- May 30, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

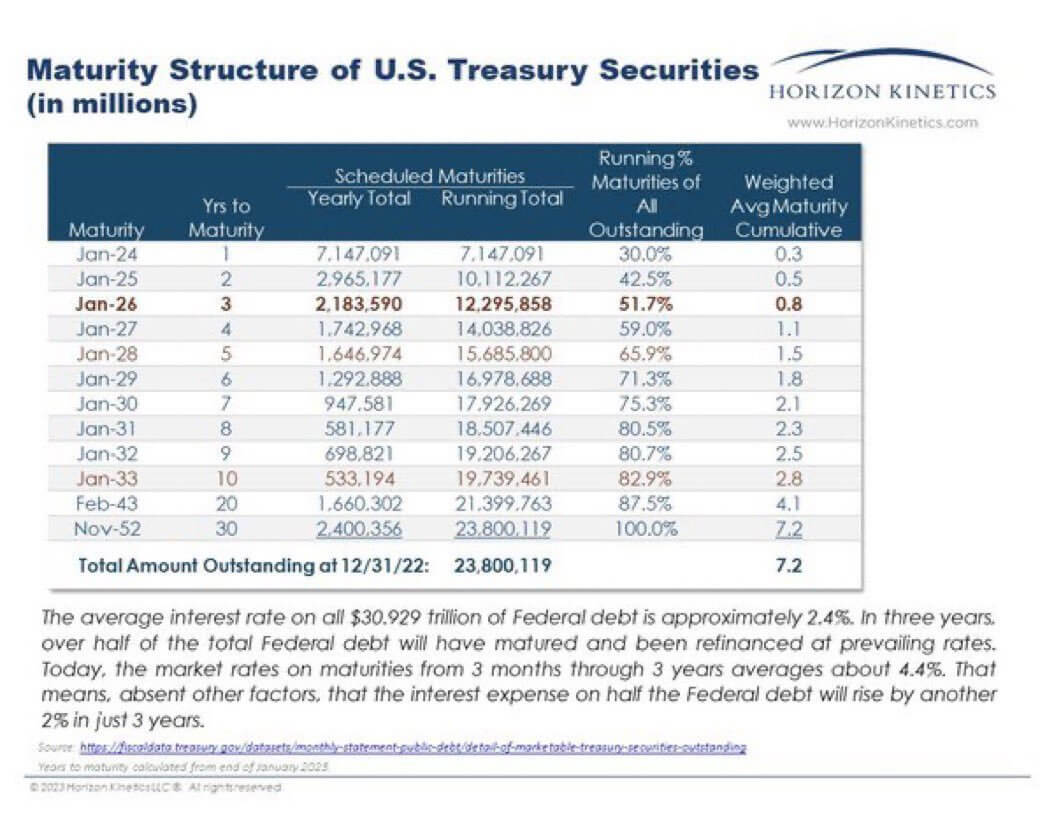

- Horizon Kinetics breaks down the maturity structure of U.S. treasury securities out to 2052, a total of $23.8 trillion.

- Maturity dates, years to maturity, and weighted average maturity are presented in a cumulative breakdown table.

- Based on figures from the end of 2022, this data reveals $23.8 trillion worth of outstanding debt that needs to be rolled over for different durations.

- By January 2026, over 50% of the debt will mature, and 30% by January 2024.

- The main issue is the federal reserve has been hiking rates at the fastest rate for over 40 years, so the debt will have to be serviced at higher rates.

