- May 15, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

For the first time since its direct listing on the NASDAQ this April, crypto exchange Coinbase published its first quarter earnings.

In its earnings call, Coinbase announced that it had seen tremendous results since its public debut. “The wind is in our sails right now, and it feels good,” the investor letter read.

The exchange saw its revenue and net income surge thanks to the recent boom in crypto markets and interest from institutional and retail investors. The results were largely in line with the estimates that Coinbase reported before its public debut.

Coinbase Earnings Growth in Line with Pre-Listing Report, Misses Top and Bottom Line

It also reached $335 billion in total trading volume, which was also a metric that was projected in the estimated report. This marks an approximate 300% increase from $90 billion from last quarter. In terms of breakdown, $120 billion came from retail activity, with the other $215 billion coming from institutions.

As Bitcoin, Ethereum, and other altcoins surged to new highs, exchanges saw an influx of volume and users. Coinbase, in particular, reported an increase of 13 million verified users. Last quarter, the exchange touted 43 million users — which has now grown to over 56 million. Its monthly transacting users grew by 217%, from 2.8 million to 6.1 million.

Potential Headwinds for the Exchange

Despite the strong quarter, Coinbase warned its investors that increasing competition may pose potential challenges:

“Our competitors are supporting certain crypto assets that are experiencing large trading volume and growth in market capitalization that we do not currently support, as well as offering new products and services that we do not offer. We welcome these challenges as they indicate that the market we serve is growing rapidly, but we also have to continue to move quickly to address them, and that inspires us towards action and growth.”

Coinbase’s commission fees, which account for the majority of the exchange’s revenue, are significantly higher than its competitors. When asked, CFO Alesia Haas reiterated that its fees will remain high: “We’re not trying to win on fees. We’re not trying to compete on fees. We’re competing on being the most trusted,” she said.

Dogecoin?

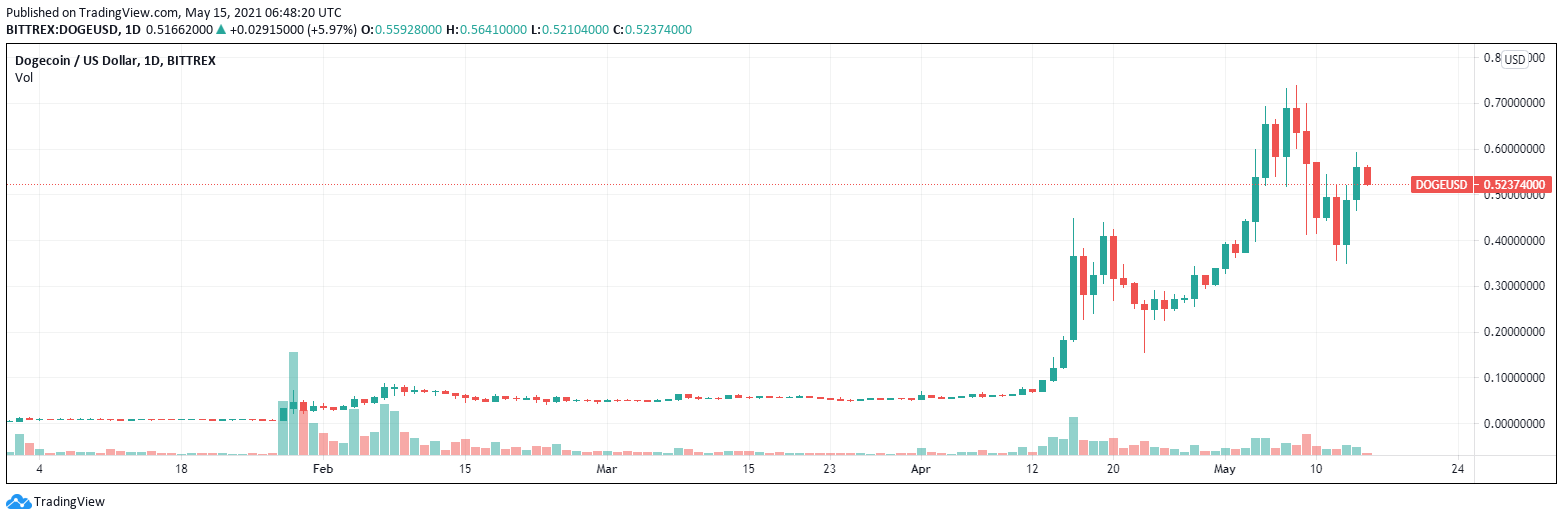

As the dog-themed meme cryptocurrency Dogecoin surged 10,000% this year and attracted millions of new users, other exchanges and competitors swiftly capitalized on the action by adding DOGE.

Coinbase, on the other hand, has yet to have added support for Dogecoin. In the earnings call, CEO Brian Armstrong addressed this by promising to add the meme coin by summertime: “We’re putting a lot of work and thought into how to accelerate our asset onboarding, including DOGE.”

Featured image from UnSplash