- October 25, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

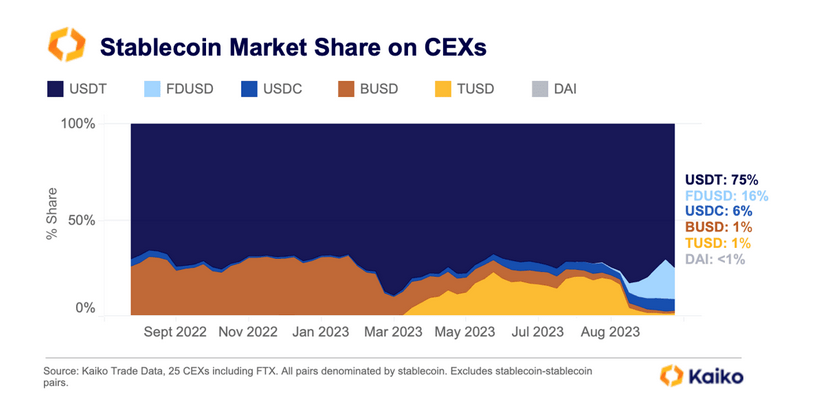

Data from Kaiko, a crypto analytics platform, now shows that a fairly new stablecoin, FDUSD, is proving tough competition for USDT, USDC, and others, looking at its rising dominance in centralized exchanges, mostly Binance. According to Kaiko, FDUSD now has a market share of 16%, more than twice that of USDC, across all centralized exchanges when writing on October 24.

FDUSD Carving More Market Share

At the same time, USDT, the world’s most liquid stablecoin, is the most dominant, with a market share of 75%. USDT was the first stablecoin issued on the Omni Protocol before being released as an ERC-20 token on Ethereum, where it picked up momentum. Currently, USDT is minted on several popular chains, including OP Mainnet, Polygon, and Algorand.

Besides the “little-known stablecoin,” as Kaiko notes, USDC has a market share of 6% across exchanges, while BUSD and TUSD control 1% each. DAI, the algorithmic stablecoin issued by MakerDAO, has less than 1% of the market share.

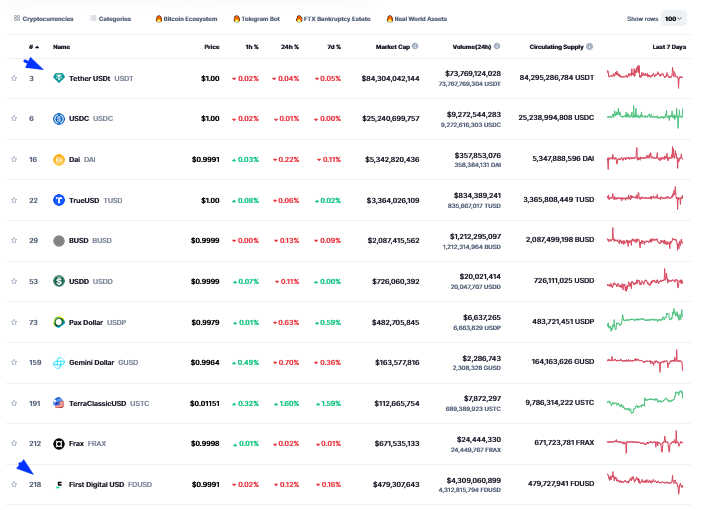

CoinMarketCap (CMC) data on October 24 shows that the total stablecoin market cap stands at over $124.5 billion. USDT has a market cap of $84.3 billion, with USDC at second with $25.2 billion. While FDUSD is the second most popular stablecoin in exchanges, it has a relatively low market cap of $479 million.

The recent surge of FDUSD in crypto exchanges at spot rates coincides with a rapid decline in BUSD. Previously backed by the Binance brand, the New York Department of Financial Services (NYDFS) ordered Paxos to stop minting new BUSD in February 2023, leading to a free-fall. BUSD’s market cap has plummeted from $23.6 billion in November 2021 to $2 billion, even lower than the $16 billion recorded in February 2022.

TUSD, BUSD Fell For FDUSD To Soar

BUSD was core to Binance, the world’s largest crypto exchange before regulators started cracking down on the ramp, leveling several allegations. The United States Securities and Exchange Commission (SEC) has also sued Changpeng Zhao, the CEO of Binance, and the exchange, Binance, for, among other charges, listing unregistered securities and violating securities laws. At the same time, the SEC alleges that BUSD is an unregistered security.

Kaiko, in their assessment, notes that the rise of the new stablecoin coincides with the fall of TUSD. In August, Binance unexpectedly stopped promoting TUSD, opting for FDUSD. There was a zero fee campaign for the BTC-FDUSD pair, a move that trackers said saw the stablecoin’s trading volume surge.

Despite the notable growth of FDUSD, the stablecoin is only listed on Binance. On the other hand, competing tokens, including USDC and TUSD, are available in over ten crypto exchanges.