- October 21, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

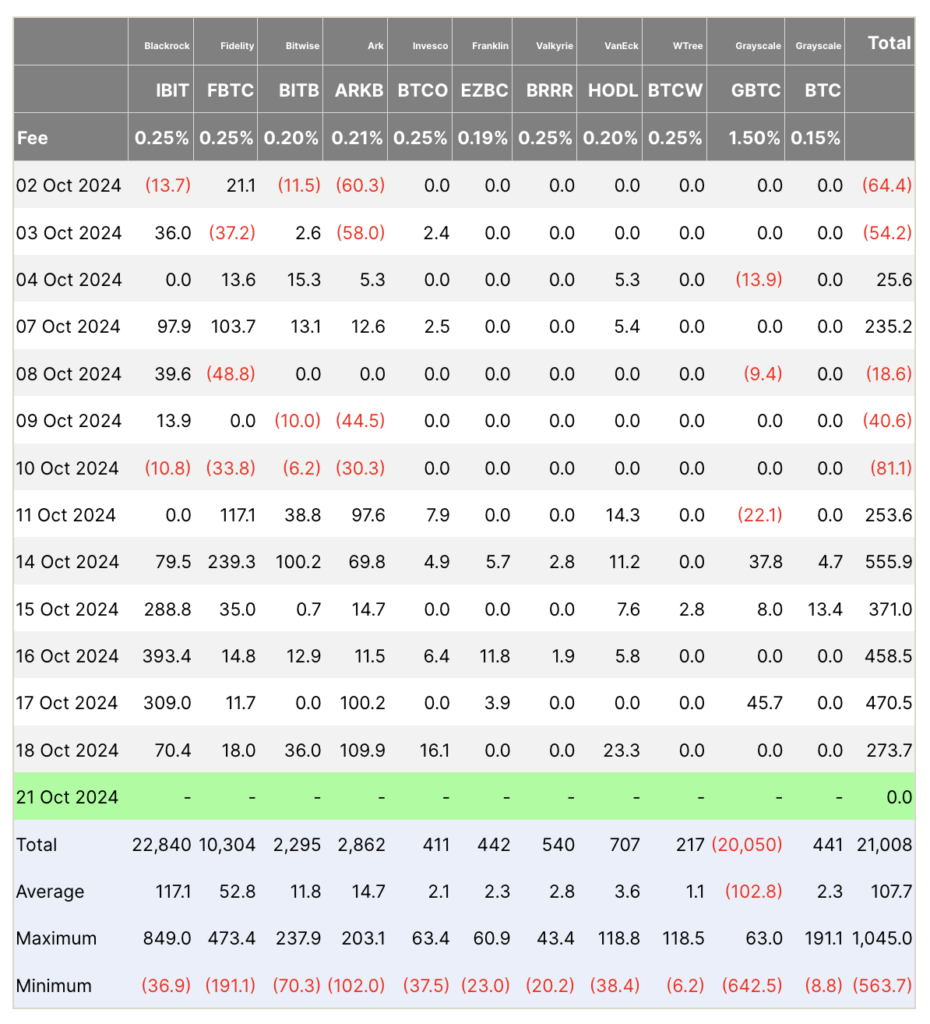

iShares Bitcoin Trust ETF (IBIT) recorded over $1.1 billion in new cash inflows last week, marking its strongest performance since March 2024. Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, shared the data, highlighting IBIT’s rapid ascent in the ETF landscape.

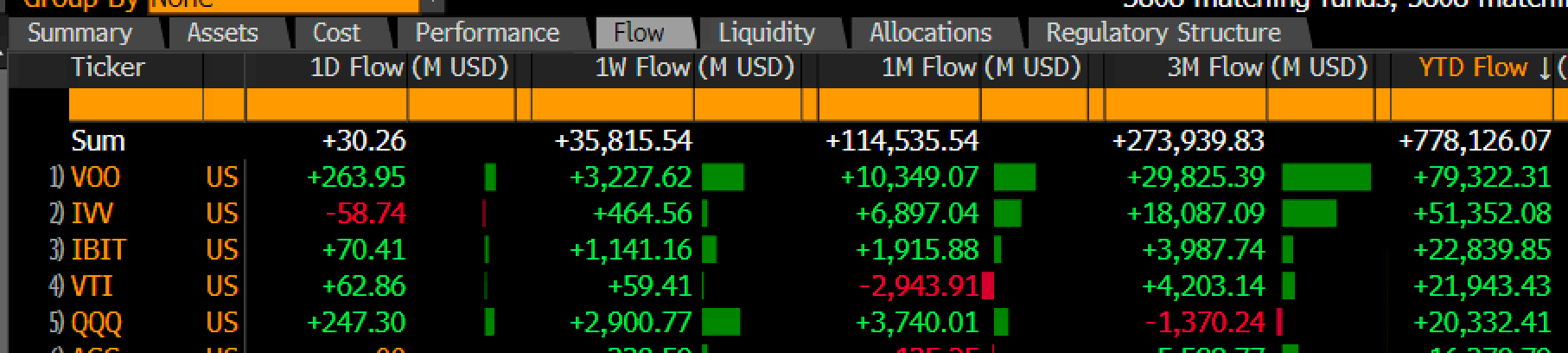

IBIT surpassed Vanguard’s Total Stock Market ETF (VTI) to secure the third spot in year-to-date flows. This achievement is notable given that IBIT launched only in January 2024, while other top ETFs have been established for over two decades and manage assets exceeding $300 billion.

The fund’s total assets under management now stand at $22.8 billion, placing it in the top 2% of all ETFs by size. This growth reflects a strong investor appetite for Bitcoin exposure through traditional investment vehicles. As one of the first spot bitcoin ETFs approved in the US, IBIT offers a familiar structure for investors seeking to enter the crypto market.

Several factors contribute to IBIT’s success: BlackRock’s reputation as the world’s largest asset manager, increasing mainstream acceptance of Bitcoin, and the convenience of the ETF format. The substantial inflows suggest that crypto-based ETFs are gaining significant traction in the broader investment community.

Balchunas’ insights emphasize IBIT’s impact across the entire ETF industry. The fund’s performance denotes a shifting landscape where digital assets are becoming integral to diversified investment portfolios.

The post BlackRock’s Bitcoin fund IBIT hits top 3 US ETFs by inflow for 2024 appeared first on CryptoSlate.