- March 14, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

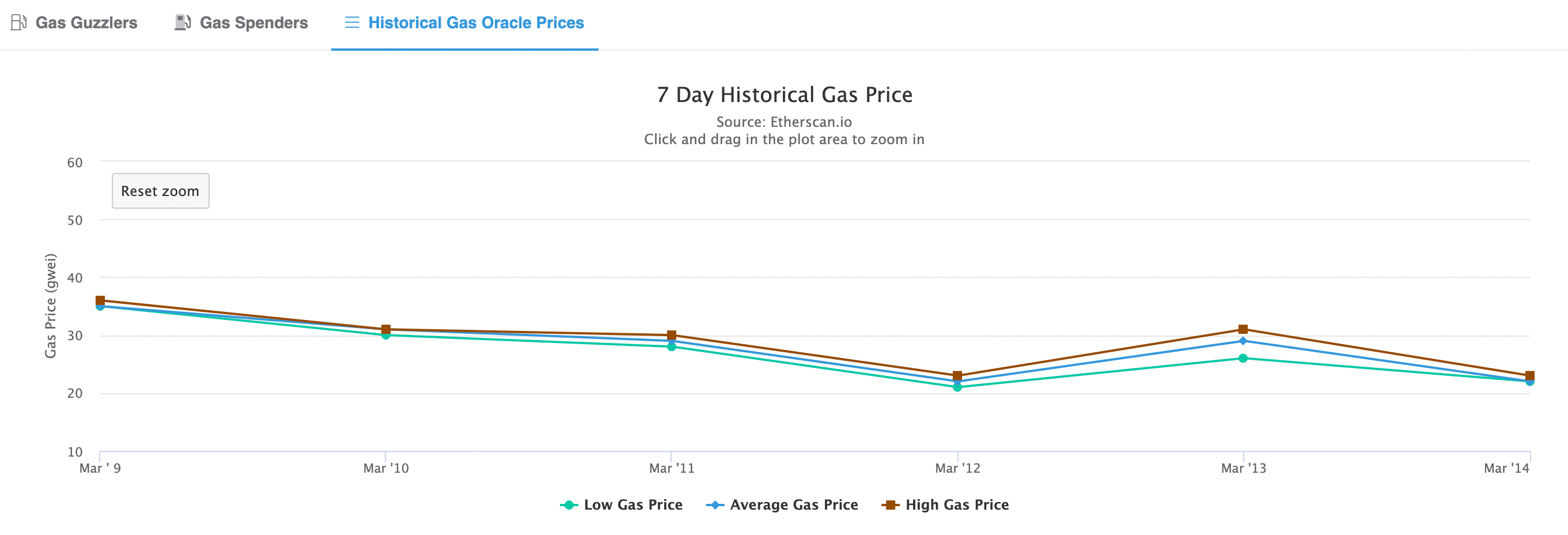

Who would have guessed Ethereum gas fees would ever be cheap again? Sometimes the past week, gas fees have been as low as just 10 gwei per gas unit even for high-priority transactions. As one gwei is one-billionth of an eth, this means a transaction on Ethereum (ETH) mainchain can be as affordable as 50 cents in total.

To find equivalent price levels, one has to go back to July 2020. This is the first time in nearly two years when using the Ethereum network’s layer-1 chain costs users so little. Last May, in contrast, fees reached as much as $70 per transaction. On May 19th 2021, an all-time-high gas fee was printed at over 659 gwei on average. That’s almost 66 times as much as the 10 gwei seen recently.

