- June 26, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

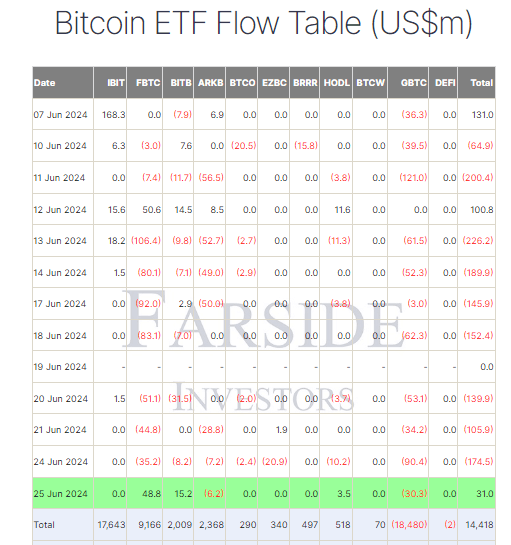

Farside data shows that on June 25, Bitcoin (BTC) exchange-traded funds (ETFs) experienced the first net inflow since June 12, with $31.0 million entering the market.

Fidelity’s FBTC led the charge with a $48.8 million inflow, raising its total net inflow to $9.2 billion. Bitwise’s BITB also saw a notable inflow, attracting $15.2 million and bringing its total net inflow to $2.0 billion. In contrast, Grayscale’s GBTC struggled with outflows, losing $30.3 million and pushing its total outflow to $18.5 billion. According to Farside data, the total net inflows to BTC ETFs now stand at $14.4 billion.

Interestingly, BlackRock’s IBIT ETF recorded no net inflows or outflows, yet its trading volume surged to $1.1 billion, according to Coinglass data. For comparison, GBTC only managed a volume of $341 million, placing IBIT at number 18 overall in trading volume among all US ETFs. This raises speculation about IBIT’s potential to become a key institutional basis trade Bitcoin ETF, given its robust trading activity despite the absence of net inflows or outflows.

The post BlackRock’s IBIT trading volume surges to $1.1 billion despite no inflows appeared first on CryptoSlate.