- November 13, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

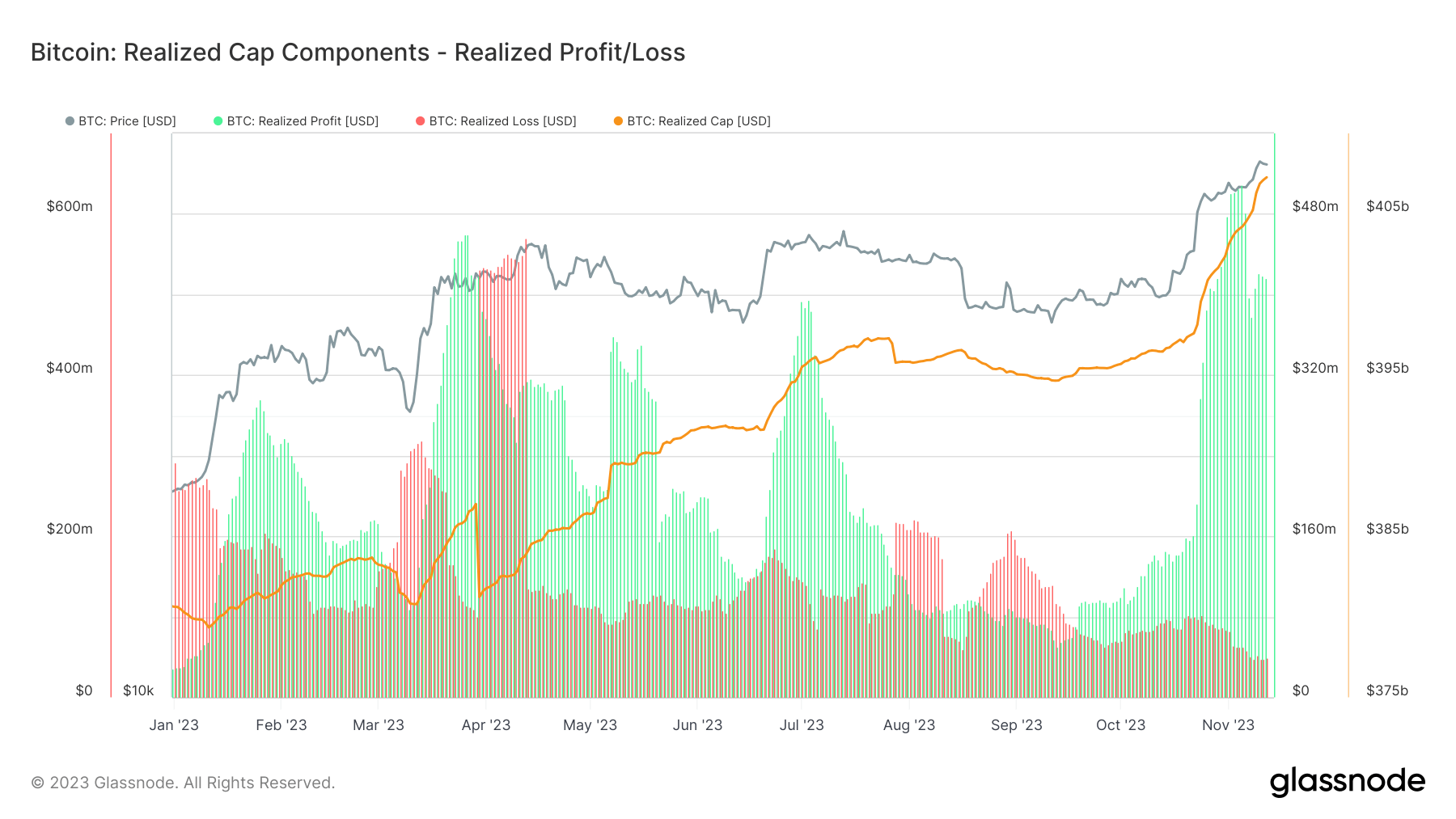

Realized cap offers a unique perspective on market behavior, representing the flow of capital in and out of Bitcoin (BTC). The realized cap is calculated by applying price stamps to each Bitcoin at the time of its last transaction, offering a more nuanced view of the market value than the traditional market cap.

At the beginning of the year, Bitcoin’s realized cap stood at $380 billion, with its price hovering just under $17,000. By Oct. 13, 2023, the realized cap increased to $396 billion, alongside a price rise to $26,800.

By Nov. 12, BTC had surged to $37,000, and the realized cap reached $407 billion, indicating a significant inflow of capital into Bitcoin.

The shift in realized profits and losses provides insight into market sentiment. While realized profits have been outpacing realized losses since mid-September, it wasn’t until Oct. 26 that the difference between them increased almost fivefold.

The year-to-date high for realized profits was recorded on Nov.5, with Bitcoin holders taking over $509 million in profits. This contrasts with the average daily realized losses, which have been declining, dropping from around $80 million in mid-October to $49 million on Nov. 12. On the same day, realized profits stood at a robust $416 million.

The increase in realized profits indicates that investors are finding lucrative exit points, while the decrease in realized losses points to a reduction in panic selling or distressed exits from the market. This trend is further bolstered by the upcoming Bitcoin halving in April 2024, an event historically associated with a tightening of Bitcoin supply and subsequent price appreciation.

Assessing the available supply also provides context to these trends. With the short-term holder supply at multi-year lows and a significant portion of the supply being classified as illiquid, it is evident that a substantial portion of Bitcoin is being held for the long term. This shift towards long-term holding, especially among institutional investors and through products like GBTC, underscores a maturing market and a growing recognition of Bitcoin as a store of value.

The decline in realized losses and the increase in realized profits indicate a market less prone to panic and more driven by strategic decisions. As the next halving approaches, the market will likely witness further tightening of supply, potentially leading to increased valuations and more profit-taking.

The post Bitcoin’s realized profits surge as market braces for 2024 halving appeared first on CryptoSlate.