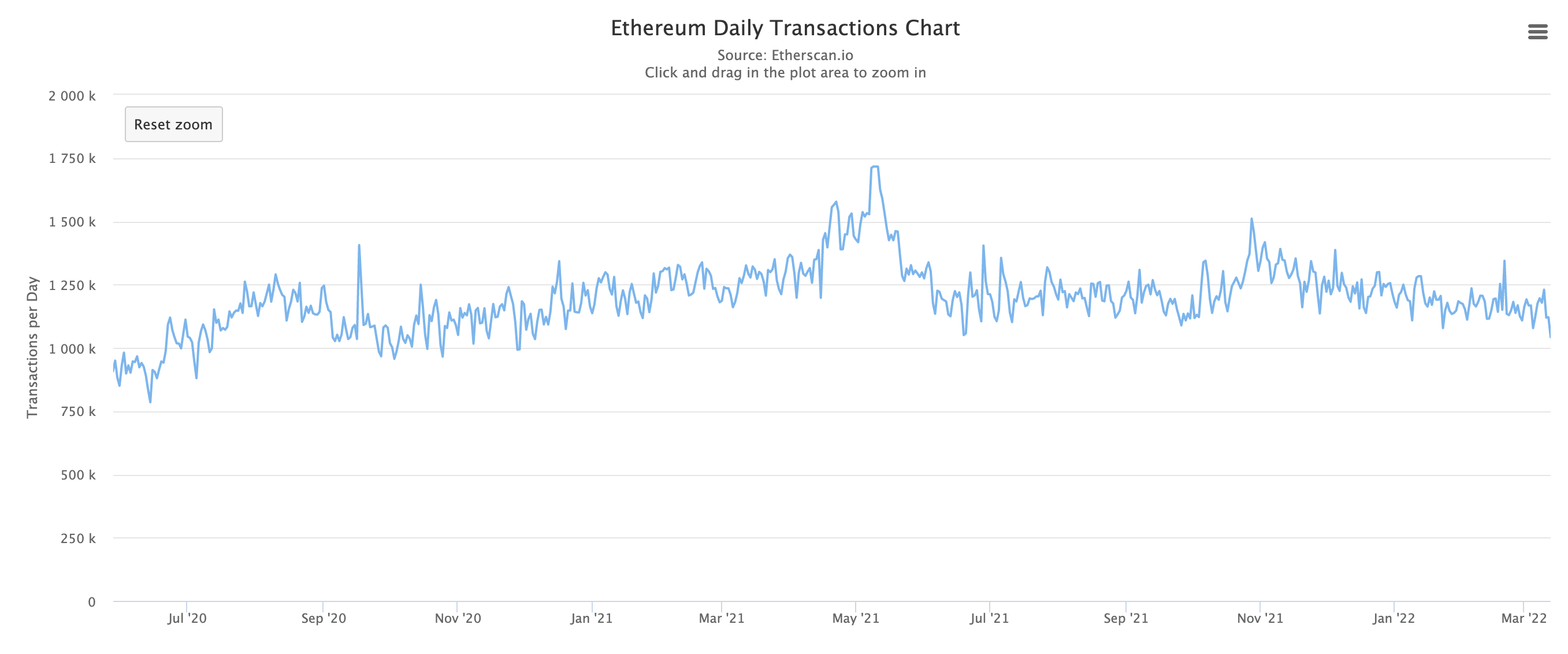

Transactions still in high demand

Yet, network demand remains relatively high with more than one million transactions a day. This number has not fallen as much as the gas fess, in fact, the number of transactions stays relatively level over time.

As CryproSlate reported last week, transaction fees on Ethereum have dropped from as high as $200 to as low as $15 within the last six months. According to Arcane Research, cited in the article, the main reason behind the recent drop in Ethereum gas fees is the lower trading volume, and perhaps lower interests, in non-fungible tokens or NFTs.

In previous times, NFT transfers accounted for most of the transactions occurring on the Ethereum blockchain. But the sudden drop in the level of interest last month has led to a massive decline in the demand for the use of Ethereum.

To understand the relationship between the drop in Ethereum’s gas fees decline and NFTs, one only has to look at how the trading volume on OpenSea declined from $247 million to $124 million from February 1 to February 6, during which the median gas fee also fell from 134 gwei to 65 gwei.

Layer-2 networks are increasingly popular

The NFT market seems to have slowed down since the top in the last week of January. According to market data from Nonfungible.com the number of sales is down from near 64,000 sales per day in mid-January to almost 24,000 in mid-February. Sales in dollar terms are down from $160 million on the 31st of January to $75 million in mid-February.

Another reason behind the falling gas fees might be the rise of layer-2 networks and sidechains such as Polygon (MATIC), Optimism and Arbitrum. These layer-2 networks are growing in popularity with 2.23 million ETH transacting on Arbitrum and other L2s.

