- November 1, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

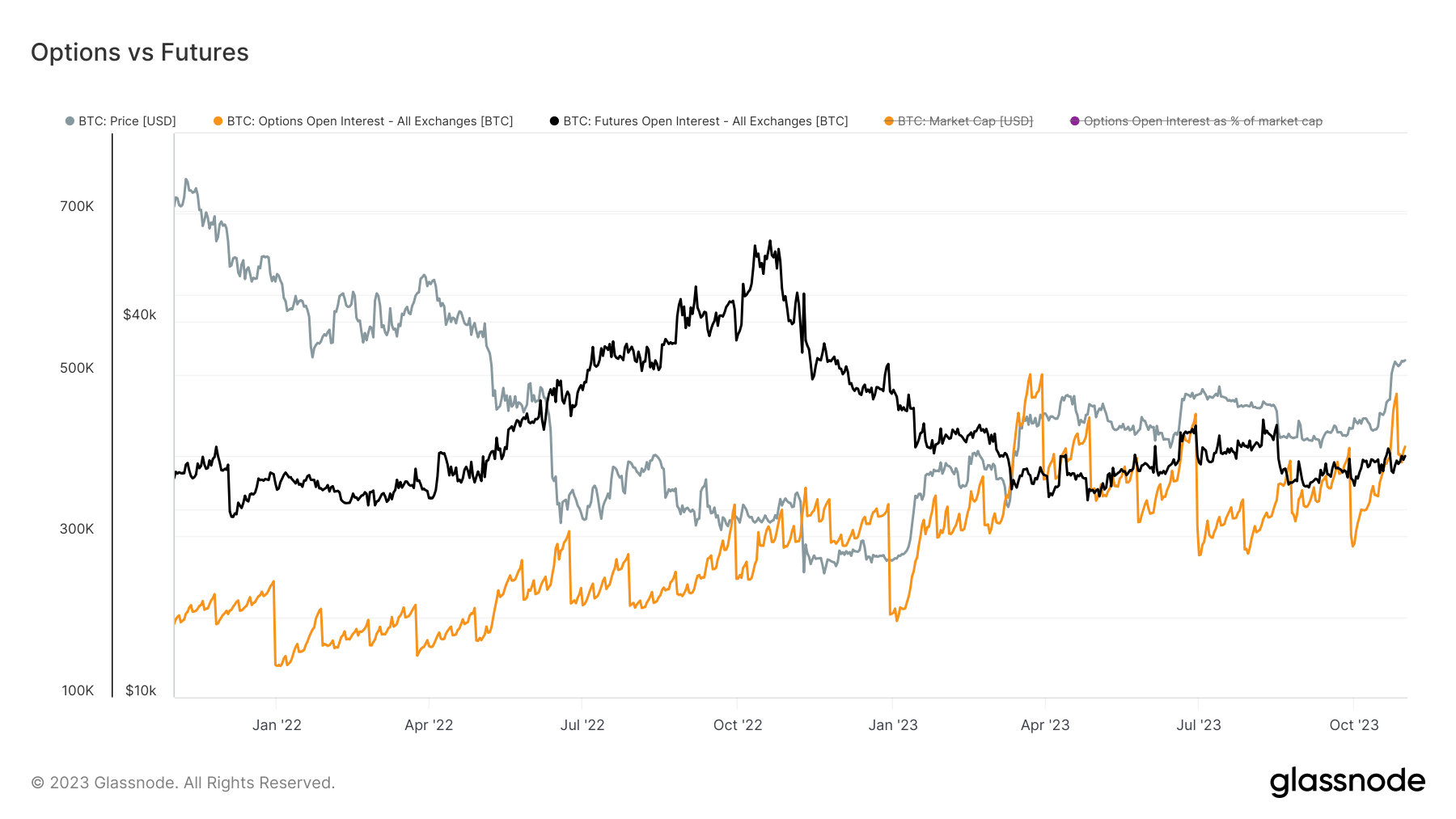

A remarkable shift is afoot in the Bitcoin options and futures markets. For the first time since March, options open interest overtook futures open interest, showcasing an intriguing dynamic in the Bitcoin trading arena. Although this trend briefly reversed, the options market has seen robust expansion since July, while the futures market has largely plateaued.

