- October 29, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Welcome to CryptoSlate’s Alpha October Snapshot, your comprehensive guide to the most insightful research, market reports, and revelations from the past month. Our Alpha subscribers are privy to a wide array of topics that are not only enlightening but are also instrumental in shaping investment decisions.

From understanding the intricacies of ETFs and their bearing on paper Bitcoin to diving deep into Bitcoin’s on-chain activities and how it contrasts with its price surge, our October dossier leaves no stone unturned. Explore the enigma of Base’s meteoric growth, decipher UTXOs’ role in Bitcoin’s consolidation, or get a fresh perspective on Bitcoin’s valuation through the active investor price.

CryptoSlate + Access Protocol

Moreover, with the Access Protocol on Solana, all this invaluable content is accessible to our users staking a minimum of 20k ACS tokens to our Access Protocol pool.

Whether you’re keen on the dynamics of the Asian Bitcoin market, the implications of the 10-2 Treasury yield spread, or the U.S. central banking system’s stance on crypto, our Alpha October Snapshot has it all. Stake, unlock, and dive deep into the crypto realm with us.

October α Market Reports

Is Bitcoin decoupling from traditional assets?

In this market report, we explore how Bitcoin’s decoupling from traditional financial benchmarks like the S&P 500 and gold could signal a new era of investment diversification.

What are ETFs and why do they matter?

CryptoSlate’s latest market report dives deep into the concept of ETFs to show why they’re so important for the crypto market.

What is paper Bitcoin and how does it influence price?

CryptoSlate’s latest market report dives deep into the notions of paper Bitcoin and liquid supply to understand their relationship and implications for the Bitcoin market.

October α Research Articles

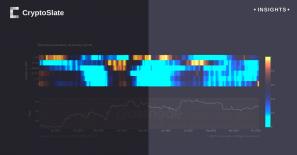

Bitcoin’s price surge not reflected by on-chain activity

In light of reduced on-chain activity, Bitcoin’s recent surge in price may be attributable to speculative trading on exchanges.

Bitcoin options market shows record call open interest and volume

Bitcoin’s price surge is accompanied by historical activity in call options market.

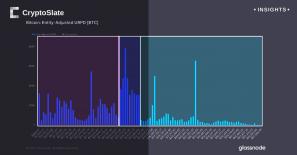

Bitcoin is soaring, and short-term holders are here for the ride

This week’s Bitcoin rally saw short-term holders cashing in and bouncing back.

Understanding the phenomenon of Base

Base’s explosive growth offers a lesson on ecosystem investment and market resilience in the bear season.

Bitcoin data shows a growing trend of dormancy as hodlers remain strong

Bitcoin liquidity crisis looms as hodlers sit tight on historic high supply.

Lightning Network transactions increased by 1,212% in two years

Surge in lightning network transactions and volume underscores maturing second-layer solution.

VIX surges while SPX remains steady: What’s behind the anomaly?

Investors brace as VIX soars in face of SPX slump.

Grayscale’s GBTC: Understanding its premium and market impact

Diving deep into the world of GBTC, its premium and discount on Bitcoin’s NAV, and the effect it has on the crypto market.

Deciphering the role of UTXOs in Bitcoin consolidation patterns

On-chain data shows users might be taking advantage of the calm October market and consolidating their UTXOs.

Diving into Ethereum’s changing supply landscape

Large Ethereum holders might not all be leaving — some of them are diving deeper.

Active investor price: a fresh perspective on Bitcoin’s valuation

Active investor data signals potential undervalued Bitcoin despite recent surge.

Mining metrics suggest bullish sentiment for Bitcoin

Bitcoin’s mining fundamentals signal a complex interplay between tech prowess and market sentiment.

The 10-2 Treasury yield spread: A harbinger of economic downturn?

There are many tools for assessing Treasury yields and broader financial markets, but the “10-2” spread stands out for its historical accuracy in predicting economic downturns.

