- March 25, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A new record of bitcoin options expiring this week will doubtlessly have an effect on the BTC price in the near and short term.

After another week of bitcoin price volatility, including a new all-time high, a new record of options expiring on March 26 could play a key role in price action and the continuation of this volatility moving into the coming days.

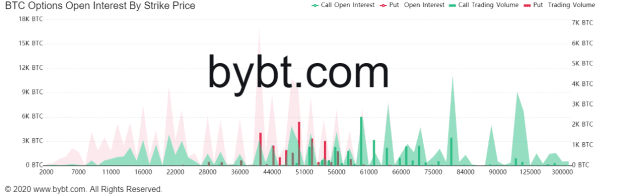

Options are a contract for the right to purchase or sell an asset at a specific price. According to data analytics company Bybt, there are over 100,000 BTC — the equivalent of $5,574,000,000 (given the bitcoin price of $55,740 at the time of this writing) — of options set to expire this Friday, March 26, across numerous major exchanges. This will make for an interesting trading session leading into the weekend.

This level of options expiring will set a new record, breaking the $4 billion mark set in late January of this year. The bitcoin price on January 31 closed at just over $33,000, meaning that bitcoin has appreciated almost 100 percent since the previous record of options expired.

Options-open interest for bitcoin has soared this year, more than doubling since the end of last year, up from about $5 billion to now nearing $14 billion. In options, there are calls (bets that price will rise) and there are puts (bets that price will fall). In aggregate, the market is leaning bullish, with a current call-to-put ratio at 1.11. Anything above one is bullish, meaning at a ratio of 1.18, the market is leaning 11 percent in favor of more upside to come.

Put options seem to be targeting the $40,000 range and the $47,500 range, while call options expiring on Friday are eyeing the $60,000 range.

If the past is any indication of what is to come, this should entail some short-term volatility, but ultimately more upside in the coming weeks following expiry.

This is a guest post by William Clemente III. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.