Currently, options open interest harbors approximately 411,000 BTC, with futures open interest trailing closely at around 400,000 BTC. CryptoSlate’s analysis of exchange-level data from CME indicates a growing institutional interest underpinning this trend.

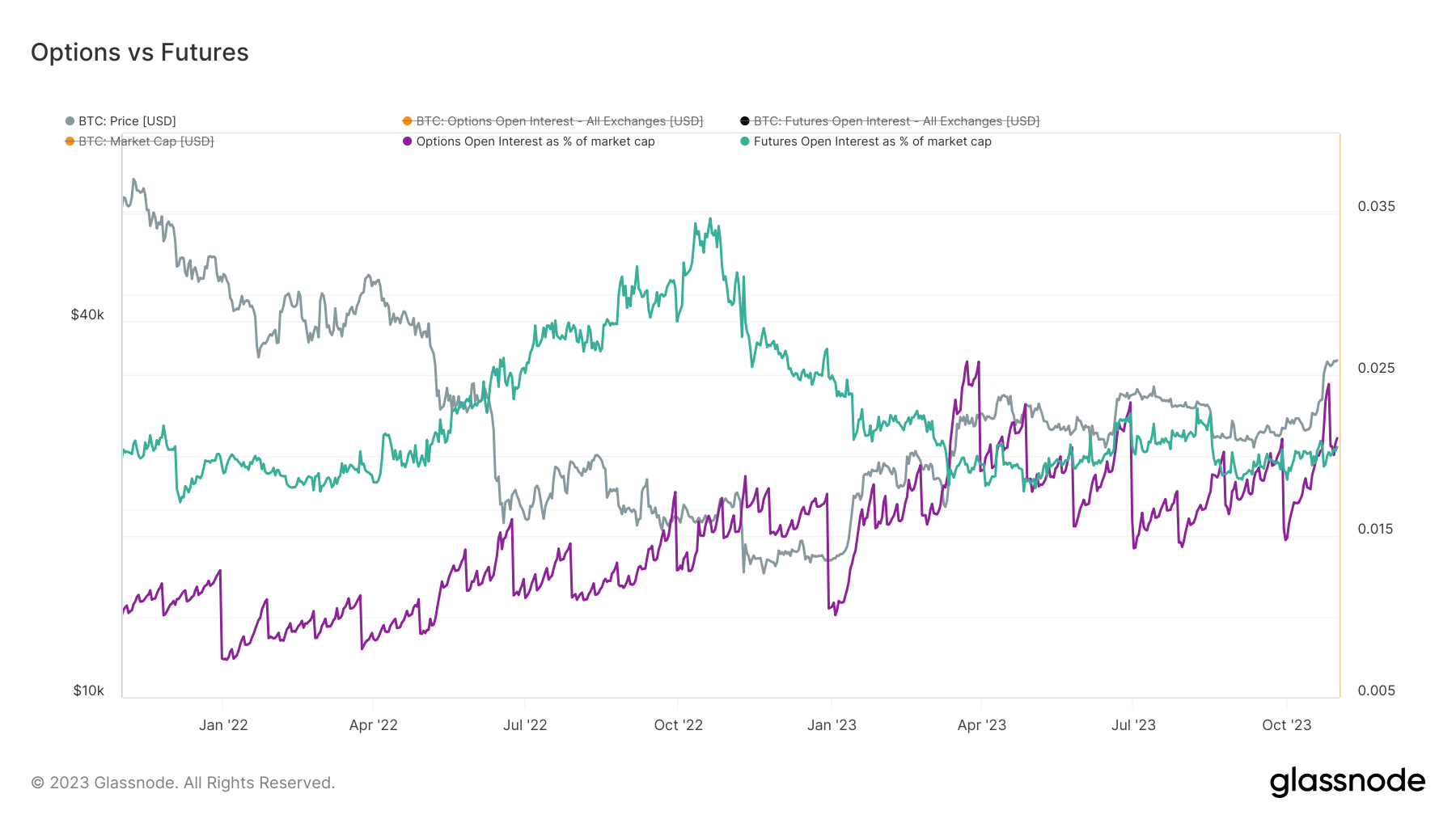

Interestingly, the relationship between open interest and market capitalization offers further depth to this narrative. Options open interest has grown to represent about 2.1% of Bitcoin’s market cap, with futures open interest accounting for slightly less at 2.0%. This suggests an emerging closeness between the options and futures markets in terms of dominance, making for a fascinating observation in the evolving landscape of Bitcoin trading.

