- April 29, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

MicroStrategy reported first quarter revenues of $122.9 million and its equity has increased 385.59% since it adopted a Bitcoin standard.

MicroStrategy (NASDAQ: MSTR) reported its quarterly earnings after market hours today, which emphasized its focused corporate strategy and the benefits of its ongoing Bitcoin standard, first adopted on August 11, 2020.

“MicroStrategy’s first quarter results were a clear example that our two-pronged corporate strategy to grow our enterprise analytics software business and acquire and hold bitcoin is generating substantial shareholder value,” per the report.

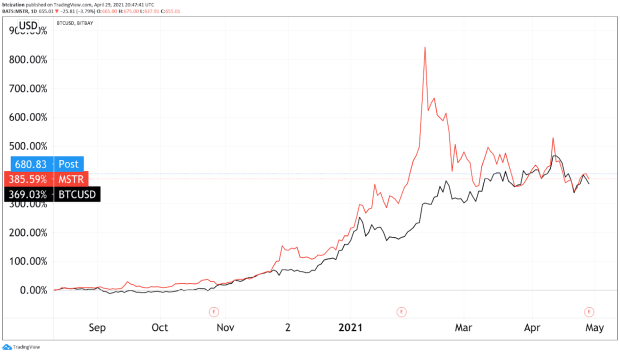

Since shifting to a Bitcoin standard, MSTR equity has increased 385.59%, while the price of BTC has increased 369.03% in the same time frame.

MSTR reported first quarter revenues of $122.9 million, a 10.3% increase, or a 7.6% increase on a non-Generally Accepted Accounting Principles (GAAP) constant currency basis, compared to the first quarter of 2020, while also reporting a gross profit of $100.4 million. Gross margins for the company came in at 81.7% compared to a gross margin of 78% in the first quarter of 2020.

During the first quarter of 2021, MSTR purchased approximately 20,857 bitcoin, at an aggregate purchase price of $1.086 billion and an average purchase price of approximately $52,087. A vast majority of these purchases were enabled by $1.05 billion of 0% convertible senior notes, which were issued in February of this past quarter. The convertible notes are due in the year 2027 and do not bear regular interest. The notes hold the optionality to be convertible into shares of MicroStrategy’s class A common stock at conversion price of $1,432.46 per share. A classic example of a speculative attack, MicroStrategy’s move to leverage 0% yielding debt to acquire bitcoin presented a masterclass in using soft money obligations to acquire hard money assets.

At the conclusion of the first quarter, MicroStrategy had cash and cash equivalents of $82.5 million, as compared to $59.7 million as of December 31, 2020. The company’s bitcoin holdings are technically accounted for as intangible assets according to GAAP standards, which necessitates that the company’s holdings be marked to market in the case of a downturn in the price of bitcoin.

As of April 28, 2021, MicroStrategy is currently holding approximately 91,579 bitcoin, having added an additional 253 bitcoin over the course of the second quarter. Going forward, MicroStrategy will continue to operate under a Bitcoin standard, showing public companies the benefits of operating a business on a sound monetary standard.