- January 14, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The cryptocurrency market is facing a sharp downturn, with Bitcoin (BTC) hitting fresh lows of around $90,000 on the daily timeframe. This marks a critical moment for the market leader, as BTC hasn’t traded at this level since late November. The steep drop has fueled concerns among investors, particularly as market sentiment shifts toward caution following weeks of volatility.

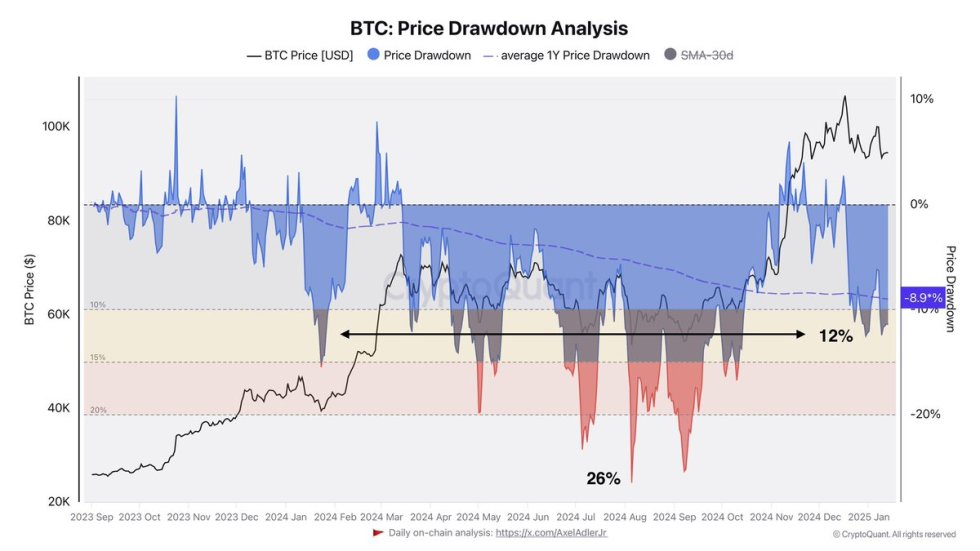

Top analyst Axel Adler has provided key insights into BTC’s price behavior during this challenging phase. Adler shared data revealing that the average Bitcoin drawdown this year has been 8.9%, underscoring the asset’s typical fluctuations. However, during the current consolidation phase, the drawdown has expanded to 12%, signaling intensified selling pressure.

This consolidation phase is testing BTC’s resilience as it grapples with broader market uncertainties. While the $90K mark represents a crucial support level, the current sentiment is mixed, with bulls aiming for a recovery and bears eyeing further downside potential. The next few days will be pivotal in determining whether BTC can stabilize or faces continued declines.

With investors and analysts closely monitoring key metrics and support zones, the market remains on edge, awaiting signals for Bitcoin’s next major move. Will BTC rebound or test deeper levels? The coming days will be critical.

Bitcoin Experiences Key Consolidation Phase

Bitcoin has faced significant bearish price action since reaching an all-time high of $108K. The steep decline has led many analysts and investors to speculate that the cycle’s top has already been reached. However, such conclusions could be premature. Key on-chain data suggests that Bitcoin’s recent movements may signal the end of its current consolidation phase, potentially setting the stage for a new rally.

Top analyst Axel Adler recently shared insightful metrics on X that provide context for Bitcoin’s behavior this year. Adler noted that the average Bitcoin drawdown in 2025 stands at 8.9%. However, during the ongoing consolidation phase, the drawdown has increased to 12%, reflecting intensified short-term selling pressure.

While this may seem concerning, historical data paints a more optimistic picture. During Bitcoin’s previous major consolidation phase, the maximum drawdown reached 26% before the asset reversed into a massive rally.

These patterns suggest that BTC may be nearing the end of its current consolidation phase. If the $90K support level holds firm, it could signal the beginning of a strong upward trajectory, potentially driving BTC to new all-time highs.

With current market conditions and metrics aligning, investors are closely monitoring for signs of reversal. Should BTC break out of this consolidation with renewed buying momentum, it could dispel fears of a cycle end and reignite optimism for another bullish run.

BTC Tests Crucial Support Amid Bearish Pressure

Bitcoin is trading at $90,700 following a sharp decline from local supply levels. Bears currently maintain control of the price action, driving BTC closer to critical support at $87,000. This level is pivotal as a failure to hold above it could lead to further downside pressure, potentially extending the ongoing bearish trend.

For bulls to regain momentum and alter the market narrative, holding the $90,000 level is imperative. A rebound from this level would indicate resilience and set the stage for a potential recovery. However, to signal a genuine trend reversal, BTC must break above the $92,500 mark. Reclaiming this level would not only invalidate the current bearish structure but also restore confidence among investors.

The next few days are expected to bring heightened volatility as market participants respond to BTC’s test of key levels. This period will likely determine the short-term direction of the asset. Despite the current bearish sentiment, many analysts remain optimistic about BTC’s performance in 2025, with expectations of a bullish trend dominating the year.

Investors are closely watching for signs of strength, as a decisive move could set the tone for BTC’s price action in the weeks ahead.

Featured image from Dall-E, chart from TradingView