- March 24, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A recent report from Wave Financial explains how seemingly outlandish bitcoin price predictions may not be so far fetched after all.

How does $400,000 per bitcoin sound? Most likely outlandish, especially if it is expected within the next five years.

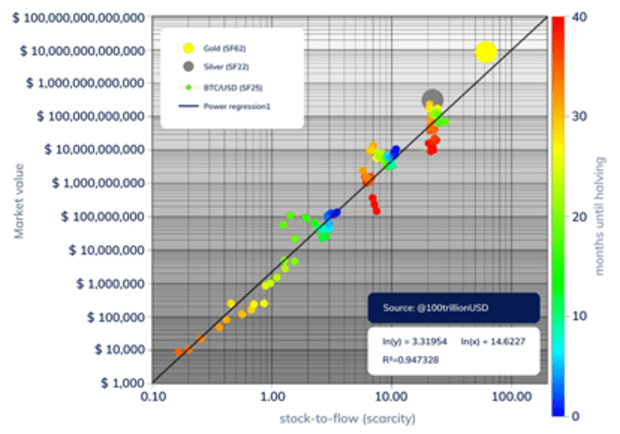

But that is exactly the price the analysts at Los Angeles-based investment management company Wave Financial believes bitcoin could reach, using the investment analysis model stock-to-flow ratio, by as early as 2025.

One of the most interesting parts of our report, released in late February 2021, is the illustration of how the stock-to-flow ratio was used to accurately predict the movement of the bitcoin price from $4,000 in March 2019 to about $50,000 in February 2021. Stock-to-flow ratio is primarily a gold valuation model. The fact that it works better on bitcoin than most of the other models gives credence to the belief of many that bitcoin is digital gold.

We say in the report, titled “Understanding Bitcoin’s Impact On Portfolio Performance,” that “a $55,000 prediction seemed relatively outlandish in March 2019. But today $55,000 seems like a reasonable target for 2021. The target price of $400,000, once again, seems outlandish today.”

As we now stand in March 2021, a month on from the report being published, some of our price targets are now out of date, with bitcoin surpassing the $60,000 level.

In mid-February, bitcoin achieved a new all-time high price of $50,000 and, for the first time, a market cap of over $1 trillion. This is a market rally that was predictable by considering the mining subsidy halving that happened in 2020 and the growing adoption of bitcoin as an institutional reserve asset.

In 2024, the bitcoin subsidy, the new coins released to circulation, will reduce from 6.25 BTC approximately every ten minutes to 3.125 BTC. In 2020, the mining subsidy dropped from 12.5 BTC. The subsidy halving happens every four years, making bitcoin a deflationary asset, which we believe is one of the main bullish drivers of its price.

Meanwhile, increasingly, mainstream corporate entities and investment firms have embraced bitcoin as a reserve asset. For example, MicroStrategy, a Virginia-based tech company, has taken the lead on this path. The company, founded by Michael Saylor and Banju Bansal in 1989, HODLs about 90,859 bitcoin, worth over $2.186 billion. The company’s latest addition to its holding was a late February purchase of an additional 328 bitcoin for about $15 million at an average price of $45,710 a bitcoin.

The electric car manufacturer Tesla in early February disclosed in a securities filing that it had acquired $1.5 billion worth of bitcoin. Indeed, within the last five years, a significant amount of bitcoin has moved into the ownership of major investment institutions and corporate entities.

Throughout February, rumors spread that the software company Oracle was about to announce the purchase of 72,000 bitcoins. On March 11, the company dispelled the rumors leading to the price of bitcoin shedding about $2,000.

Interest in bitcoin as a reserve asset by mainstream companies is not limited to the U.S. In early March, Meitu, a Chinese tech company, announced its acquisition of 380 BTC and 15,000 ETH. It also came out that Meitu founder Cai Wensheng owned 10,000 BTC (worth about $504 million) in 2018.

Around the same time, Aker ASA announced the establishment of Seetee, a firm through which it intends to invest in bitcoin and bitcoin startups. Aker ASA is a Norwegian industrial investment company with interests in oil and gas, renewable energy, maritime and green technologies.

Indeed, within the last five years, a significant amount of bitcoin has moved into the ownership of major investment institutions and corporate entities.

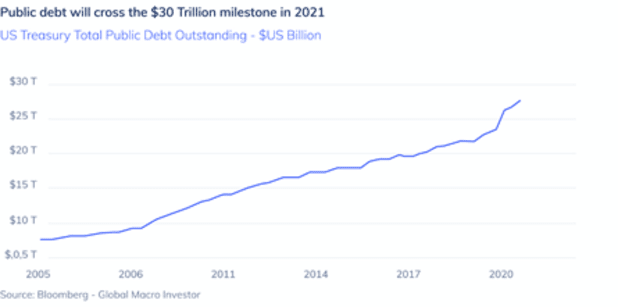

“The fundamental reason for such focus on Bitcoin is actually centered around the financial environment of 2020,” reads part of our report. “Due to the pandemic, governments around the world are printing money to stabilize and boost the economy” and this is pushing investors toward digital assets as a safe haven.

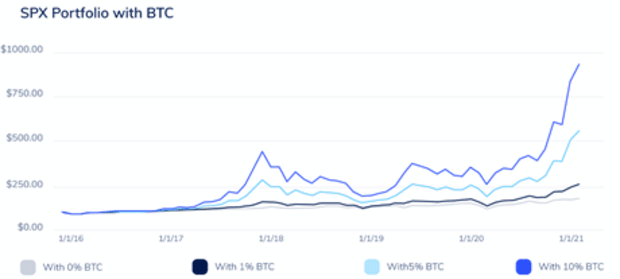

The report also explains and illustrates the impact the price movement of bitcoin has on investment portfolios that have it as a significant component.

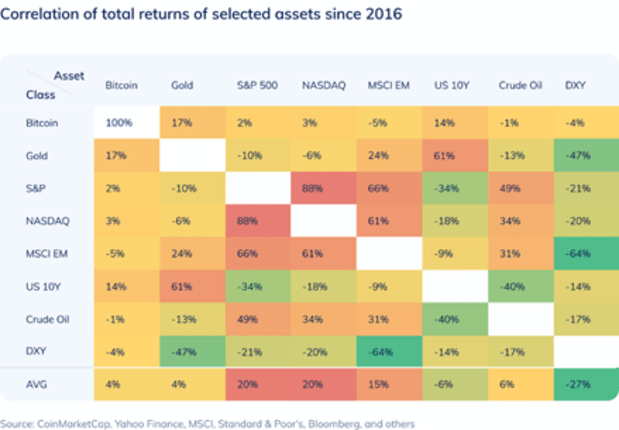

Bitcoin has technical aspects that set it apart as an asset class in portfolio management and it is most likely to turn into a superior one. Historically, bitcoin has performed well as an addition to different portfolios because it has a low correlation relative to most other traditional asset classes. Using different hypothetical scenarios, the cryptocurrency is a great tool for portfolio diversification and managing portfolio risk-adjusted returns.

It is also very interesting to look at the technical comparisons between bitcoin and other assets using different scenarios and looking at returns on investment by focusing on metrics like volatility, Sharpe ratio and Sortino ratio.

Wave Financial LLC (Wave) provides institutional digital asset fund products. You can read the “Understanding Bitcoin’s Impact On Portfolio Performance” report by following this link.

This is a guest post by Constantin Kogan. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.