- November 17, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A new report from the Bank for International Settlements (BIS) has revealed a critical insight into the crypto market: no current stablecoin can guarantee full parity with its peg at all times, regardless of its size or backing type.

The report, aptly titled “Will the real stablecoin please stand up?”, categorizes stablecoins into four distinct types, including those backed by fiat currency, commodities, or other crypto assets, and assesses their stability. As the report notes, “while stablecoins backed by fiat currency, commodities, or other crypto assets have generally been less volatile than traditional crypto assets, not one of them has been able to maintain parity with its peg at all times”

Different Types Stablecoins

This finding is consistent across all stablecoin types, whether fiat-backed, crypto-backed, commodity-backed, or unbacked. The BIS report provides a detailed analysis of the stablecoin market, which has seen considerable growth since the inception of the first stablecoin.

As of the end of September 2023, there were over 60 active stablecoins, including prominent ones like Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). The report classifies stablecoins into four categories: fiat-backed (examples being Tether and USD Coin), crypto-backed (like Dai and Frax), commodity-backed (such as PAX Gold and Tether Gold), and unbacked stablecoins.

The market capitalization of unbacked stablecoins, however, is significantly lower, constituting less than 1% of the total market capitalization of stablecoins by the end of September 2023. The report highlights the variations in stablecoin performance based on the currency they are pegged to.

Stablecoins pegged to the US dollar and the euro have generally tracked their pegs more effectively than those pegged to other currencies or stablecoins. For instance, stablecoins pegged to more “volatile” currencies like the rupiah, Singapore dollar, and Turkish lira have experienced larger deviations from their pegs.

Criticism On Stablecoins

The BIS report also delves into the stability of various stablecoins. It found that only seven fiat-backed stablecoins, including Tether (USDT) and USD Coin (USDC), have managed to keep their deviations from the peg below 1% for more than 97% of their lifespan. However, even these stablecoins have occasionally failed to maintain strict parity.

Since 2020, Tether’s maximum negative and positive end-of-day deviations from the peg were –$0.018 and $0.012, respectively. Additionally, the report reveals that the intraday price deviations of Tether have been significant, with the maximum deviation being 13% below the peg and 11% above it since 2020.

The report specifically notes that “for Tether, the minimum redeemable amount is $100,000 and users would have to pay a redemption fee of 0.1% and a one-time verification fee of $150”. This indicates significant barriers to redemption for average users, impacting the utility and reliability of these stablecoins, according to the BIS.

Regarding transparency in the stablecoin market, the report identifies a varied landscape. As of September 2023, while issuers of the largest fiat-backed and commodity-backed stablecoins have disclosed their reserve compositions, “the majority of crypto-backed stablecoins are opaque on the size and breakdown of their reserves,” the report states.

It adds, “Only a few stablecoins publish their reserves on a daily or even more frequent basis.” The report highlights TrueUSD (fiat-backed) as a stablecoin that provides daily updates on their reserve holdings, while others like Tether and USD Coin publish this information less frequently, sometimes quarterly or even on an ad-hoc basis.

BIS’ Stance On Crypto

In summary, the BIS report sheds light on the challenges faced by stablecoins in maintaining value stability and transparency in reserve holdings. In the past, the Bank for International Settlements (BIS) has taken a significant stance on crypto with a focus on disclosure and regulation.

Major banks will be required to disclose their crypto holdings starting in 2025. The BIS has also unveiled Project Atlas, a data platform mapping crypto transfers, indicating a proactive approach to understanding and monitoring activities. Furthermore, the BIS has repeatedly expressed concerns about crypto, stating that it considers the system flawed and advocating for tokenization as an alternative.

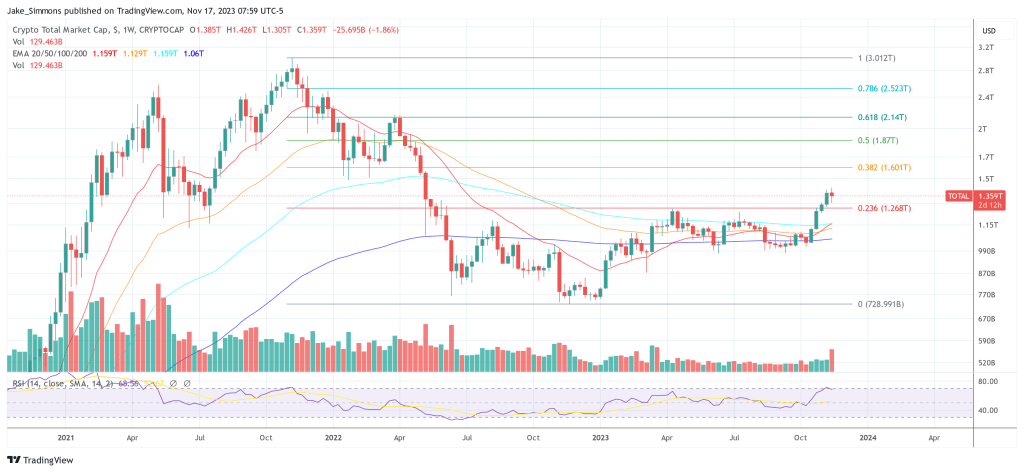

At press time, the total crypto market cap stood at $1.359 trillion.