- December 7, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

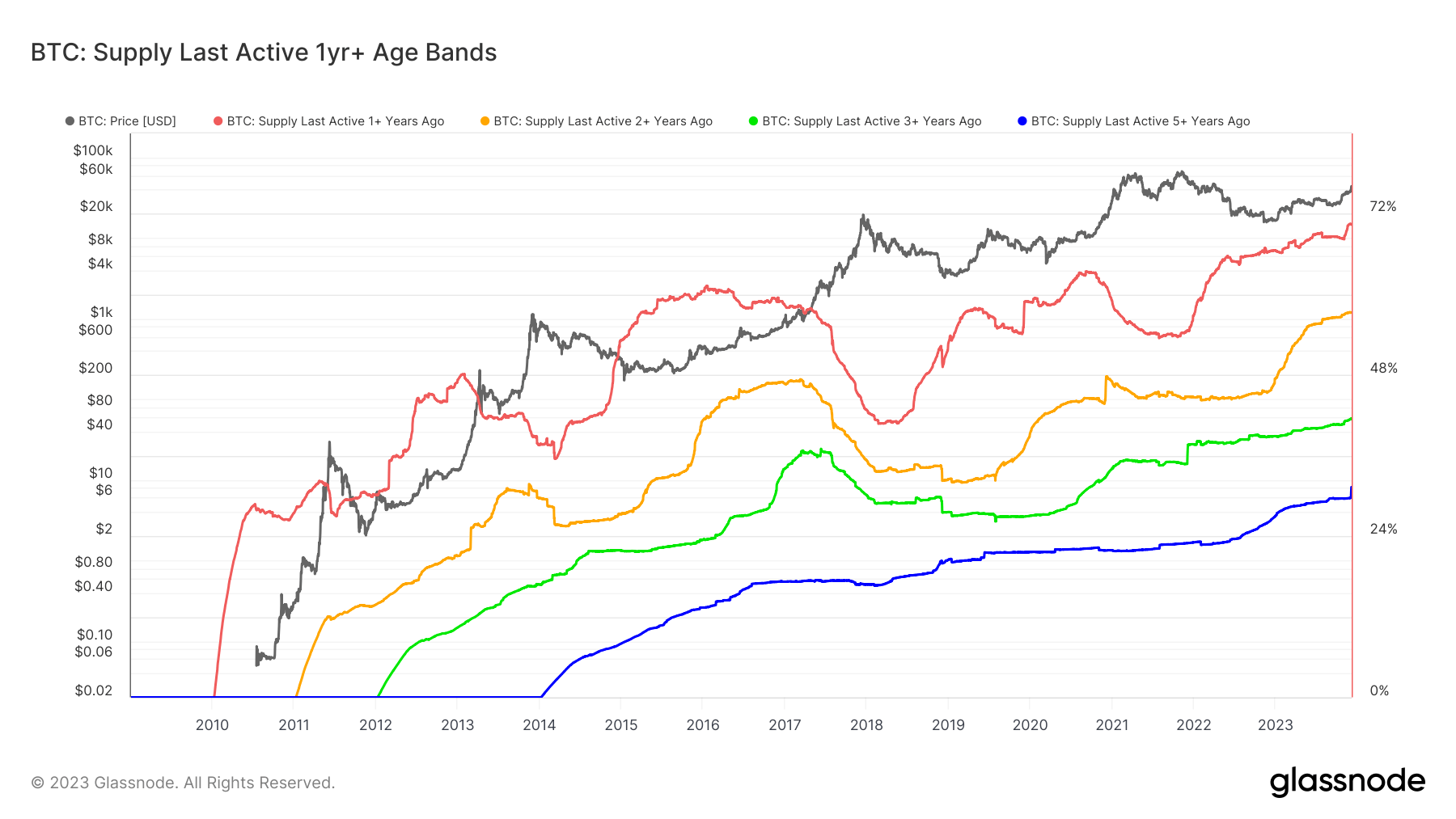

Historical data indicates a growing trend among Bitcoin investors towards long-term holding. Since Bitcoin’s inception on Jan. 3, 2009, coins have continuously circulated through mining, purchasing, and selling processes, with some being lost. However, an analysis of the supply last active reveals a significant percentage of Bitcoin has not moved on-chain for extended periods.

Specifically, 70.3% of the supply was last active more than a year ago, 57.3% more than two years ago, 41.5% over three years, and a record 31.3% last active over five years ago. This suggests that almost a third of the current Bitcoin supply is retained by investors who have held onto their assets for over half a decade.

Interestingly, the timing coincides with the bottom of the 2018 bear market, hinting at the emergence of steadfast investors, colloquially known as “diamond hands,” who hold onto their assets regardless of market fluctuations.

In light of a 160% year-to-date return on Bitcoin, these figures underline a remarkable trend: despite substantial profits, most investors choose to hold onto their Bitcoin, indicating a strong belief in its long-term value.

The post Record 31% of Bitcoin supply dormant for over five years appeared first on CryptoSlate.