- November 6, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

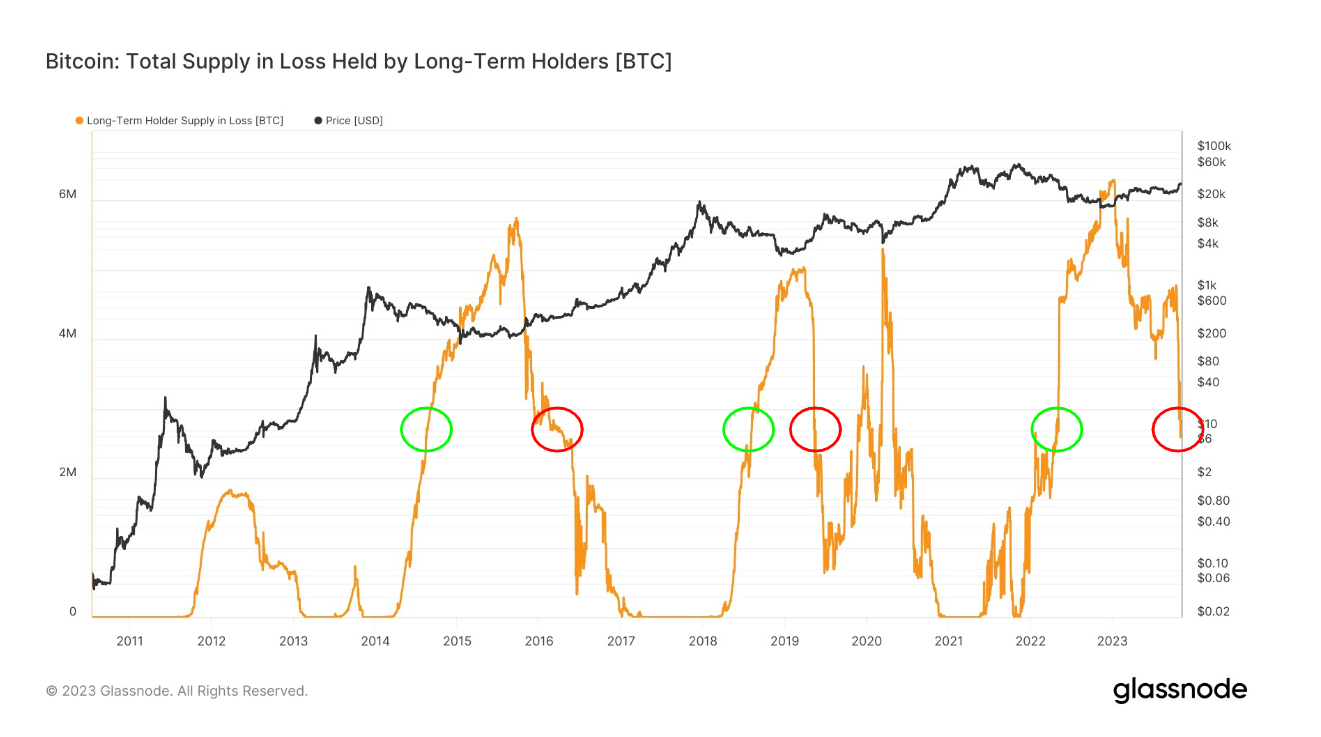

Understanding Bitcoin’s cycles is pivotal, and an intriguing way to capture this information is through an analysis of the total supply of Bitcoin held at loss by long-term holders. Long-term holders refer to investors who have retained Bitcoin in their portfolio for a period exceeding 155 days.

Currently, this figure sits at 2.6 million Bitcoin. Traditionally, as we emerge from bear markets and Bitcoin initiates its bull run, there have been instances where long-term holders have sustained this level of Bitcoin supply at a loss: 2016, 2019, and 2023. An exception was the COVID-induced segment of the cycle, which, due to its unpredictability, is excluded from this analysis.

It is observable that the lowest point in Bitcoin’s price cycle coincides with the period when long-term holders experience their most significant losses in terms of Bitcoin value.

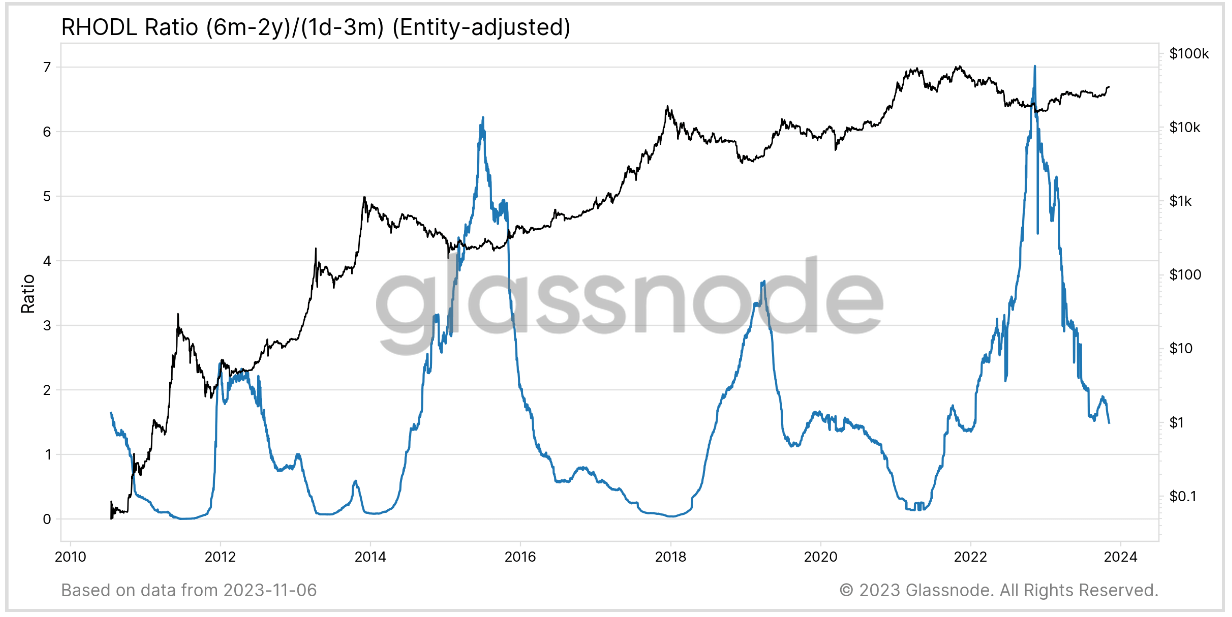

Further substantiating these trends is the RHODL ratio, a measure that contrasts the wealth held by single-cycle Long-Term Holders (6m-2y) against the newest Short-Term Holders (1d-3m). This ratio is used to identify the capital rotation turning point across cycle transitions.

Once again, it’s evident that the peak of the RHODL ratio aligns with the nadir of Bitcoin’s price cycle. As we ascend from the market bottom, the RHODL ratio initiates its transition, a shift that commenced in early 2023.

As per the current data, we are still amidst this transition phase in the cycle, potentially heading towards a bull market, a pattern that is consistent with previous cycles.

The post Long-term holder trends suggest crypto markets could be headed for a bull run appeared first on CryptoSlate.