- July 30, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

New data may suggest that almost all the excess savings accumulated during COVID have been spent. The timing might correlate with the slowdown in Bitcoin’s price.

Could The Bitcoin Slowdown Be A Result Of American Consumers Spending Their Excess Savings?

As per a report from Zero Hedge, it looks like US consumers may have already burnt through most of their excess savings.

These “excess savings” came up during the COVID pandemic due to a number of reasons. One of them is that since people now had to stay at home, they couldn’t take part in many of the normal activities.

All the money that people would spend going out, eating at restaurants, etc. would just accumulate as savings. Though, many people ran through their savings instead due to unemployment or other factors. So, these “excess savings” of course won’t be significant enough.

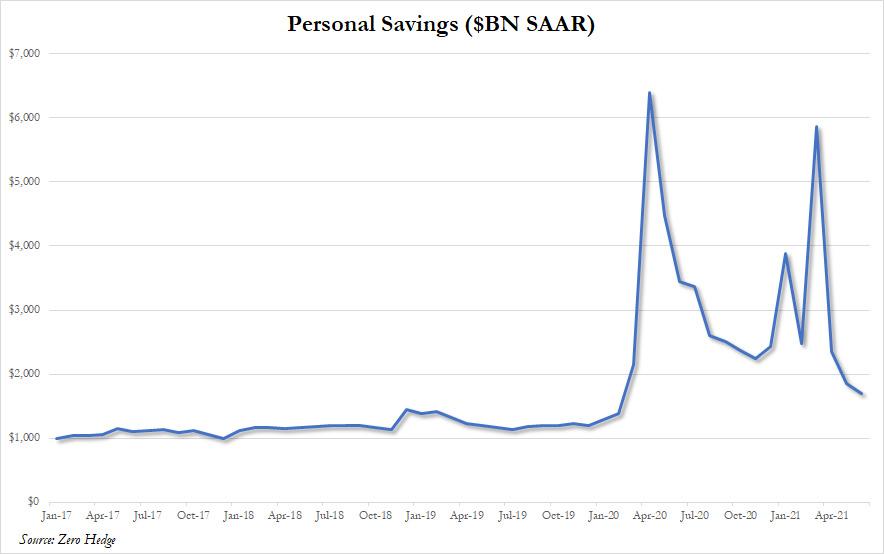

The main driving force behind this mass accumulation of savings will become apparent through the chart below. The chart shows how the consumer savings have changed over the past few years. This graph would also help showcase how it might relate to Bitcoin.

The personal savings seem to be going down | Source: Zero Hedge

Notice the three major spikes on the chart. These exactly correlate with the timings of the stimulus checks. And it makes sense as everyone received these so the contribution to excess savings from these would be pretty large.

Pre-COVID, savings were around $1.3 trillion. These rose to around $2.5 trillion average for the period with the stimulus checks (which also overlaps with Bitcoin’s bull run).

Related Reading | Elon Musk Hints Tesla Might Hold Close To 42k Bitcoin

Today, the excess savings only amount to around $1.7 billion. While the value is still $400 billion more than the pre-COVID figure, these gains would disappear by August at the rate US consumers are spending, according to Zero Hedge.

Consumers received the last stimulus check in March. Interestingly, that’s at the same time as the height of the Bitcoin bull run.

BTC Price

The correlation between the excess savings and the price of Bitcoin might indeed be there. Excess savings mean people can more freely invest in assets like cryptocurrency.

Related Reading | Gold Versus Bitcoin Chart Makes It Seem Like Bull Run Has Barely Begun

But as soon as these excess savings start to run out, that won’t be possible anymore. This period after the third stimulus check when savings hit a low seems to be around the same time as BTC’s slow price movement after the crash.

At the time of writing, Bitcoin’s price is around $39k, up 21% in the last 7 days. Here is a chart showing the trend in the value of the cryptocurrency over the last 6 months:

BTC's price seems to be on an overall upwards trend | Source: BTCUSD on TradingView