- November 18, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A surge in Bitcoin derivatives activity reminiscent of late 2021 has sparked renewed enthusiasm among traders. Factors such as the cost of perpetual futures trades and increasing options open interest indicate a revival of speculative interest in Bitcoin.

The cryptocurrency has experienced a significant price recovery this year, more than doubling in value after a tumultuous 2022.

Bitcoin Options Open Interest Hits New All-Time High

According to Bloomberg, anticipation surrounding the potential approval of the first US spot Bitcoin exchange-traded funds (ETFs) has contributed to the heightened attention.

The approval of such ETFs is expected to attract a broader range of investors to the asset. While the exact level of ETF inflows remains uncertain, the possibility of increased demand is driving riskier trading strategies.

Deribit, the largest crypto options exchange, reported a record notional value of approximately $14.9 billion in Bitcoin options open interest earlier this week.

This surpassed the previous $14.4 billion set in October 2021, just before BTC reached its all-time high of nearly $69,000. For clarity, open interest refers to outstanding contracts that have not yet been settled.

On this matter, Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets, recently highlighted the strong demand for crypto call options. While some traders have taken leveraged positions speculating on a potential breakout to $100,000 or beyond, the immediate test lies at the $38,000 level.

Bitcoin approached $38,000 before retracing, currently trading at $36,400. Notable trends in Bitcoin’s futures and options markets can be observed through three key charts.

Insights From Futures And Options Charts

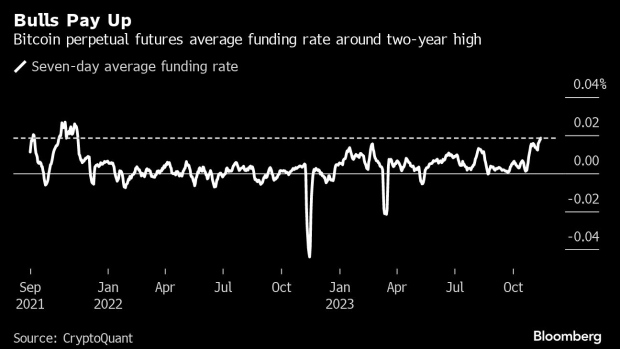

Perpetual futures have no set expiry date and are popular BTC derivatives. The funding rate, a cost for maintaining positions, tends to be positive during bullish periods.

Per the report, the rolling seven-day average funding rate for BTC perpetual futures closely resembles levels seen in the final quarter of 2021 when Bitcoin was surging to its peak.

Bitcoin futures curves provide insights into price outlooks. The entire curve based on Chicago Mercantile Exchange (CME) Group contracts has shifted upward compared to a month ago.

The farthest contract now rises to nearly $40,000, whereas previously it reached almost $32,000. CME’s open interest for Bitcoin futures has surpassed Binance’s, suggesting increased institutional participation in using futures for long exposure to BTC.

Data from Deribit reveals a predominance of bullish options bets on BTC, reaching $40,000 and even $45,000 by the end of December. The willingness of traders to sell call options implies that $40,000 could become a significant test area for Bitcoin’s rally.

Overall, the surge in Bitcoin derivatives activity and the growing interest in options and perpetual futures indicate a renewed bullish sentiment among traders.

The potential approval of US spot BTC ETFs has contributed to this heightened enthusiasm. As Bitcoin approaches key resistance levels, market participants eagerly watch for further developments, with $40,000 as a crucial juncture in the ongoing rally.

Featured image from Shutterstock, chart from TradingView.com