- November 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

Recent CryptoSlate analysis revealed a significant shift in the crypto market sentiment influenced by profitable Bitcoin withdrawals from exchanges.

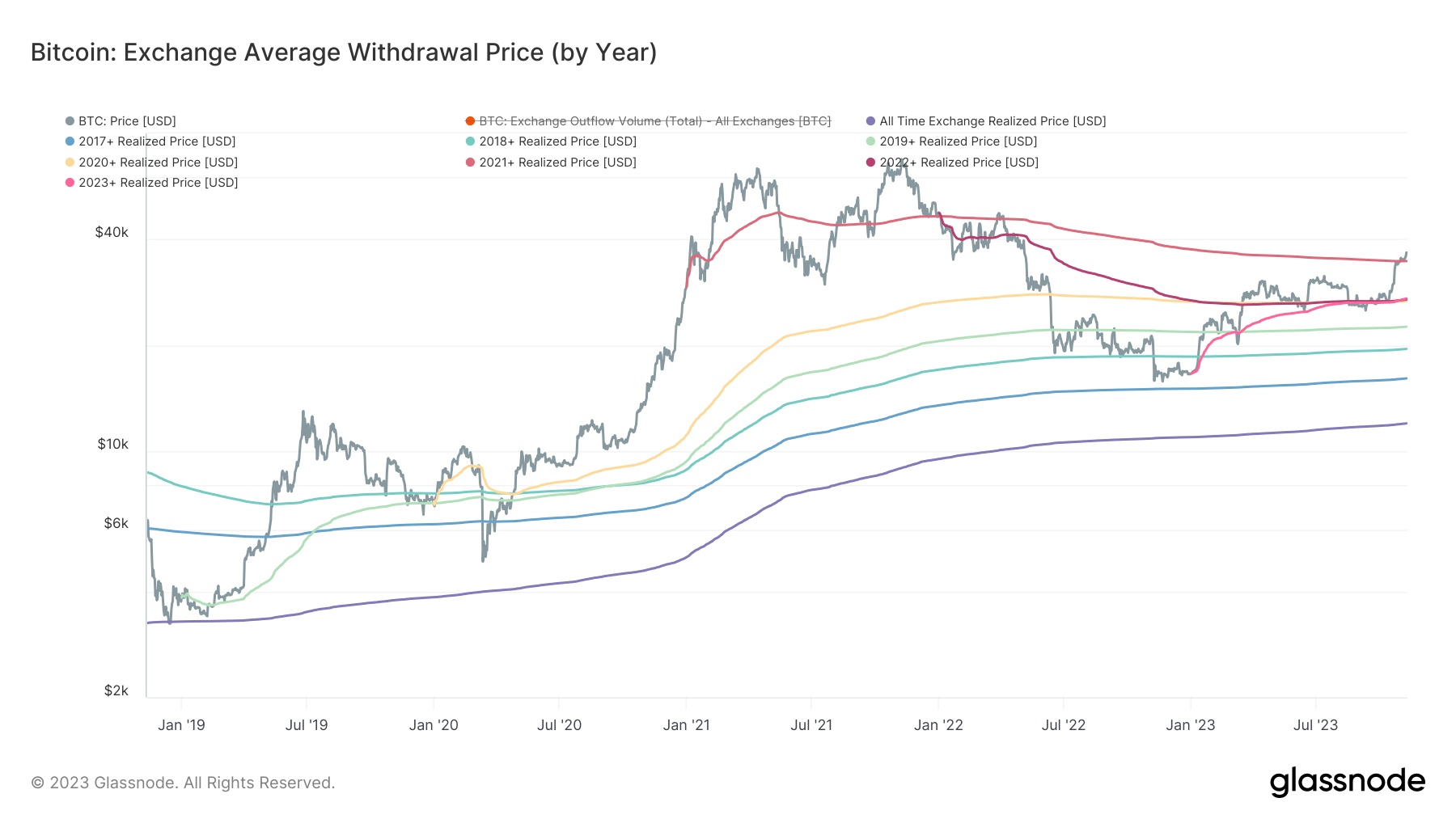

The average withdrawal prices for cohorts categorized by date paint an intriguing picture of the market-wide cost basis. The all-time average withdrawal price stands at $12,003, escalating gradually with every passing year and reaching $34,706 in 2021. A noteworthy observation is this is the first instance since October 2021 that all yearly cohorts have been in profit.

| Year | Realized Price |

|---|---|

| All-time | $12,003 |

| 2017+ | $16,109 |

| 2018+ | $19,540 |

| 2019+ | $22,590 |

| 2020+ | $26,693 |

| 2021+ | $34,706 |

| 2022+ | $27,001 |

| 2023 | $27,198 |

Table showing the realized price for cohorts categorized by date from 2017 to 2023 (Source: Glassnode)

The 2021 cohort, which previously realized a price of almost $50,000, has successfully dollar-cost averaged its realized price to $34,706. This indicates a strategic shift from unrealizing or realizing losses to recording profits or unrealized profits. This trend has resulted in a massive transformation in market sentiment, with holders now more inclined towards profit-taking.

