- May 3, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

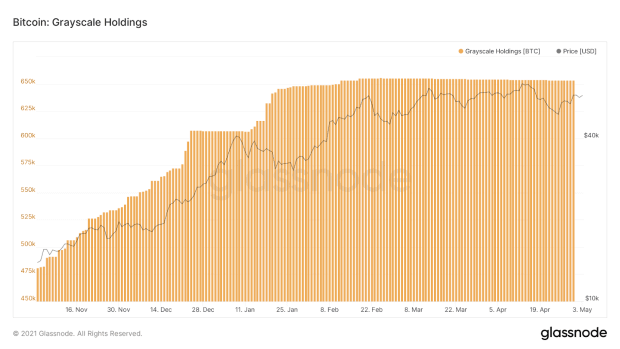

Grayscale’s parent company authorized up to $750 million in GBTC purchases as the trust’s shares continue to trade at a discount to NAV.

Earlier today, Digital Currency Group, the parent company of Grayscale Investments, announced that it had authorized up to an additional $750 million worth of the Grayscale Bitcoin Trust (GBTC) to be purchased by the company. This is an increase of $500 million compared to an authorization by DCG announced last month.

As of April 30, the parent company has purchased $193.5 million worth of GBTC shares, in an apparent attempt to bring the discount between GBTC’s shares and its net asset value (NAV) back to zero.

With many funds executing the cash and carry trade over the past year, and easy access to bitcoin products still very much lacking in the legacy financial system, GBTC exponentially grew in size as the “risk free” yield opportunity presented quite an allure to investors looking to capture yield, who could redeem shares at NAV directly from Grayscale.

Now, with the premium to NAV deep in negative territory, and with newly issued shares of the trust locked from six months before being able to be traded on the secondary market, these arbitrageurs are underwater.

At the time of writing, GBTC is trading at a -12.07% discount to NAV, as seen on https://bitbo.io/.