- January 27, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin Magazine

Bitcoin Price Surges Near $90,000 as Trump Downplays Dollar Decline, Gold Hits New Record

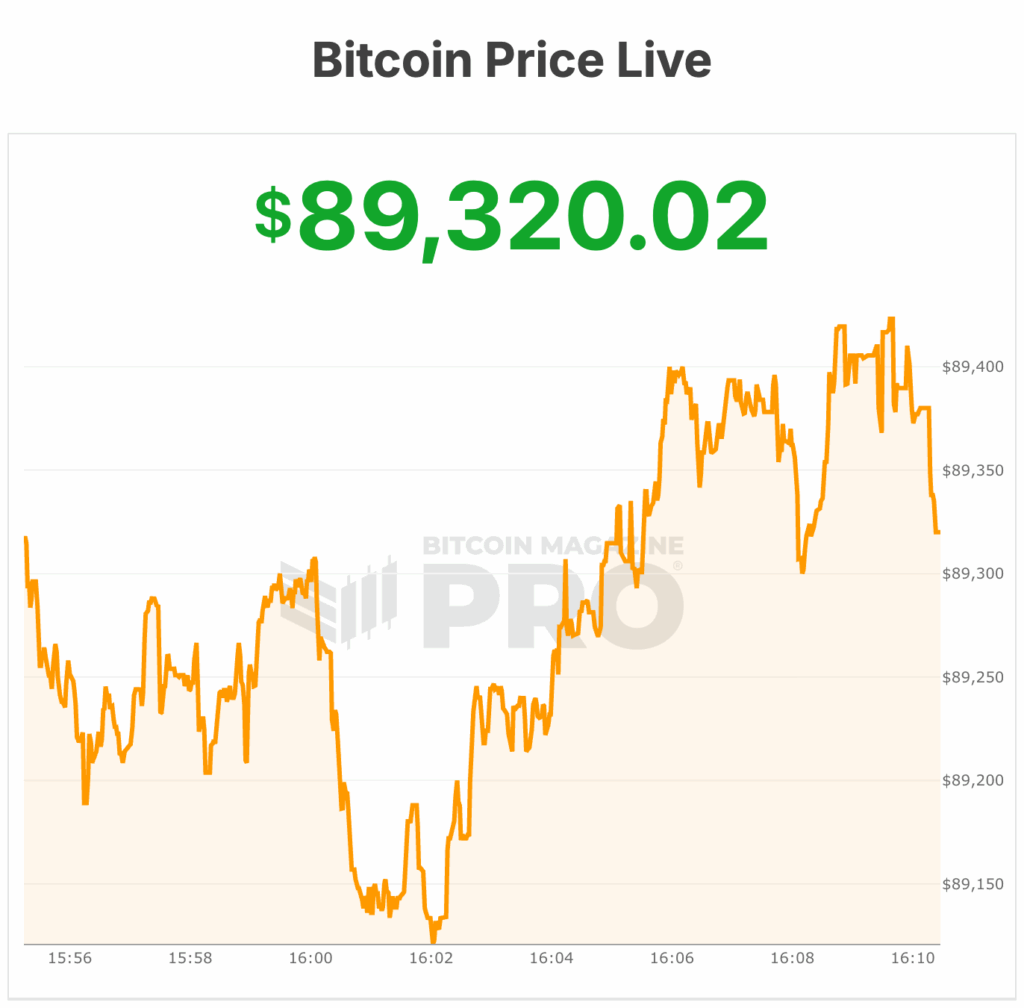

The bitcoin price rallied sharply into the close on Tuesday, surging above $89,400 after trading as low as $87,100 earlier in the day, according to Bitcoin Magazine Pro data, as markets reacted to fresh remarks from President Donald Trump on the U.S. economy.

The late-day move came as Trump, speaking in Iowa, dismissed concerns over the weakening U.S. dollar, telling supporters he was “not concerned” about its decline and insisting the dollar was “doing great.” The comments triggered an immediate reaction across markets, with the dollar sliding further and alternative stores of value catching a bid.

Gold climbed to a new all-time high of $5,223 per ounce at the time of writing, underscoring growing demand for hard assets amid mounting currency uncertainty.

The bitcoin price appeared to benefit from the same macro tailwinds, reversing earlier caution that had dominated trading following last weekend’s dip to $86,000.

The rally marks a notable shift in sentiment after bitcoin spent much of the past 24 hours struggling to reclaim the $88,000 level amid Federal Reserve uncertainty, ETF outflows, and lingering bearish technical pressure.

Monday’s breakout above $89,000 suggests buyers are reasserting control in the near term, though markets remain highly sensitive to macro signals as the Federal Reserve’s policy decision looms later this week.

At the time of publication, Bitcoin price traded at $89,320 today, up 2% over the past 24 hours, with $43 billion in daily trading volume. The asset’s circulating supply stands at 19,981,268 BTC, out of a fixed 21 million maximum.

Bitcoin mining stocks soaring along with bitcoin price

Bitcoin miners that have pivoted toward artificial intelligence and high-performance computing (HPC) infrastructure are roaring up near 10% on Tuesday, as investors continue to reward diversification beyond traditional mining revenues.

IREN ($IREN) and Cipher Mining ($CIFR) are each up more than 13%, while Hut 8 ($HUT) and TeraWulf ($WULF) are posting gains around 10%, extending a broader rally across the mining sector tied to AI-adjacent exposure.

The move comes as markets increasingly view large-scale miners as power and data-center plays rather than pure Bitcoin proxies, particularly in the wake of tighter post-halving economics.

Companies like Cipher, IREN, Hut 8, and TeraWulf have spent the past year repositioning excess capacity toward long-term AI and HPC hosting contracts, which offer steadier cash flows and higher margins than block rewards alone.

This post Bitcoin Price Surges Near $90,000 as Trump Downplays Dollar Decline, Gold Hits New Record first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

President Trump says he "doesn't think the dollar declined too much."

President Trump says he "doesn't think the dollar declined too much."