- April 4, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The financial giant is gradually becoming more bullish on Bitcoin and institutional adoption.

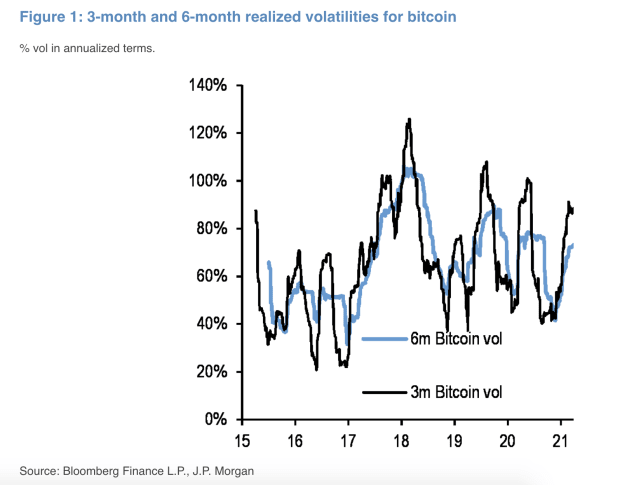

JPMorgan, in an email note released to clients on Thursday, cited decreasing Bitcoin volatility as a positive for institutional interest in the asset. In an article covering the release by Bloomberg, strategists including Nikolaos Panigirtzoglou at JPMorgan wrote:

“These tentative signs of Bitcoin volatility normalization are encouraging… In our opinion, a potential normalization of Bitcoin volatility from here would likely help to reinvigorate the institutional interest going forward.”

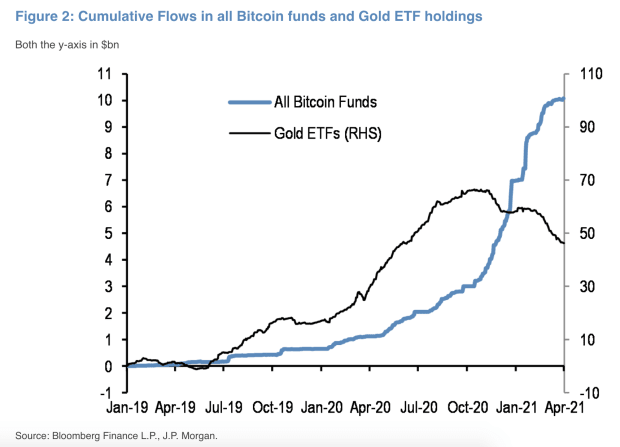

On the basis of Bitcoin’s declining long term volatility, the strategists revised their Bitcoin price target to align with private market investment in Gold.

“Considering how big the financial investment into gold is, any such crowding out of gold as an ‘alternative’ currency implies big upside for bitcoin over the long term… Mechanically, the Bitcoin price would have to rise [to] $130,000 to match the total private sector investment in gold,” JP Morgan reportedly said in the email.

In what has been a landmark year for Bitcoin, the continued support from incumbents in the legacy financial sector is very bullish, with Goldman Sachs and Morgan Stanley both filing to offer products in the space.

As time passes and the Bitcoin price continues to fly on the back of additional adoption and entrance into the space, expect additional upward price target revisions from JPMorgan and others, who have historically remained far too bearish. Matching the private sector investment in gold is just the start, as Wall Street will come to find out.