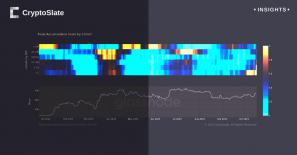

Bitcoin’s regional dynamics: Asia bullish, U.S. and E.U. in distribution mode

Asia takes the lead in Bitcoin trading as caution looms over the U.S. and E.U. markets.

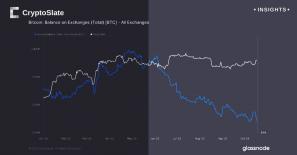

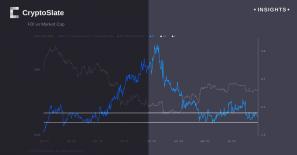

Declining Bitcoin exchange balances show strong holding sentiment

Reduced Bitcoin on exchanges mirrors growing long-term holding confidence.

Declining open interest in futures market contrasts Bitcoin’s bullish rally

The increase in bitcoin price is not matched by futures market activity.

IMF paper proposes risk assessment framework for integrating crypto into financial system

As market interest in crypto continues to grow, global monetary authorities are working on how to integrate the new technologies into legacy systems with minimal chaos.

Bitcoin’s surge to $28k leads to $114M in liquidations in 24 hours

Bitcoin’s ascent stuns short sellers causing over $97 million in liquidations in a day.

Record highs in Bitcoin’s long-term holder supply signal market confidence

Long-term holders’ willingness to hold, even amidst price fluctuations, suggests a belief in the cryptocurrency’s enduring value.

The Fed and web3: Understanding the U.S. central banking system’s approach to all things crypto

A deep dive into the Federal Reserve’s perspectives on digital assets and its policy priorities as blockchain technology reshapes finance.

October Top α Insights

Grayscale Bitcoin Trust’s impressive surge a potential indicator for spot ETF approval

Outshining bitcoin and Ethereum, Grayscale Bitcoin Trust charts notable advance

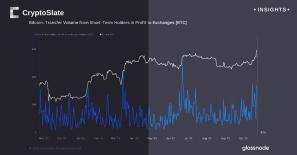

Short-term holders rush to sell Bitcoin amid market pump

Profit-taking frenzy by short-term Bitcoin holders revealed in Glassnode data

Binance leads as Bitcoin exchange outflows surge

In two days, exchanges face heavy $430 million bitcoin withdrawal

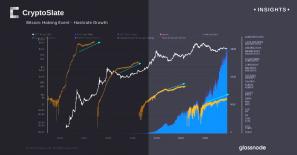

Advancing mining efficiency in light of Bitcoin’s diminishing returns

The upcoming Bitcoin halving is driving industry evolution, with the most efficient mining companies likely to dominate.

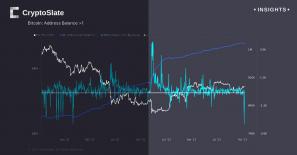

Dramatic slide in Bitcoin ‘small holders’ sparks market intrigue

A sharp decrease in the number of smaller Bitcoin holders raises questions about the market impact of the trend.

Bitcoin accumulation hits highest level since July, signaling bullish trend

Bitcoin holders rally as accumulation trend score hits 4-month peak.

Bitcoin’s hash rate surges as 2024 halving draws near

Miners continue to accumulate their holdings, boosting Bitcoin’s hash rate as the April halving event looms.

Bitcoin increasingly accessible as small investors accelerate accumulation

Shrimp investors’ spearheading the democratization of Bitcoin with accelerated accumulation

Bitcoin futures market stagnation hints at robust $25,000 support level

Bitcoin’s futures market displays subtler speculation as $25,000 support level stands strong

Bitcoin holder sentiment split as UTXO data reveals both substantial profits and losses

Bitcoin’s supply distribution – a unique insight into market gains and losses

The post From ETFs to on-chain dynamics: The CryptoSlate Alpha October Snapshot unveiled appeared first on CryptoSlate.