- November 27, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Monitoring miner revenue is essential for understanding the health and sustainability of the Bitcoin network. Miner revenue, a combination of block rewards and transaction fees, provides a window into the economic viability of Bitcoin mining. In the context of the upcoming halving, which will slash block rewards by half, the analysis of miner revenue becomes even more pertinent.

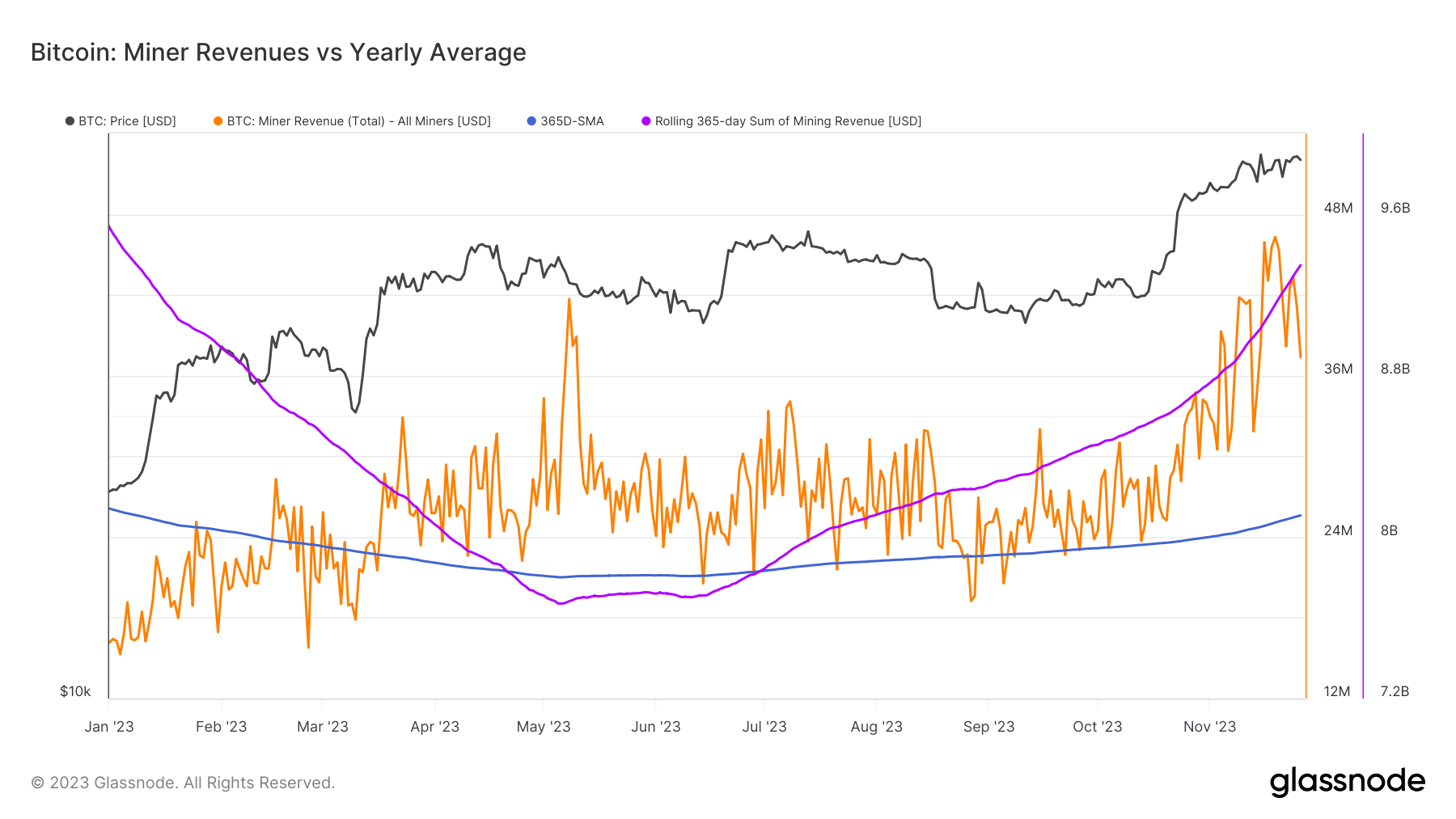

The 365-day Simple Moving Average (SMA) and the 365-day rolling sum are crucial metrics in this analysis. The 365-day SMA smooths out daily revenue fluctuations, providing insight into long-term trends, while the 365-day rolling sum offers a cumulative view of miner revenues over a year. These metrics offer a comprehensive understanding of miner revenue trends, which is crucial for predicting future market movements.

From January to June 2023, the rolling sum of miner revenues decreased from $9.53 billion to $7.7 billion, indicating a period of reduced revenue. This could stem from lower Bitcoin prices, increased mining difficulty, or reduced transaction fees. However, a subsequent increase to $9.34 billion by November suggests a recovery in mining revenue. This fluctuation reflects the volatile nature of the mining industry and its sensitivity to broader market trends.

In contrast, the 365-day SMA of miner revenues shows a more gradual improvement. Rising from $22.12 million in January to $25.6 million in November, this increase, despite a nearly constant rolling sum, indicates recent months have been more profitable for miners. This trend underscores the stabilizing effect of the SMA metric, offering a more nuanced view of the mining landscape.

Total daily USD revenue paid to miners has seen a significant increase over the year, peaking at $46.30 million in November, a 19-month high. This peak, driven by a combination of high Bitcoin prices and increased transaction volumes, suggests a profitable period for miners. The volatility of daily revenues compared to the more stable SMA and rolling sum reflects the inherent unpredictability of the mining sector.

The close tie of mining revenues to the Bitcoin price is evident. As the price increases, so does the profitability of mining, influencing miner sentiment. The reaching of a 19-month revenue high indicates bullish sentiment among miners, potentially leading to increased investment in mining infrastructure.

With the next Bitcoin halving approaching, the surge in the Bitcoin hash rate signals a firm commitment from miners. This increased computational power for transaction processing and block generation indicates a robust and secure network. However, it also implies heightened competition and potential challenges for individual miners.

Furthermore, high transaction fees within the Bitcoin mempool indicate increased network activity and potential congestion. This increase in fees and network usage could impact Bitcoin’s market position, affecting user behavior.

The post Bitcoin miners see 19-month high in revenue as halving nears appeared first on CryptoSlate.