- January 22, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

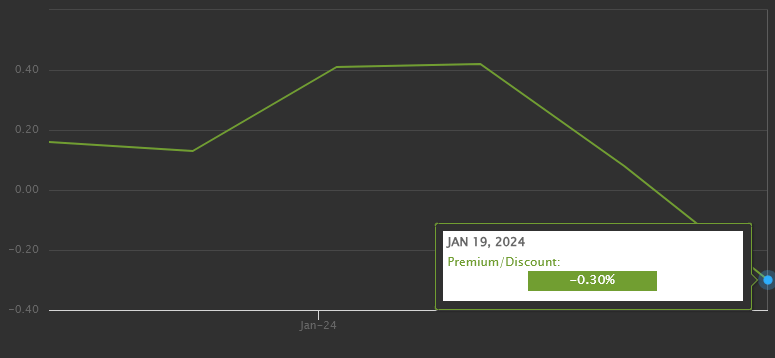

BlackRock’s iShares Bitcoin Trust recorded its first discount to its Net Asset Value (NAV) on Jan. 19, dropping to a discounted rate of -0.30%, according to official BlackRock data.

“The above table and line graph present information about the differences between the daily closing price for shares of the fund and the fund’s net asset value. The closing prices are determined by the fund’s listing exchange.” – BlackRock

Conversely, after a prolonged period at a heavy discount, Grayscale’s (GBTC) NAV is now slightly tighter at just -0.27%, according to Y Charts data. GBTC saw a staggering 48% discount to NAV on Dec. 22. However, as anticipation of its conversion to a spot, Bitcoin ETF rose, the discount closed, reaching just -1.55% on the day it was converted. The discount has continued to close and has surpassed even some of the ‘Newborn Nine’ Bitcoin ETFs, such as IBIT.

In its first week, the iShares Bitcoin Trust experienced a varied NAV per share, beginning at $26.59 and seeing a decrease to $23.87 by Jan. 19. The trust’s outstanding shares showed a significant increase from 400,000 to over 50 million within the same period.

The NAV premium/discount fluctuated modestly, recording a premium of 0.16% on launch day, peaking at 0.42% by Jan. 17, before declining to a discount. This change indicates the investors’ valuation of the shares relative to the underlying Bitcoin assets held by the trust. A premium suggests shares are valued higher than the NAV, while a discount indicates a lower valuation. The reference rate for Bitcoin used was $41,898, calculated between 8 pm and 9 pm GMT (3 pm – 4 pm EST), as highlighted in the chart below.

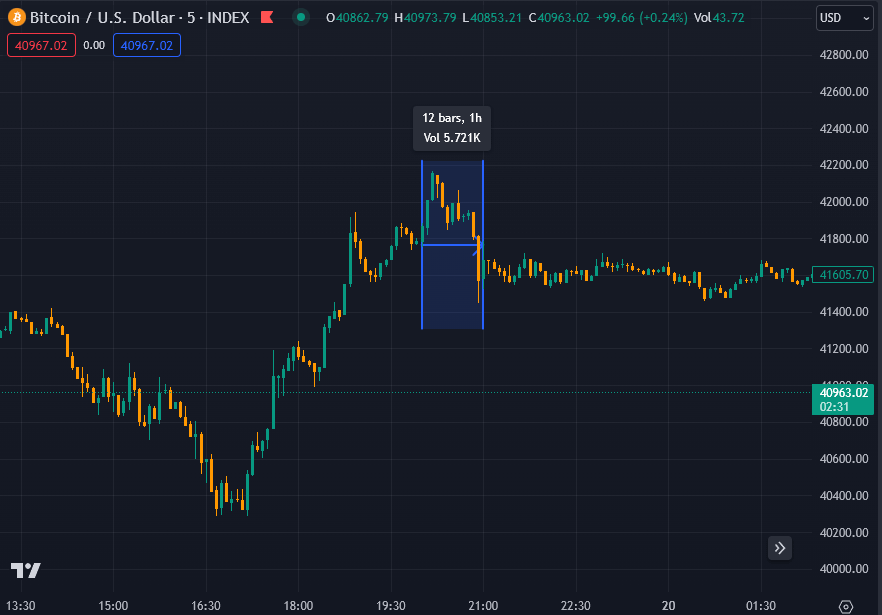

The underlying Bitcoin price has declined toward the psychological support of $40,000, trading at $40,840 as of press time, while IBIT shares are trading at $23.39 pre-market after closing at $23.80 on Friday, Jan. 19.

Therefore, IBIT shares have declined 1.72% since Friday’s trading session. In contrast, the underlying asset, Bitcoin, will have fallen around 2.5% if it does not recover before the reference rate (BRRNY) is calculated later today. Should IBIT shares trade in line with Bitcoin throughout Jan. 22, it will likely reverse the discount and rise to a premium potentially as high as 0.7% based on current calculations. However, with the primary market not opening for several hours, IBIT may close this gap during official trading hours.

Given the time lag in reporting ETF data, the impact of the reported NAV is limited. In its prospectus, BlackRock said it would publish an intra-day indicative nav (IIV). Still, this data is not published on its official website but should be available under IBIT.IIV through Nasdaq trading terminals.

Since its launch, the Assets Under Management (AUM) of the iShares Bitcoin Trust have reached $1,346,912,907.59, with 33,430 BTC under management, emphasizing the scale at which the trust is operating and the level of investment that it has attracted in a short period. Tied with the increase in outstanding shares, the overall health of the trust suggests a growing investor interest as the number of shares is more than tenfold.

The post Grayscale NAV flips BlackRock as IBIT records first discount to Bitcoin since launch appeared first on CryptoSlate.