- May 28, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Japanese “Bitcoin-first” firm Metaplanet just lifted its treasury to 7,800 BTC (≈$842 million) after a $50 million purchase. It has now overtaken El Salvador as Asia’s largest corporate holder.

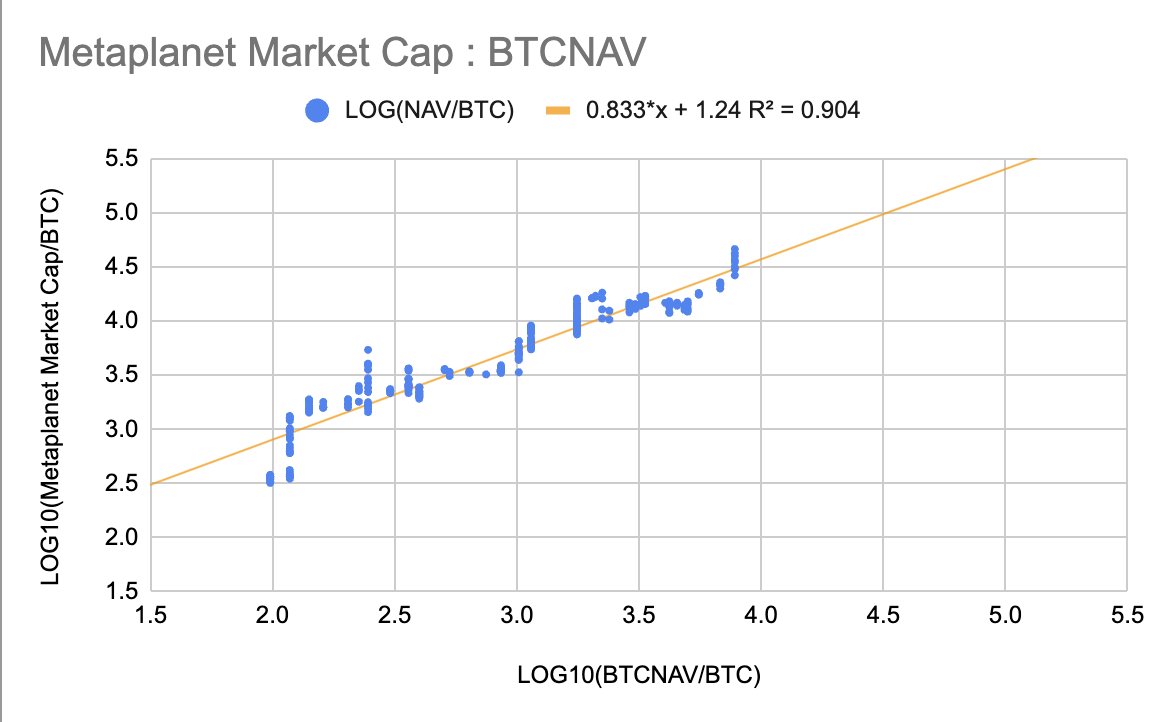

On X, Metaplanet investor TakaAnikuni applied a power-law fit that links a company’s BTC-denominated Net Asset Value (BTC NAV) to its equity market cap:

mNAV ≈ e[(0.89 – 1) ln (BTC NAV) + 4.11]

For today’s stack, the model outputs an mNAV multiple of 3.75-4.0, while Metaplanet’s site quotes 3.25, implying the stock trades 15-20 % below power-law “fair value”. The table he published shows the multiple compressing as holdings scale, mirroring Strategy’s trajectory, where size dampens premium.

Why it matters:

- Re-rating potential. Even with multiple compression, doubling BTC every two months, as Metaplanet has since January, projects ≈15 k BTC by early August, which the model pegs at a still-healthy mNAV ~3.5, lifting implied equity value ~40 %.

- Fuel in the tank. Metaplanet continues to issue bonds and warrants to finance buys, signalling management is committed to the accumulation flywheel.

- Retail froth check. After a 1,560 % Y/Y rally, the share closed today at ¥1,222, yet the model suggests room before froth sets in.

Bottom line: Anikuni’s framework offers a quantifiable undervaluation thesis and a handy lookup table that could resonate with both equity and crypto-native audiences as Metaplanet races toward five-digit BTC holdings.

The post Bitcoin Power-Law model points to 40% gain in Metaplanet stock – Here’s why appeared first on CryptoSlate.