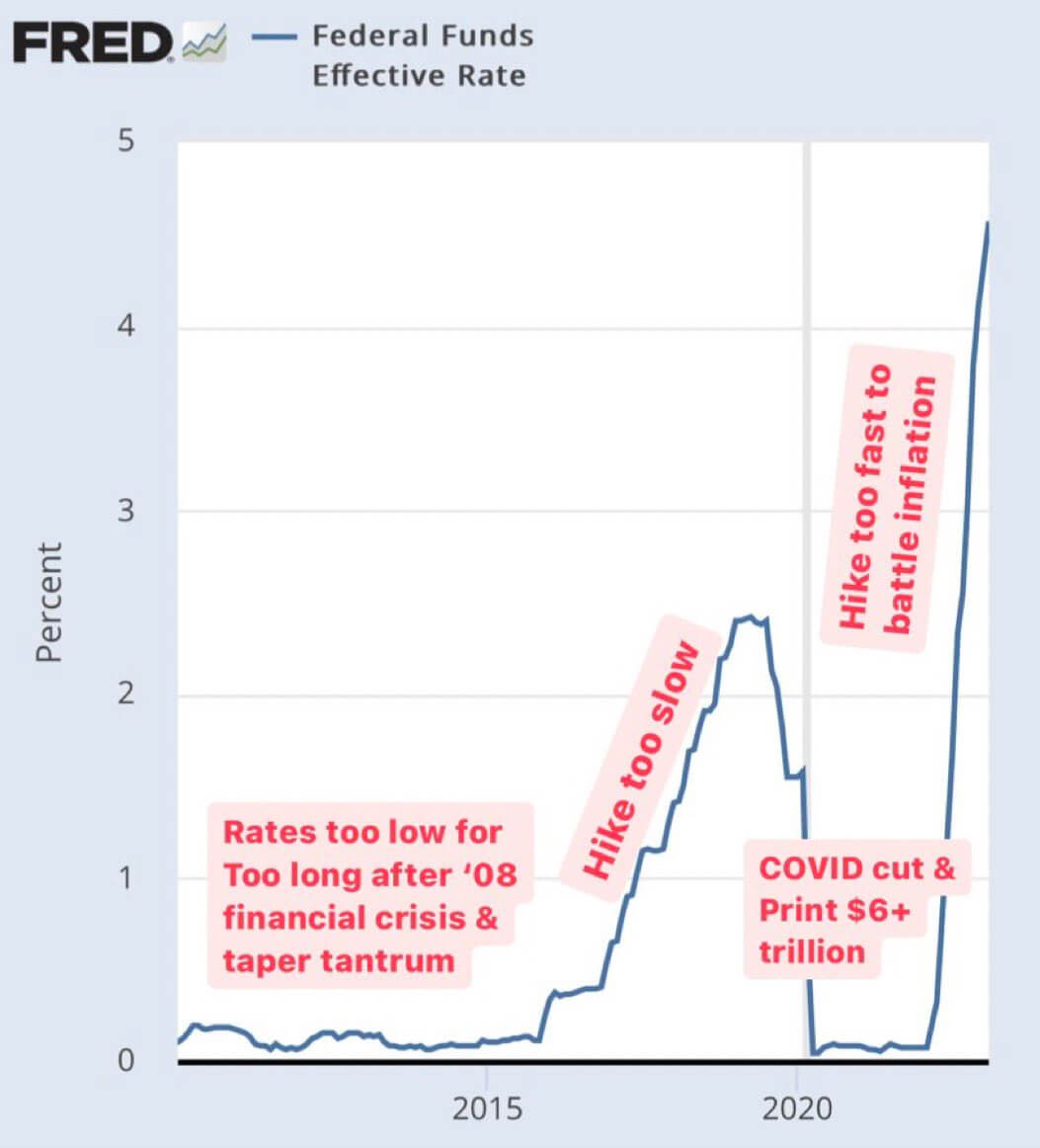

- Gabor Guracs, a strategy advisor at Tether, also points out that rates were held too low between 2008 and 2021, and the subsequent changes “hiked to 5% too quickly.”

- As the fed stays higher for longer on the federal funds rate, this will continue to have a more significant % share of the U.S. budget, which will eat into other sectors such as education.

The post Maturity structure of U.S treasuries: 30% matures by end of 2023 appeared first on CryptoSlate.