In addition, as all fees no longer go to miners, it may be that the fee burning mechanism set in motion with EIP-1559 reduces network spam, especially from miners but also other actors.

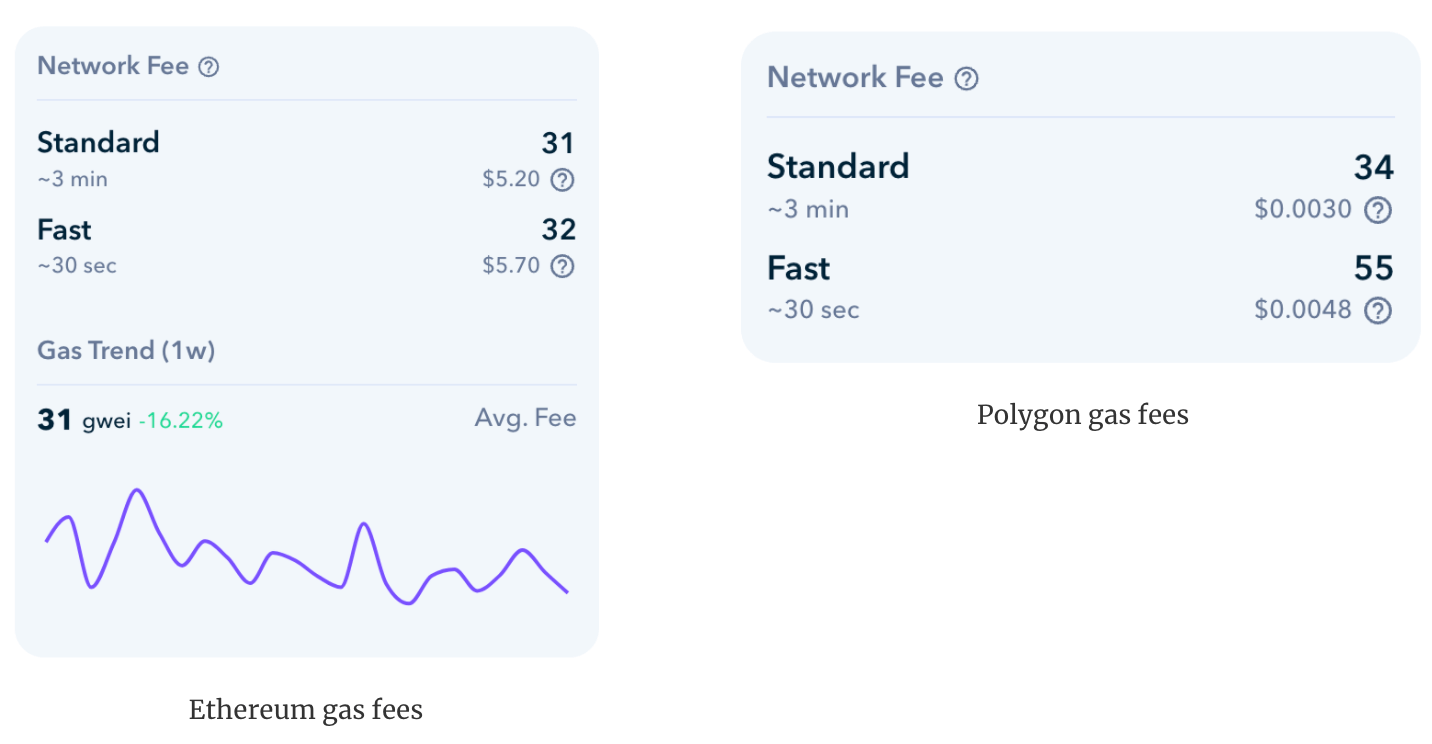

All in all, these low levels of Ethereum gas fees means the second-largest blockchain by market cap is cheaper to use than the Polygon sidechain. To be fair, Polygon is deliberately adding 30 gwei to all transactions to mitigate spam transactions, but as long as this policy remains, Ethereum’s gas fees are comparable to Polygon’s fees, and sometimes even lower.

The post Gas fees: Ethereum is now cheaper than Polygon appeared first on CryptoSlate.