- December 8, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

In a notable development in the Bitcoin mining arena, an uptick in miner fees was observed by CryptoSlate yesterday.

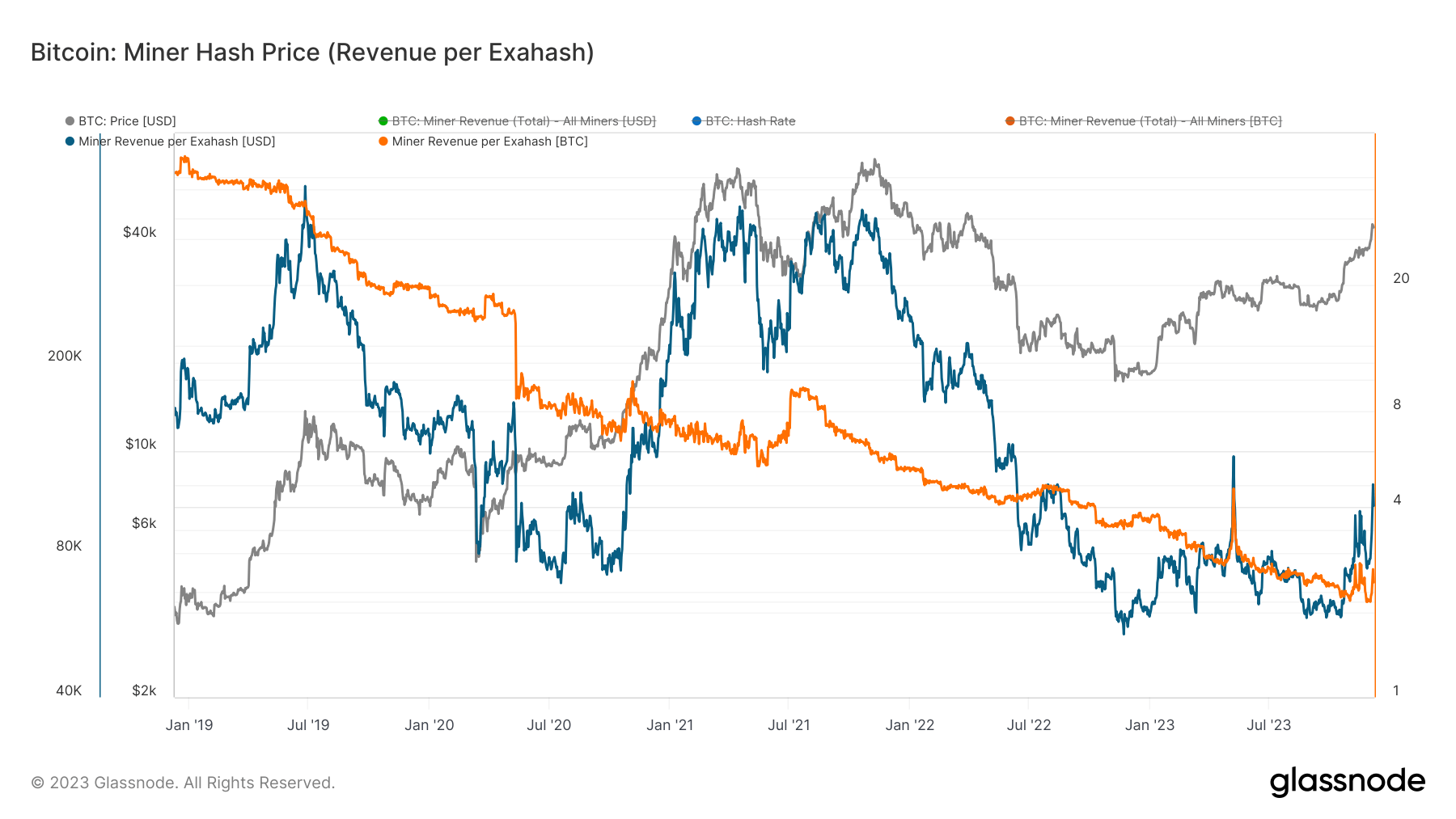

Miner revenue per Exahash, a metric applied to estimate the daily income of miners in relation to their network hash-power contribution, has experienced a significant surge. This metric, calculated by the ratio of total miner income (in USD or BTC) to the current hash rate, indicates the daily revenue per 1 EH/s of hash power a miner contributes to the network.

The long-term trend for miner revenue has generally been downward due to increasing difficulties for miners to remain profitable. In contrast to this trend, since October, there’s been a notable upsurge in hash price, pushing the miner revenue per exahash to one of the highest levels in 2023, standing at 2.53 Bitcoin or $111,000. This figure is only slightly below the May high, driven by the inscription craze.

