- August 5, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Historically, hyperinflation is a positive feedback loop of free money, illusionary wealth and greed.

Almost two thousand years before the early 1920s Weimar Germany hyperinflation, there was the great currency debasement of the Roman Empire.

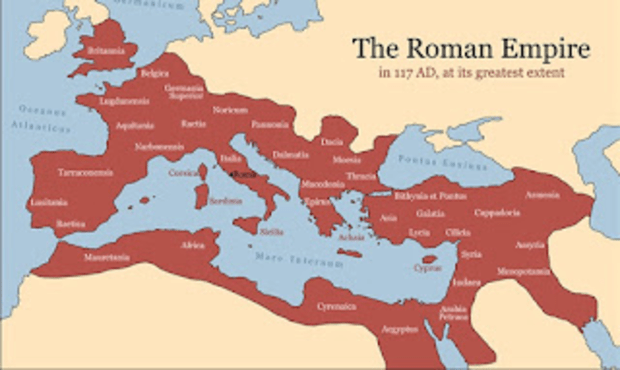

At the turn of the second century, the Roman Empire controlled all of Western Europe, parts of North Africa and the Middle East. Some estimate up to 65-100 million people lived under Roman rule, with 55–65 million as the most accepted range. — approximately 20% of the world population.

Yet, 150 years later the empire was near collapse. There are many factors which caused the “Crisis of the Third Century” (A.D. 235–284) — notably, factors such as political disorders, corruption, slowing expansion, wars etc. The biggest factor in my opinion was the debasement of the Roman currency. The debasement of the Roman currency ultimately led to over-taxation and inflation, which in turn caused a financial crisis.

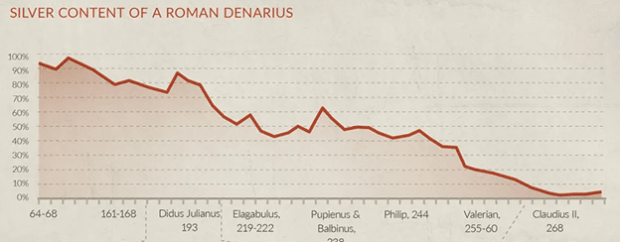

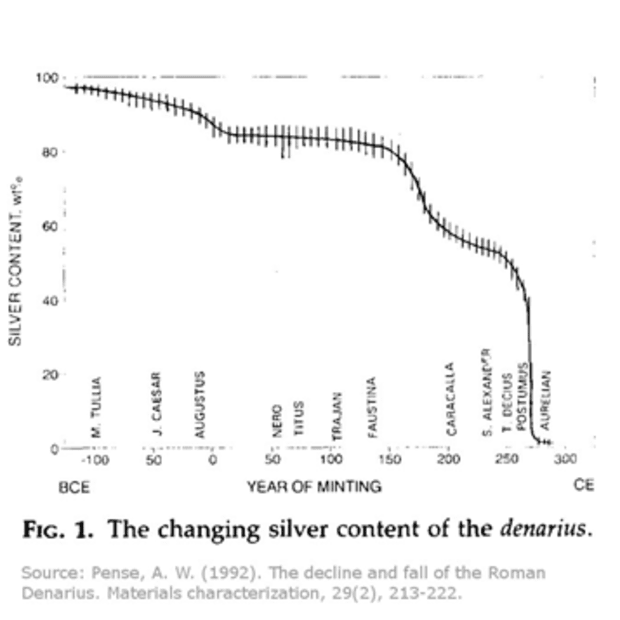

The gradual debasement of the Roman currency/coin can be tracked through the metal composition of the denarius. The silver denarius was minted for common use during the first two centuries of the Roman Empire. A four-gram coin was composed of 95% silver at the approximate time of A.D. 60. By A.D. 110, a 40-gram coin was made of only 85% silver.

By A.D. 170 the denarius was made from 75% silver, and only 60% silver by A.D. 211. By A.D. 270 this was finally reduced to merely 5% silver. Soon thereafter, Rome abandoned using silver in their coins altogether, switching to bronze to mint their coins. Inflation was severe as the value of the currency declined.

By A.D. 290 new coins such as the solidus were introduced in an attempt to halt inflation. The introduction of a “new” currency to halt inflation seems to be a staple of any hyperinflationary event. The same thing happened in Weimar Germany in the 1920s when the government implemented the rentenmark (issued Nov 15, 1923) to stop hyperinflation of the papiermark. At the end of 1922 a loaf of bread cost around 160 marks, yet by late 1923 that same loaf cost 200,000,000,000 marks. Using these historical markers, I find it very interesting when I come across a headline that states that central banks are desperately trying to “fast track” central bank digital currencies (CBDC’s). Like the rentenmark and the solidus before it, a “new” fiat currency is just more of the same problem, but with a shiny new branding and nametag.

The solidus failed to halt runaway inflation in Rome, leading to the “Edict on Maximum Prices“. The edict was designed to “cap” the prices of over 1,000 goods and services. The edict was also unsuccessful. Similarly in Weimar Germany, rent controls were put in place in an attempt to stem the rising inflation trend. Towards the end of the third century, prices of goods in Rome were now 70 TIMES what they were two centuries prior and most of that price increase would have occurred in the last decade (A.D. 290).

What began as steady devaluation soon became a rapid destruction of the currency in Rome. You see, the debasement starts slowly at first (it always does). It’s easy to debase in the beginning. Shave a little silver here, add a few more coins there, what’s the big deal!? Besides, we are creating new money (early-day money printers) for the economy and that’s great! Or is it? The problem is currency debasement is a lot like heroin (I wouldn’t know personally, but stay with me). The first time you use it is the most potent. Afterwards, you are constantly trying to take more and more to get the same “high” — economic stimulus via printing new money. In the end, you overdose by taking too much. The same holds true for currency debasement; in the end your currency collapses.