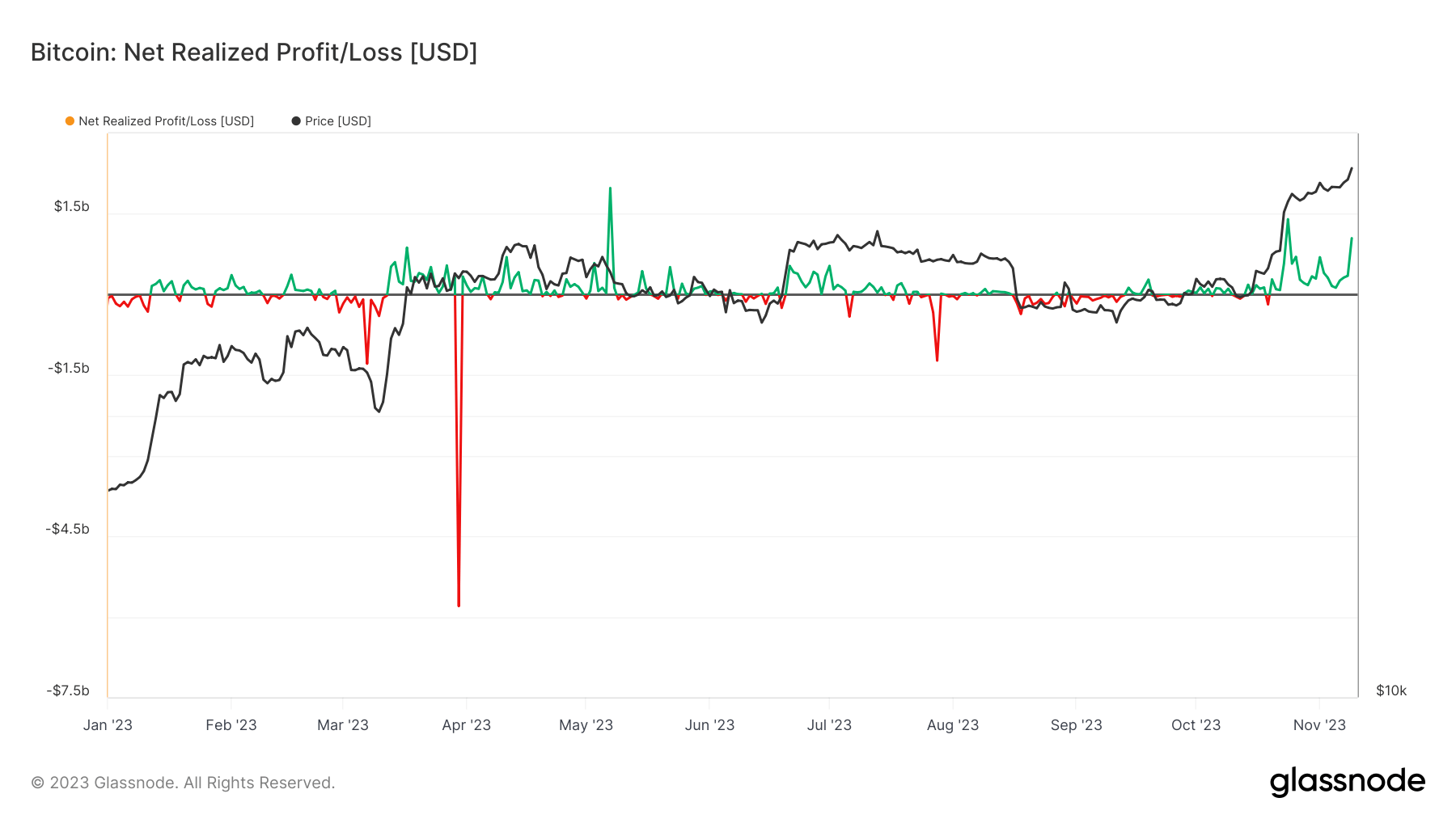

Despite Bitcoin’s significant leap to $38,000 on Nov. 9, only $1 billion of profit was realized. This may seem marginal compared to the bull market of 2021, but consistent profit-taking over the past few weeks suggests that investors’ appetite for higher gains remains strong.

The post All Bitcoin cohorts are in profit for the first time since October 2021 appeared first on CryptoSlate.