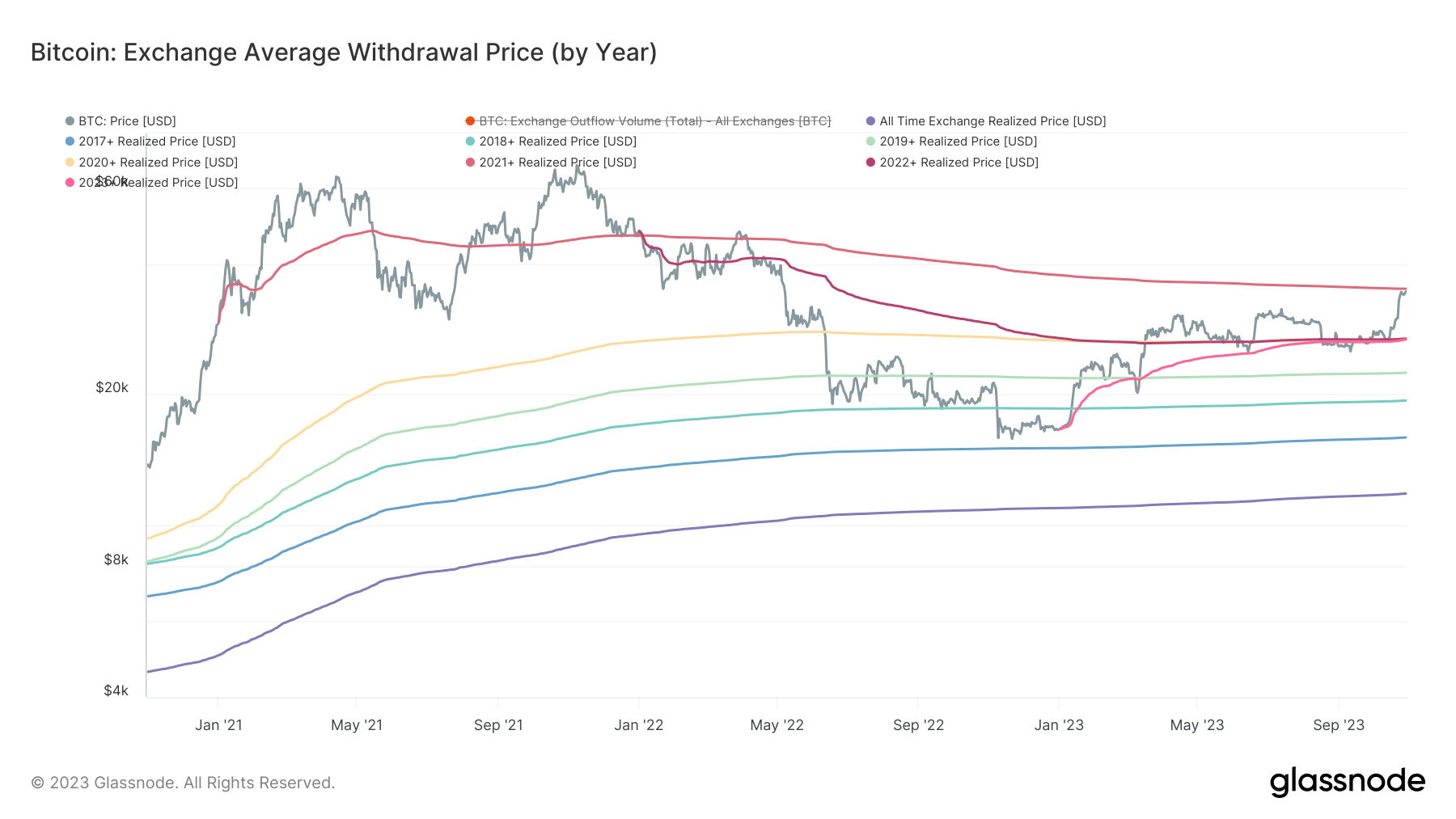

Bitcoin (BTC) has seen a noteworthy surge in October, marking a 28% increase and paving the way for it to be the second most lucrative month of the year, tailing behind January’s 40% ascension. One key metric that provides an insightful perspective is the ‘realized price‘, a concept that reveals the mean purchase price for all current Bitcoin owners, thereby countering the effects of volatility.

A closer examination of the yearly cohorts’ on-chain cost basis reveals that all groups, except those who began purchasing in 2021, are in a profitable position.

Anticipating that the 2021 investor cohort will continue with their dollar-cost averaging strategies, it’s noteworthy that their realized price level has declined from $50,000 to $35,000 over a span of two years. As such, any surge beyond the $35,000 threshold could potentially instigate a round of profit-taking. Therefore, this price level is expected to serve as a short-term resistance, tempering any immediate upward price movement.

In addition, we’ve consistently used the 2023 realized price level as a support, deviating below it just once this year during the SVB collapse in March. However, we promptly rebounded above that level shortly thereafter.

To break it down, the realized prices for the cohorts are as follows: 2017+ ($15,907), 2018+ ($19,352), 2019+ ($22,432), 2020+ ($26,649), 2021+ ($35,053), 2022 ($26,902), and 2023 ($26,790).

| Cohort Realized Price | Price Realized Price |

|---|---|

| 2017+ | $15,907 |

| 2018+ | $19,352 |

| 2019+ | $22,432 |

| 2020+ | $26,649 |

| 2021+ | $35,053 |

| 2022 | $26,902 |

| 2023 | $26,790 |

Realized Price by cohort: (Source: Glassnode)

The post Bitcoin’s October surge leaves one buyer group in the cold appeared first on CryptoSlate.