- November 2, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In a recent statement via X (formerly known as Twitter), Jurrien Timmer, the Director of Global Macro at Fidelity, expounded on Bitcoin’s latest market movements and reiterated his view of the digital asset as “exponential gold.”

“Bitcoin is on the move again (following the pattern of previous boom-bust cycles, so far). What to make of it? Let’s revisit my thesis from late 2020,” Timmer shared, adding that, “In my view, Bitcoin is a commodity currency that aspires to be a store of value and a hedge against monetary debasement. I think of it as exponential gold.”

What This Means For Bitcoin

In his analysis, Timmer compared BTC to gold, noting gold’s limitations in modern economics. He explained that gold is money, but is “too deflationary and clunky” to be used as a medium of exchange in daily life. Because of that, investors own gold primarily as a store of value, “one of the many reasons Bitcoin is often compared to gold,” remarked the Fidelity exec.

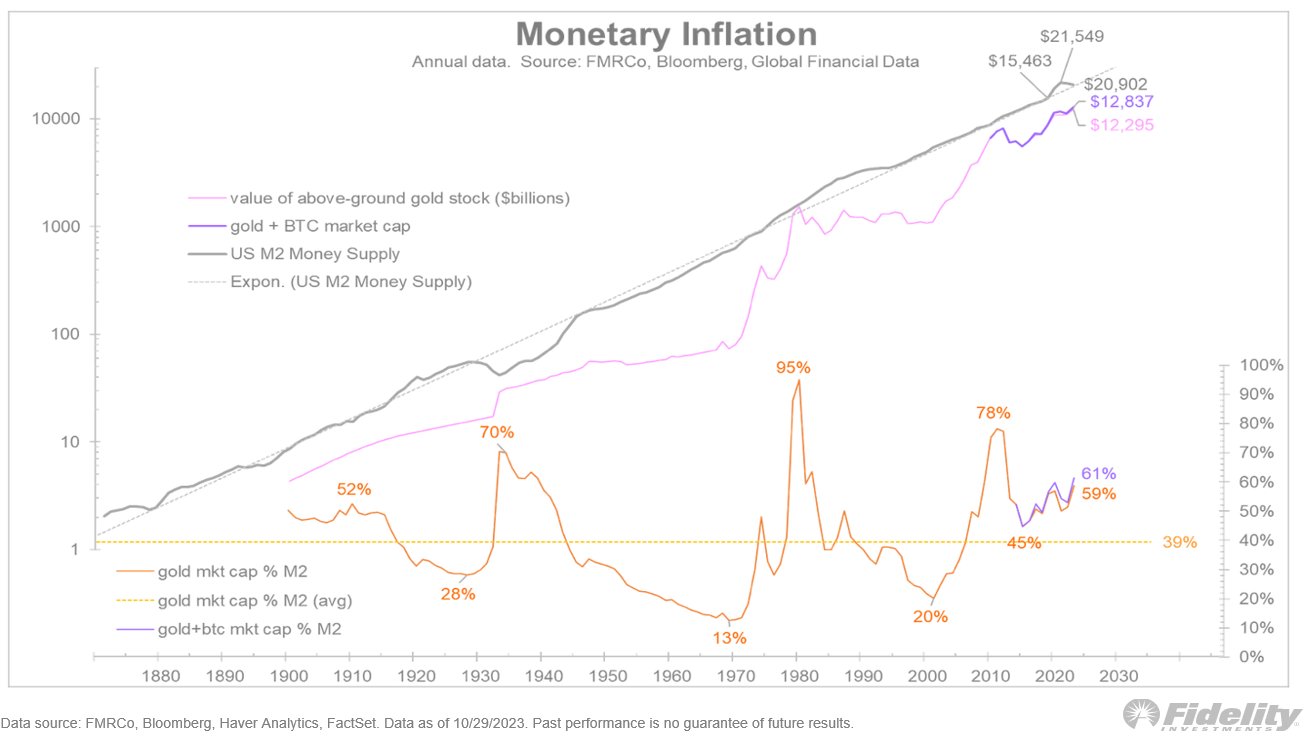

Timmer also touched on historical precedents where gold has prospered, stating, “Historically, during structural regimes in which inflation runs hot, real rates are negative, and/or money supply growth is excessive, gold tends to shine and gain market share relative to GDP. Notable examples: the 1970s and 2000s.” The following chart shows that gold had its best times when the money supply (M2) was rising steeply.

