- November 3, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In a recent development, it has come to light that advisers of bankrupt crypto exchange FTX have provided federal law enforcement agencies across the United States with customer account information and transaction records.

Court records reveal that FTX advisers collaborated with at least five FBI field offices, responding to subpoenas and conducting investigations on specific customers’ trades. This revelation serves as a reminder that the privacy often associated with cryptocurrency trading is not guaranteed, particularly on centralized platforms like FTX.

Furthermore, according to Bloomberg, it is the FTX customers who will bear the financial burden associated with these activities.

FTX Advisers’ Fees Expose Customers To Reduced Recoveries

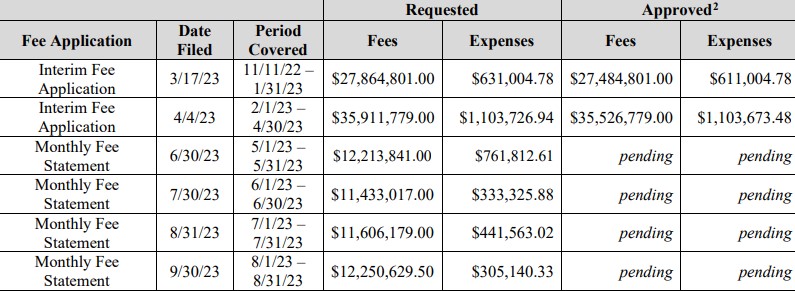

Billing records indicate that two advisers invoiced over $21,000 for tasks related to the FBI’s inquiries during July, August, and September. These professional fees will ultimately reduce potential recoveries for FTX customers affected by the platform’s collapse.

The exact nature and targets of the FBI probes remain undisclosed in the billing records submitted for bankruptcy court review. However, it is worth noting that one line item references a grand jury subpoena.

Per the report, FTX, the FBI, and the consultancy Alvarez & Marsal, which provided the billing records, have refrained from commenting.

Alvarez & Marsal, in a court filing, disclosed that it extracted transaction data in September from FTX’s cloud computing provider in response to a subpoena from the FBI’s Philadelphia office. FTX utilized Amazon’s cloud service and stored private keys to billions of dollars in crypto assets on an AWS security tool.

Additionally, Alvarez stated that it investigated customer accounts and transactions in July, following a request from the FBI’s Oakland office, and extracted customer information in August related to specific transactions, as per a subpoena from the bureau’s Portland office.

FTX’s financial adviser also conducted investigations into the activities of specific individuals based on an FBI Philadelphia Grand Jury subpoena request.

According to court documents, FTX responded to subpoenas from FBI offices in Oakland, Portland, Philadelphia, Cleveland, and Minneapolis between July and September.

Neeraj Agrawal, a spokesperson for the crypto policy non-profit organization Coin Center, told Bloomberg that US crypto firms generally have procedures to comply with government subpoenas and provide data when there is probable cause for specific information.

However, Agrawal emphasized that it would be concerning if the authority granted were used to collect vast amounts of customer data in a fishing expedition to find criminal activity.

Sam Bankman-Fried Found Guilty In Massive Fraud Scheme

The recent conviction of Sam Bankman-Fried for a massive fraud scheme resulting in the collapse of the exchange adds further complexity to the situation.

Former executives had previously pleaded guilty to fraud charges and cooperated with federal prosecutors. Bankman-Fried now faces a maximum sentence of 115 years in prison, with the sentencing date set for March 28, 2024.

According to Bloomberg, the identity of the exchange’s customers has been carefully guarded during the bankruptcy proceedings. The Delaware bankruptcy judge overseeing the case agreed to keep the names of the largest creditors under seal, as creditors argued that disclosing customer names could expose them to potential hacking and scams.

As of this writing, FTX’s token, FTT, is trading at $1.18, down 6.7% in the past 24 hours and over 10% in the past seven days.

Featured image from Shutterstock, chart from TradingView.com