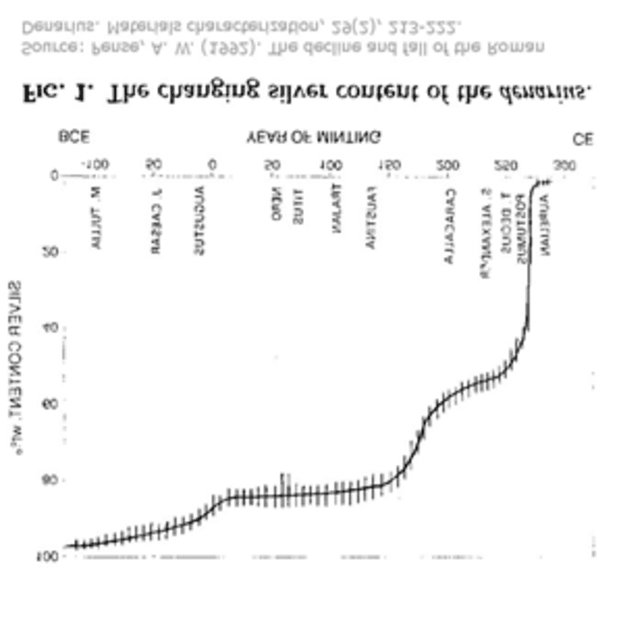

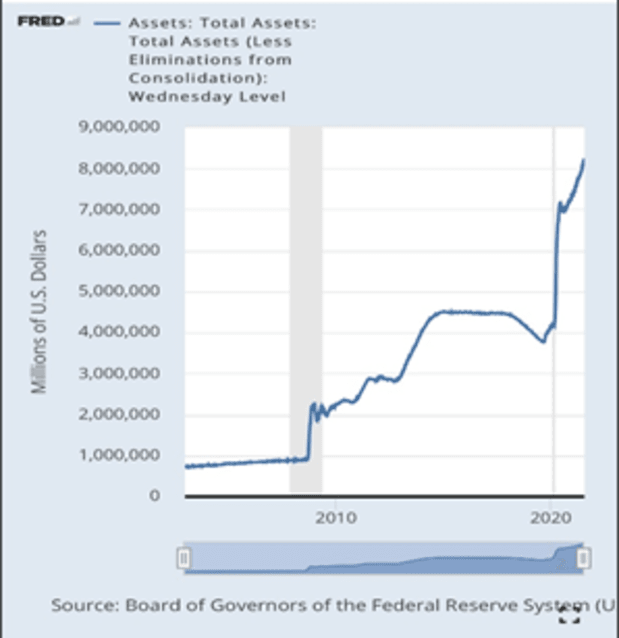

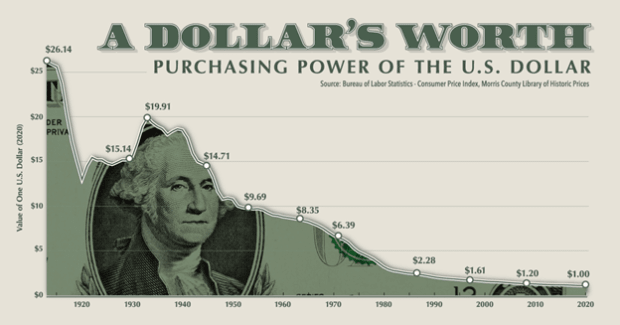

Where this history lesson becomes eye opening to me is the striking similarities between the Roman silver content chart (chart intentionally inverted to show the amount of the coin which is NOTsilver) and the balance sheet of any central bank in the world these days. For this example, see the U,S. Federal Reserve balance sheet below. The similarities of these charts should be a massive fire alarm in your head screaming “WARNING!” Despite these charts being from very different time periods and time lengths it is the rate of decay (shoutout to Greg Foss for that term) that is most astounding. The rate of decay — or relative purchasing power — for both charts follows a very similar path.

You see, the problem with currency debasement is that it is a hard habit to kick. Worse, most don’t even realize that it’s bad. This held true in Rome, held true in Weimar, Germany and holds true today. History is rhyming. U.S. politicians in power do not see balance sheet expansion as an issue that needs solving. Worse, they do not see it as a cause of inflation, or that high inflation is bad. Currency debasement is a one-way street. The boulder only rolls downhill. Greg Foss said it best “I am 100% certain that fiats will continue to debase…. on an accelerated basis.”

They simply cannot turn off the printers. If they attempt to slow down inflation (typically by raising interest rates and turning off the money printers), within weeks if not days, you would see immediate bankruptcies, unemployment, strikes, hunger, violence, and possibly even revolution in an extreme case. The government and by extension the banks are backed into a corner. This is a carbon copy of the same issues that Weimar faced and Rome as well. No country/government willingly chooses hyperinflation. Frankly, historically it has been the lesser of two evils. That does not make it any better (frankly, one could argue that it is way worse), but it occurs less directly than a massive deflationary event.

In reality, expanding the balance sheet at an exponential rate makes the problem worse and worse until it finally cannot be ignored any more. They will keep printing until the effects of inflation are WORSE than the effects of not printing. Full stop.

You need to protect yourself against inflation by purchasing hard assets. Buy bitcoin, gold, silver, and/or real estate. Things that are hard, scarce and difficult to reproduce. Agricultural farmland also historically has a high correlation to inflation. Even if you are a gold bug or a silver bug, your allocation to bitcoin should not be 0%. Nobody can predict the future with 100% certainty. As a result, your bitcoin allocation should not be zero either in the event that you are wrong. Finally, get educated on what’s going on; there are many people online who are willing to help and share information freely.

This is a guest post by Drew MacMartin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.