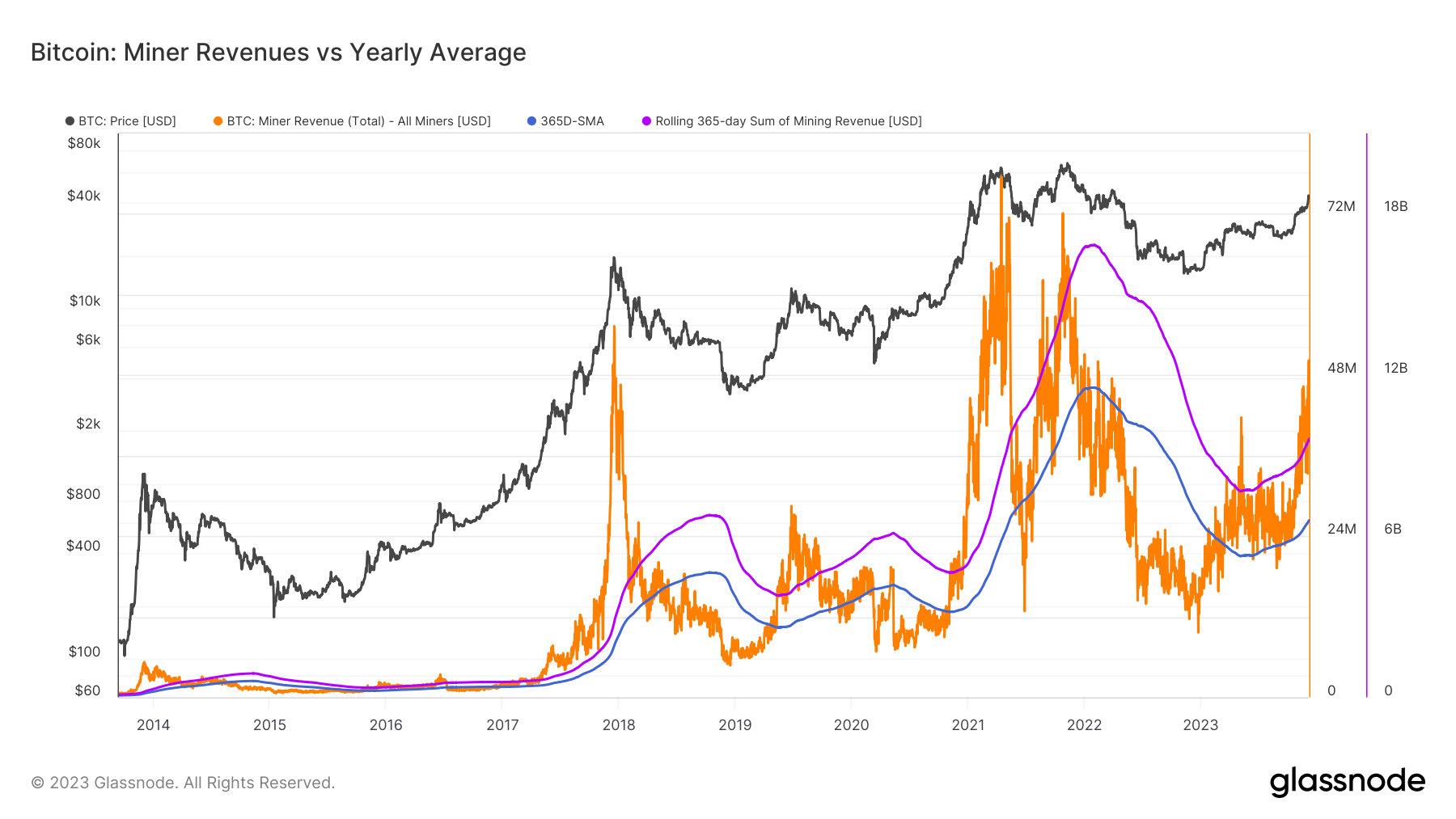

A rolling 365-day sum of miner revenues is considered to assess the industry’s aggregate income. Most recently, the miner revenue peaked at around $50 million ( fees plus newly minted coins.), comfortably above the 365-day simple moving average. This metric, compared with the total daily USD revenue paid to Bitcoin miners, helps gauge daily volatility against the longer-term trend and informs the Puell Multiple oscillator.

During the initial stages of bull markets, it’s common to witness miner revenue soaring above the 365-day moving average of mining revenue, a phenomenon that has already begun to materialize.

The post Bitcoin miner revenue per exahash spikes, nearing yearly high appeared first on CryptoSlate.