This historical perspective lays the foundation for BTC’s potential to play a similar role. “Can Bitcoin be a player on the same team? I think the potential is there,” Timmer mused, promising more insights in an upcoming thread.

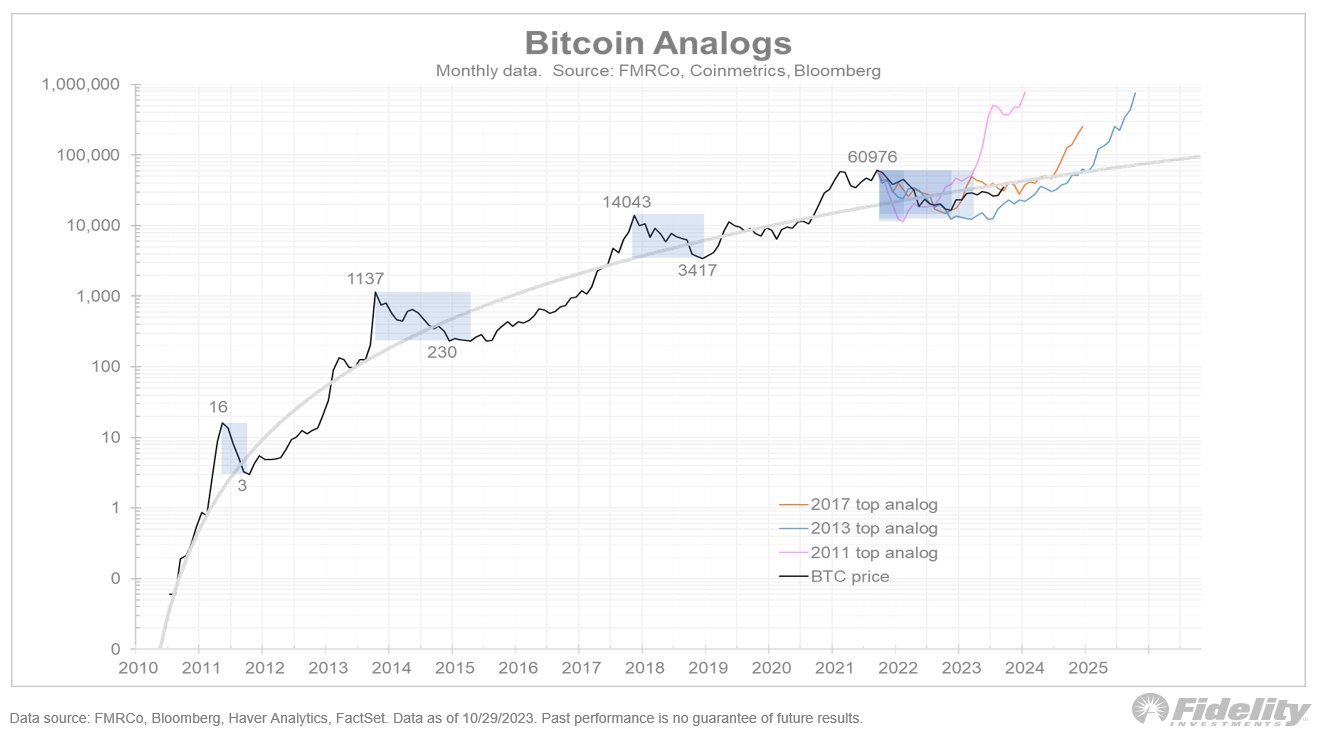

Accompanying his commentary, the “Bitcoin analogs” chart presented by Timmer suggests an ambitious trajectory for BTC price if it emulates past market cycles. According to this model, should BTC follow the patterns observed in 2011 and 2013, the premier cryptocurrency could soar to an approximate value of $700,000. On a more conservative note, mirroring the 2017 cycle might place BTC’s price between $200,000 and $300,000.

This predictive model, while speculative, showcases the significant optimism some market analysts hold for Bitcoin’s future, despite its notorious volatility. Timmer’s assessment reflects a growing sentiment among certain factions of the investment community that view BTC as a viable alternative to traditional stores of value, especially in times of financial uncertainty.

Recently, plenty of big names have joined in recognizing Bitcoin’s potential, including BlackRock’s Larry Fink, Allianz’s Mohamed A. El-Erian, analysts at AB Bernstein, legendary investor Stanley Druckenmiller, among numerous others.

At press time, BTC traded at $35,348.