- October 13, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Modeling the bitcoin price based on the value of all coins when they last moved on-chain.

October 12th, 2021

Realized Value

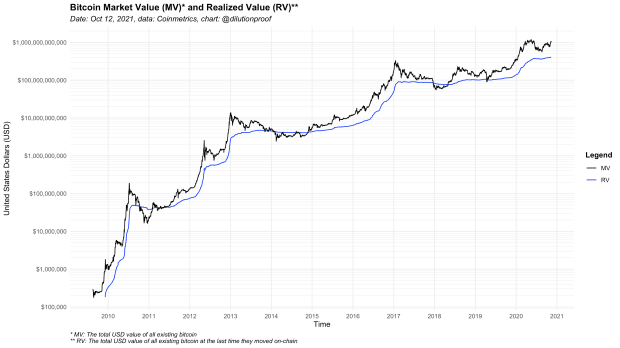

On September 23, 2018, at the Baltic Honeybadger conference in Riga, Latvia, Nic Carter presented the concept of realized value (originally “realized cap,” but both terms are since then used interchangeably) that he had developed in collaboration with Antoine Le Calvez. By leveraging the Bitcoin timechain, which holds a public record of all Bitcoin transactions that were ever made, realized value looks to quantify the total United States dollar (USD) value of all bitcoin that existed at the last time those coins were moved on-chain. Figure 1 displays this realized value (blue) alongside the total bitcoin market value (black), which is the total market value of all bitcoin that exist at any point in time.

Under the assumption that most on-chain transactions represent an actual transfer of value (e.g., buying or selling bitcoin against fiat money or using it to consume goods or services), realized value, therefore, represents the aggregated cost base of each bitcoin in existence. As can be seen in figure 1, this aggregated cost base appears to be well suited to estimate bottom prices during bear market conditions, as apparently most bitcoin holders are unlikely to realize losses on an asset that they feel has a lot of long-term upside.

Market-Value-to-Realized-Value (MVRV) Z-Score

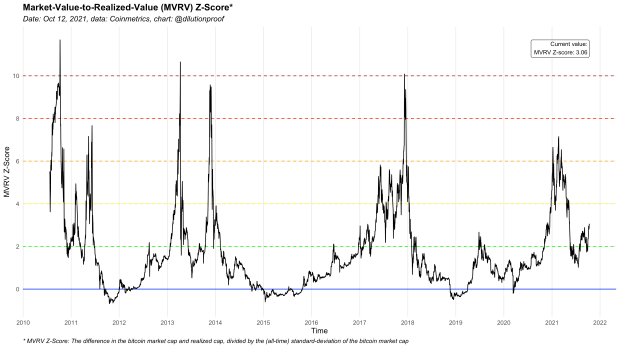

This new concept of realized value was a breakthrough in the emerging field of on-chain analysis. On October 2, 2018, David Puell and Murad Mahmudov iterated on Carter and Calvez’s work by introducing the market-value-to-realized-value (MVRV) ratio. The MVRV ratio is calculated by dividing the total bitcoin market value (MV) by its realized value (RV). Therefore, the metric represents the extent in which the current bitcoin market valuation is overextended beyond (values >1) or actually at a discount (values <1) compared to the holders’ aggregated cost base.

A week later, on October 9, 2018, Awe and Wonder further interated upon the MVRV ratio by creating a metric called the MVRV z-Score. The MVRV z-score first calculates the difference between the total bitcoin market value and its realized value, and then divides that by the standard deviation of the market valuation — a common statistical procedure called “standardization.” The MVRV z-scores, therefore, represent the number of standard deviations that each bitcoin market valuation is increased or decreased against its realized value. Although the methodology behind this oscillator might be difficult to interpret for some, the visualization of this metric actually makes it much easier to compare how relative bitcoin market valuations compare to those of previous bitcoin market cycles.

Figure 2 displays the MVRV z-score over time. The colored horizontal lines represent MVRV z-scores of 0 (blue), 2 (green), 4 (yellow), 6 (orange), 8 (red) and 10 (brown).

MVRV Bands

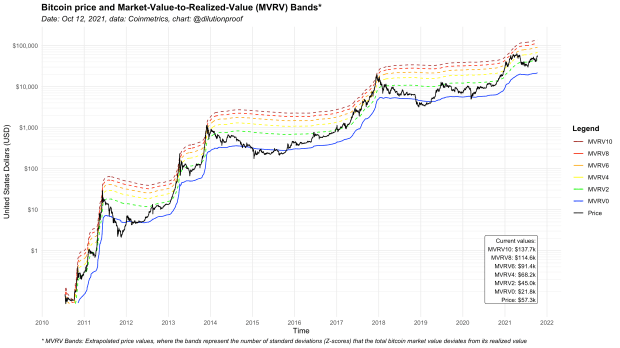

Based on the same methodology that was used in creating the Bitcoin Price Temperature (BPT) Bands on December 15, 2020, this article iterates upon the MVRV z-score by visualizing the price levels of the six colored MVRV z-scores that were highlighted in figure 2 on a regular (logarithmic) bitcoin price chart in figure 3. These “MVRV bands” represent the price that bitcoin would have if it were to reach those MVRV z-score levels.

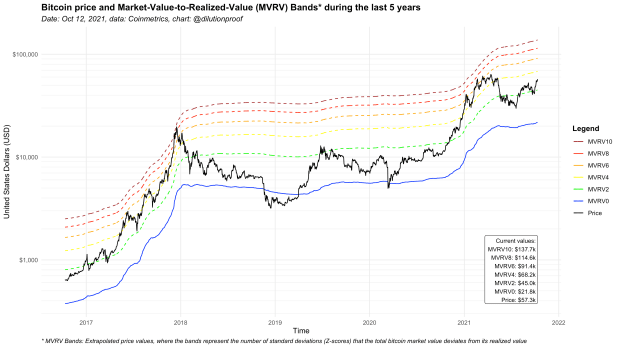

Since the MVRV z-score divides the difference between the bitcoin market value and realized value by the (all-time) standard deviation of the market price, the metric is sensitive to changes in bitcoin price volatility. During times where the bitcoin market price rapidly increased, its all-time standard deviation also increases, causing the displayed bands to slope up, thus suggesting higher values are needed to reach those MVRV z-score levels, and vice versa during market downturns. This dynamic is better visible in figure 4, which zooms in on the last five years of data.

The metrics and visualizations that were introduced in this article are free to be replicated, used and expanded upon by others. At the time of writing, there is no web-based version of the metric available yet, but the R code is available on GitHub.

Disclaimer: This article was written for educational and entertainment purposes only and should not be taken as investment advice.

This is a guest post by Dilution-proof. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.