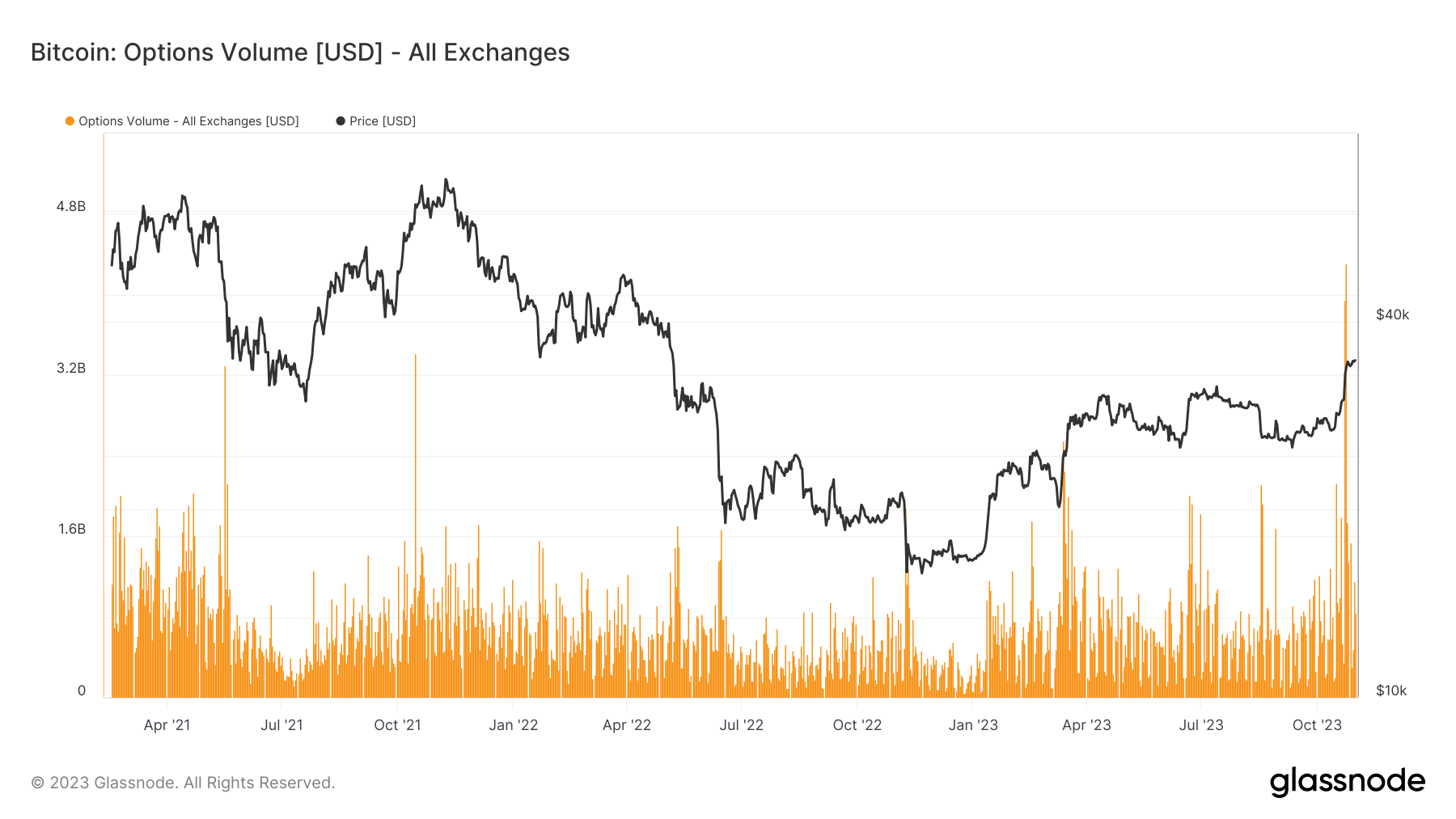

This increase in options open interest occurred simultaneously with the most substantial Bitcoin options volume ever recorded. On Oct. 23 and 24, we observed an approximate daily options volume of $4 billion. This figure represents the highest volume ever observed, surpassing any recorded during the 2021 bull market.

The post Bitcoin options market expands, overtakes futures open interest appeared first on CryptoSlate.