- January 30, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

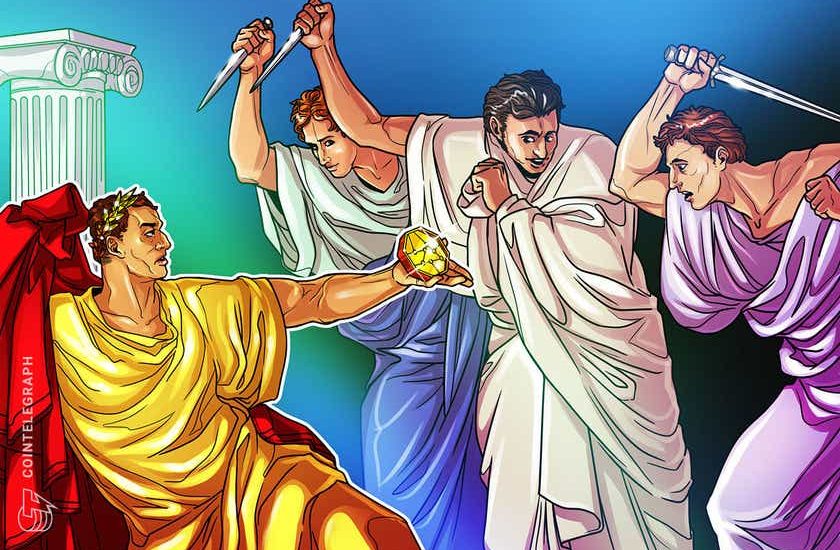

As Venezuela and Iran find themselves caught up in the cryptocurrency revolution, could this have saved the Roman Empire from crumbling into infighting and crippling inflation?

Two currency crises two thousand years apart. Modern-day Venezuela and the Roman Empire have more in common than you might think. Both know too well the dangers of soaring inflation and a collapse in investor confidence. But, only one has crypto on its side.

Venezuela’s official currency, the bolívar, has suffered from hyperinflation for half a decade due to repeated currency devaluations, minimum wage rises and significant public spending increases.

For a sustained period of several centuries, the Roman Empire enjoyed the enormous trade and commercial benefits associated with the world’s first fiat currency, as explored in my book Pugnare: Economic success and failure. The Roman currency was comprised of three coins: gold (Aureus), silver (Denarius) and copper or brass coins (Sestertius and Dupondius). Crucially, and despite fluctuations in the value of the underlying metal, the exchange rate between them was fixed by imperial decree.

This seemingly simple financial innovation brought with it untold wealth and commercial opportunity to the citizens of the Roman Empire, leading to the transition of Ancient Rome from an empire dependent largely on the spoils of war and imperial conquest to one founded on trade, commerce and free enterprise.

Just as with modern currencies, it was underpinned by a sophisticated banking system, which allowed goods to be bought and sold without the physical transfer of tonnes of precious metal. Most of their money was also like ours: created by banks out of thin air when they made loans. Just like modern economies, the majority of Rome’s money supply was held in bank deposits rather than cash in circulation. Though modern-day electronic transactions are faster, whether you use a graphics card or a horse and cart, the process is much the same.

Much like modern-day Venezuela, irresponsible public spending and currency debasement in the empire led to soaring inflation, a collapse in investor confidence and an abandonment of the consumer trust that underpinned the exchange rate innovation. But, if the Romans, paralleling the citizens of Venezuela today, traded in their Aureus for Ether (ETH) or if the government had set up a “digital denarius,” could the empire have survived?

Related: Gold, Bitcoin or DeFi: How can investors hedge against inflation?

Centuries apart, Rome and Caracas face the same menace: Hyperinflation

From the time of Emperor Philip the Arab (244 AD to 249 AD), the system of fixed exchange broke down. Every day, commercial activity became more difficult because of the variable rate of exchange. The equivalent effect would be if ten one-dollar bills were worth a ten-dollar bill one day then a five-dollar bill the next. Citizens no longer knew the value of their money. Economic activity declined.

This was a dramatic fall from grace for the world’s first government-controlled currency, which had been in use to pay for goods from Britannia to Judaea to Africa Proconsularis.

Unlike their Roman forebears, digital currencies have offered the citizens of Venezuela an innovative solution. They can circumvent the bolívar by adopting cryptocurrencies such as Bitcoin (BTC), Ether, Dash (DASH) and EOS (EOS), to the extent that the government introduced its own, the petro, in 2018. Iran is hoping to use the profits from a booming cryptocurrency mining sector to bolster its economy while still under siege from United States sanctions.

Related: US sanctions strategy and crypto: The cracks are showing in Iran

Turning to cryptocurrency was, despite the many technological and societal advancements they made, not an option available to the Romans. Instead, the Roman currency collapse led to a decline in economic activity, delivering economic destitution to once prosperous regions and triggering the start of a long and slow economic decline from which it would never truly recover.

Romans could have made a mint from crypto

Cryptocurrency would also have relieved the Romans of having to maintain a mint as well. It eventually became more and more difficult for the Romans to source the gold and silver to make new coins, so the government cheated by increasing the amount of base metal. This led to inflation which eventually made people lose trust in the money they held.

The breakdown in trust was worsened by a civil war in 193 AD that led to key currency reforms which had centralized control of the currency being abandoned. Once that control was lost, manufacturing and trade went into decline.

Like Venezuela, soaring inflation, a loss of confidence in government and civil unrest led to a collapse in the banking system and, finally, full-scale economic collapse. But, unlike the Romans, the decline of centralized currency offers a possible route out of economic decline for Venezuela, not the slow nail in the coffin it was for the empire.

Cryptocurrency is used by Venezuelans for everything from hotel bookings to pizza deliveries. While President Maduro’s government released the Petro, crypto has also been used against them. Maduro’s rival, National Assembly President Juan Guaidó, has used the stablecoin USD Coin (USDC) to circumvent Venezuela’s banks and send humanitarian aid to healthcare workers.

Power over the empire’s monetary supply was often contested between rival factions. For example, during the civil war of 193 AD, a new mint was opened in what is now Turkey and used by rival claimants to the imperial throne, Niger and Septimius Severus. In contrast, Emperor Vespasian was able to maintain a period of peace and stability between AD 69 and 79, partly because he recognized that he must control the money supply, especially the mints.

Roman cryptocurrencies could have survived to modern times

Governments in Venezuela, Iran and elsewhere today looking at adopting cryptocurrencies as official currencies should pay attention to the Roman example. It shows how badly things can go wrong if the money supply is controlled by different even rival organizations.

Perhaps if the Romans had not been reliant on physical currency but had instead had access to crypto, maybe it would not have been destabilized by economic collapse and in-fighting.

If so, maybe today the people of Venezuela would not be using Bitcoin or Ether, but instead a digital currency inherited from the time of Nero and Vespasian.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.